Explained: How Fuel Prices Are Calculated In India

Highlights

- Fuel prices are decided by oil marketing companies like IOCL, BP & HPCL

- Central & state taxes make for about 60% on the price of petrol

- Govt. has fast-tracked 20% ethanol blend in petrol to reduce oil import

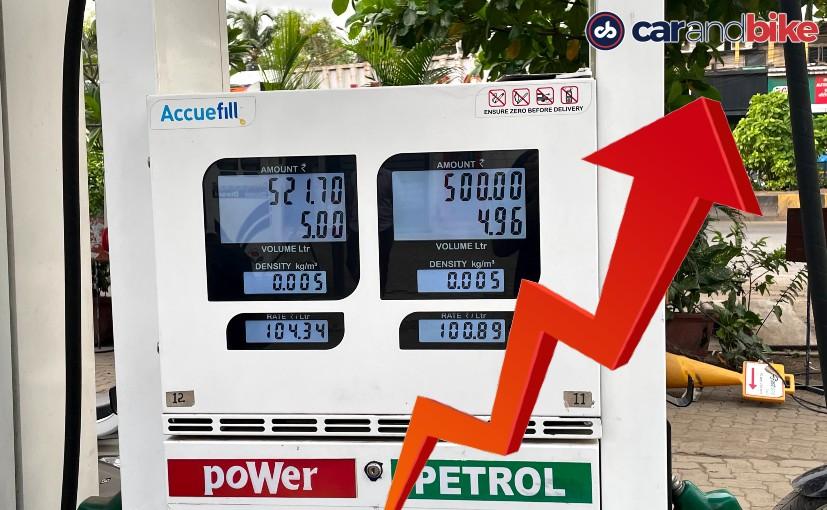

Fuel prices increased 23 times since May 4, 2021, when fuel rates started increasing once again nearly every day across the country. Petrol rates have already crossed Rs. 100 per litre in several cities and the number is inching towards the three-digit figure in other places as well. Not the century we were rooting for. But that was not always the case, was it? Up until December 2020, petrol was a good Rs. 12 cheaper, while diesel was more affordable by about Rs. 14. So for every Rs. 1000 of fuel, you now get about a litre less than you used to. But what is affecting fuel prices right now and how are fuel prices calculated in India? We break it down for you.

Also Read: Fuel Prices Hiked Again Across India; Diesel Crosses Rs. 100/Litre In Sri Ganganagar

Crude Oil Prices And Taxes

India imports about 80 per cent of its petrol and diesel demand. And Brent crude oil has a major role to play here. At present, the price of crude oil per barrel stands at about $72, which keeps fluctuating every day. Fuel prices in India are revised daily based on the changing crude oil prices globally. As global crude oil prices go up, the import cost also increases. But that's just one reason for the high retail prices. The remainder of the amount is just state and central government taxes. In fact, fuel prices in India are one of the highest taxed in the world.

How Retail Price Of Petrol & Diesel Calculated? Breakdown

Fuel rates are decided by oil marketing companies. Since they aren't government regulated anymore, it's the responsibility of the oil companies to adjust prices according to global rates. However, the state and central governments take a hefty sum as taxes on the retail price of petrol and diesel, which you and I pay at the fuel pump.

As of June 1, 2021, the base price of petrol in Delhi stood at Rs. 36.04 per litre. The central government charges 35.35 per cent as Excise Duty, followed by 23 per cent charged by the Delhi state government. Add the dealer commission and value-added tax to this and you are paying about 60 per cent as the tax on the retail price of one litre of petrol.

| Petrol Price Elements | Unit | Price In Delhi (As On June 1, 2021) |

|---|---|---|

| Price To Dealers (excluding Excise Duty & VAT) | Rs./Litre | Rs 36.04 |

| Add: Excise Duty | Rs./Litre | Rs. 32.90 |

| Add: Dealer Commission (Average) | Rs./Litre | Rs. 3.79 |

| Add: VAT (including VAT on Dealer Commission) applicable for Delhi @ 30% | Rs./Litre | Rs. 21.82 |

| Retail Selling Price | Rs./Litre | Rs.94.55 |

Data Source: HPCL

Similarly, the base diesel price in Delhi stands at Rs. 38.54 per litre, which then increases with the centra government tax of 38.21 per cent along with the state government tax of 14.64 per cent along an additional 0.25/litre air ambience charges. This makes up about 54 per cent of taxes in the retail price of diesel.

| Diesel Price Elements | Unit | Price In Delhi (As On June 1, 2021) |

|---|---|---|

| Price To Dealers (excluding Excise Duty & VAT) | Rs./Litre | Rs. 38.54 |

| Add: Excise Duty | Rs./Litre | Rs. 31.80 |

| Add: Dealer Commission (Average) | Rs./Litre | Rs. 2.59 |

| Add: VAT (including VAT on Dealer Commission) applicable for Delhi @ 16.75% and Air Ambience Charges @ r 0.25/Litre | Rs./Litre | Rs. 12.51 |

| Retail Selling Price | Rs./Litre | Rs. 85.44 |

Data Source: HPCL

Why Are Fuel Prices Different In Each State?

