Tips To Avoid Getting Your Vehicle Insurance Claims Rejected?

- Insurance companies have certain rules about insurance claims.

- Having your claims rejected can cost you dearly.

- Following these rules is very important.

Your swanky new car may be your most prized possession. And no matter how well you take care of it, the fact remains that due to your mistake or others', it may eventually incur damage. In such times, your trusty insurance policy comes in very handy. It helps you out in getting the car fixed; sometimes, without even asking you to spend a single penny. However, there are a few possibilities under which the insurance company can end up rejecting your claim. Take a look at them.

Policy renewal

Your policy lasts only for a particular duration, which is usually one year. So each year, it is imperative to renew it on time, otherwise, your claim will get rejected straightaway. These days, the insurance company's representatives themselves call you beforehand to remind you about the renewal date. Even if they don't, setting a reminder on your phone's calendar is always a good option.

Driver's license

Always have your driver's licence on you when driving. If you've been involved in an accident in which there was no fault of yours, you will still be considered an equal culprit if you were driving without your license. And the insurance company will hence refrain from passing your claim.

Drunk driving

Driving under the influence is a criminal offence in India. Any damage sustained to your vehicle while you were driving drunk will not be covered under the claim. No matter what the situation, avoid driving under the influence.

Policy conditions

When you get an insurance policy issued for your vehicle, there are certain policy conditions that are part of the contract. Violating these will lead to your claims getting rejected. Such conditions include defined geographical boundaries or prohibition from using your vehicle for commercial purposes. To understand them, you can either read the policy document carefully or ask the insurance agent to explain them to you.

Self-negligence

This is a very clear-cut point. No insurance company is going to accept a claim if the accident that damaged your vehicle was caused by your own negligence. Needless to say then that driving carefully is something that you should follow always.

Consequential loss

If an accident has occurred and damaged your already damaged car, the fault is still yours for not having it repaired on time. Such a claim will also not be accepted by the insurance company as it will be classified as a consequential loss.

Claim process

Due diligence needs to be followed in order to get a claim passed. And every company has its own set of guidelines that you need to follow. Just abide by these processes while seeking a claim and you should be good. If you don't, there is a risk of your claim getting rejected.

Repairing your damaged car by yourself can end up costing you dearly. Your insurance policy comes as a great help during such situations. It's hence necessary that you always keep these few factors in mind to ensure that your claims don't get rejected.

Latest News

car&bike Team | Feb 20, 2026Production-Ready Royal Enfield Flying Flea C6 Spotted On TestTest mules of the Flying Flea C6 have been spotted sans camouflage.2 mins read

car&bike Team | Feb 20, 2026Production-Ready Royal Enfield Flying Flea C6 Spotted On TestTest mules of the Flying Flea C6 have been spotted sans camouflage.2 mins read Jaiveer Mehra | Feb 20, 2026New Audi RS5 Debuts With 630 bhp V6 PHEV PowertrainThe RS5 features a twin-turbo 2.9-litre V6 paired with an electric motor and a 25.9 kWh battery and offers over 80 km of EV-only driving.1 min read

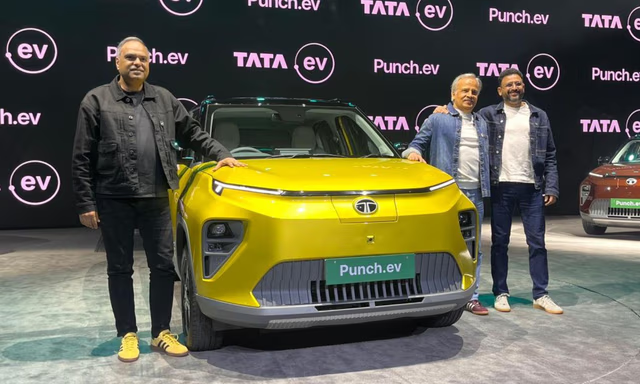

Jaiveer Mehra | Feb 20, 2026New Audi RS5 Debuts With 630 bhp V6 PHEV PowertrainThe RS5 features a twin-turbo 2.9-litre V6 paired with an electric motor and a 25.9 kWh battery and offers over 80 km of EV-only driving.1 min read Jaiveer Mehra | Feb 20, 2026Tata Punch EV Facelift Launched In India; Prices Start From Rs 9.69 LakhNotable changes to the Punch EV include faster DC fast charging and larger battery packs.3 mins read

Jaiveer Mehra | Feb 20, 2026Tata Punch EV Facelift Launched In India; Prices Start From Rs 9.69 LakhNotable changes to the Punch EV include faster DC fast charging and larger battery packs.3 mins read Jaiveer Mehra | Feb 20, 2026Level 2 ADAS Systems To Be Mainstay Of Auto IndustryUse of Level 2+ ADAS technologies to gain popularity in the coming year and overtake the basic Level 2 system by 20354 mins read

Jaiveer Mehra | Feb 20, 2026Level 2 ADAS Systems To Be Mainstay Of Auto IndustryUse of Level 2+ ADAS technologies to gain popularity in the coming year and overtake the basic Level 2 system by 20354 mins read car&bike Team | Feb 20, 2026Tata Punch EV Facelift Launch Highlights: Price, Specifications, Features, Images0 mins read

car&bike Team | Feb 20, 2026Tata Punch EV Facelift Launch Highlights: Price, Specifications, Features, Images0 mins read car&bike Team | Feb 19, 2026KTM 390, 250 Adventure Offered With Free Accessories And 10-Year Extended WarrantyThis limited-run scheme is offered until February 28 on both motorcycles.2 mins read

car&bike Team | Feb 19, 2026KTM 390, 250 Adventure Offered With Free Accessories And 10-Year Extended WarrantyThis limited-run scheme is offered until February 28 on both motorcycles.2 mins read

Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read

Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read

Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read Jafar Rizvi | Feb 15, 2026Maruti Suzuki Victoris: Long-Term Review - Report 1The Victoris is Maruti’s latest offering for the Indian market, and after spending some time with it, here are a few early impressions.1 min read

Jafar Rizvi | Feb 15, 2026Maruti Suzuki Victoris: Long-Term Review - Report 1The Victoris is Maruti’s latest offering for the Indian market, and after spending some time with it, here are a few early impressions.1 min read Bilal Firfiray | Feb 12, 2026BMW X3 30 xDrive M Sport Review: The Driver’s SUV ReturnsRange-toppingX3 30 xDrive M Sport brings back the fun with 255bhp and genuine enthusiast appeal. Does this performance-focused SUV stand out?5 mins read

Bilal Firfiray | Feb 12, 2026BMW X3 30 xDrive M Sport Review: The Driver’s SUV ReturnsRange-toppingX3 30 xDrive M Sport brings back the fun with 255bhp and genuine enthusiast appeal. Does this performance-focused SUV stand out?5 mins read Bilal Firfiray | Feb 11, 2026Mercedes-AMG CLE 53 Coupe Review: The Goldilocks AMG?The Mercedes-AMG CLE 53 Coupe is a concoction of hooliganistic performance and everyday usability. Here’s why this Rs 1.5 crore two-door AMG might be the perfect modern sports coupe for India.6 mins read

Bilal Firfiray | Feb 11, 2026Mercedes-AMG CLE 53 Coupe Review: The Goldilocks AMG?The Mercedes-AMG CLE 53 Coupe is a concoction of hooliganistic performance and everyday usability. Here’s why this Rs 1.5 crore two-door AMG might be the perfect modern sports coupe for India.6 mins read