Fuel prices in India also attract higher Value-Added Tax in some states that further increases the price disparity. States like Madhya Pradesh and Rajasthan levy higher value-added tax at 33 per cent and 36 per cent respectively. Similarly, the fuel prices in Maharashtra include 26 per cent VAT plus an additional tax of Rs. 10.12 per litre.

| State | Sales Tax/VAT on Petrol | Sales Tax/VAT on Diesel |

|---|---|---|

| Madhya Pradesh | 33% VAT + Rs. 4.5/Litre VAT + 1% Cess | 23% VAT + Rs. 3/Litre VAT + 1% Cess |

| Rajasthan | 36% VAT + Rs. 1500/KL Road Development Cess | 26% VAT + Rs. 1750/KL Road Development Cess |

| Uttar Pradesh | 26.80% or Rs. 18.74/Litre, whichever is higher | 17.48% or Rs. 10.41/Litre, whichever is higher |

| Maharashtra | 26% VAT + Rs. 10.12/Litre additional tax | 24% VAT + Rs. 3/Litre additional tax |

| Tamil Nadu | 15% + Rs. 13.02/Litre | 11% + Rs. 9.62/Litre |

| Odisha | 32% VAT | 28% VAT |

Data Source: Petroleum Planning and Analysis Cell

Fuel Prices In India vs Neighbouring Countries

India's fuel taxes are so high that they are nearly double when compared to neighbouring countries. In Bhutan, petrol is priced at an Indian equivalent of Rs. 68.4 per litre while diesel is priced at Rs. 66.4 per litre. In Pakistan, petrol is much cheaper at Rs.50.67 per litre while diesel retails at Rs. 51.79 per litre. Prices are lower in Russia with petrol priced at Rs. 49.2 per litre, whereas diesel will cost you Rs. 48.4 per litre.

To give you some more perspective, a litre of petrol in Mumbai is almost twice as much when compared to New York wherein it retails at $0.79 (around Rs. 57). That's some steep premium that Indians are paying for fuel at present.

What Does The Government Have To Say?

In a recent interaction with the media, Oil Minister Dharmendra Pradhan agreed that the rising rates were a problem. He said, "I accept that fuel prices are pinching consumers, there's no doubt about this. But over Rs. 35,000 crore has been spent on Covid vaccines in a year. Rs. 1 lakh crore has been spent on Pradhan Mantri Gareeb Kalyan Yojana in order to provide eight months' ration to the poor. A few thousand crores of rupees have also been transferred to farmers' bank accounts under PM Kisan. In such dire times, we're saving money to spend on welfare schemes."

The union minister further suggested that states like Maharashtra and Rajasthan reduce the sales tax levied on fuel to ease the burden on the common man.

Taxes from fuel sales is a major revenue source for both central and state governments. According to the petroleum ministry, the fuel tax contributed Rs. 2.88 lakh crore to the central government exchequer during FY2019-20. In comparison, fuel taxes contributed Rs. 2.09 lakh crore in FY2015-16. With state governments, the contribution has been about Rs. 2.21 lakh crore during FY2019-20.

The government has fast-tracked its target for selling petrol with 20% blended Ethanol to April 1, 2023

What Can The Government Actually Do About It?

So, reducing the taxes would be heavily hurt the state and central government revenue. Meanwhile, the government has been working on pushing for alternative fuel options to compensate for the high cost of petrol and diesel. There has been a renewed push for biofuel, particularly ethanol and the government recently fast-tracked its target for selling petrol with 20 per cent blended Ethanol to April 1, 2023. Under The National Biofuel Policy 2018, the indicative target for blending ethanol stood at 20 per cent for petrol and five per cent for diesel by 2030.

This, in turn, will reduce dependency on oil from foreign markets, and also reduce carbon emissions. Ethanol will also push the sugar industry as the fuel source is one of the byproducts of sugar production. At present, the blending percentage of ethanol with petrol has gone up from 1.53 per cent in 2013-14 to 8.5 per cent in 2020-21.

Also Read: Is Ethanol A Viable Fuel Option For India?

With such high taxes, the overall price of fuel in India remains on the higher side. The Indian government is pushing for alternative fuel in the country and is also trying to promote biofuel, which will reduce India's dependency on fuel imports. India currently imports more than 82% of its fuel demand from foreign markets. With the use of alternative fuels and electric cars, that figure is likely to come down in the future. At present, India has an ethanol production capacity of 684 crore litre, which needs to increase to 1000 crore per litre to meet the country's demand.

The government has been actively pushing for EVs in a bid to promote electric mobility and reduce our dependency on oil

What About Electrification?

The other option is electrification that the government has been actively pushing with its subsidies and incentives. The recently announced FAME II Policy amendment further hinted at the government's commitment towards the same. The amendment increases the subsidy on electric two-wheelers from Rs. 10,000 per kWh to Rs. 15,000 per kWh. With OEMs passing on the benefit to customers, the upfront cost of an electric two-wheeler can be identical to a comparative ICE-powered motorcycle or scooter.

Also Read: Electric Two-Wheelers To Get More Affordable As Government Amends FAME II Subsidies

What About Incorporating Fuel Prices Under GST?

There has also been a long-standing demand to bring fuel prices under Goods and Services Tax (GST) that would cap the taxes to 28 per cent (and a little higher if cess is imposed). The decision to include fuel prices under GST lies with the GST Council and there has been no progress in that regard. Moreover, lowering fuel prices via GST would also hurt the centre and state in terms of revenue.

So, unless state and central governments and oil marketing companies decide to rework the pricing structure, it's unlikely that the fuel prices will go down. Meanwhile, we would recommend that you press the accelerator pedal more judiciously.

Great Deals on Used Cars

View All Used Cars

- 46,324 km

- Petrol

- AMT

- 35,000 km

- Petrol+CNG

- Manual

- 29,065 km

- Diesel

- Manual

- 16,178 km

- Diesel

- Automatic

- 19,000 km

- Diesel

- Automatic

- 25,279 km

- Diesel

- AMT

- 19,398 km

- Diesel

- Manual

- 13,870 km

- Petrol

- Manual

- 19,798 km

- Petrol

- Manual

- 5,903 km

- Petrol

- Manual

Upcoming Cars

Upcoming Bikes

Explore More

Latest News

Related Articles