Auto Insurance: New 'Pay As You Drive, How You Drive' Motor Insurance Rule Announced

- New set of motor insurance rules announced

- Users to pay premium as per their driving style, requirements etc.

- Owners with multiple vehicles can opt for a 'floater insurance' policy

People who have bought an automobile in recent years will know that motor insurance is costly, with a fixed premium that needs to be paid every year. But now, the Insurance Regulatory and Development Authority of India (IRDAI) has revealed a new set of motor insurance rules that will allow the user to pay for insurance as per their automobile usage, under 'Pay as you drive, pay how you drive' and floater policy for vehicles belonging to same individual owner for private cars and two-wheelers.

Also Read: Advantages Of Renewing Insurance On Time

(Motor insurance could become more affordable with the new rules)

In a notification, the IRDAI said that these technology-enabled add-ons for own damage (OD) motor insurance seeks to offer flexibility to automobile users, enabling them to pay for insurance based on their driving history, with general insurers offering a dynamic insurance cover. The floater policy will allow individuals who own more than one vehicle to get a single insurance cover for all their motor vehicles. Of course, the telematics-based motor insurance plan will also impact the premium, with safer driving and lesser driving leading to lesser premiums. This is likely to benefit the entire automotive insurance eco-system.

(Automotive insurance premium could change with the new set of rules)

Also Read: Guide To Calculate Your Insurance Cost

"This is a very welcome step in the direction of a larger goal of incentivising better driving behaviour on Indian roads. While, for the now, you may pay only for your drive, the eventual goal will be to ensure a lower insurance premium when we adhere to road and safety norms. Entire ecosystem, be it insured, insurance companies and partners will get benefitted from this in long term", said, Vivek Sharma, Founder & CEO, Fixcraft.

"The Concept of Motor Insurance is constantly evolving. The advent of technology has created a relentless pace for the insurance fraternity to rise up to interesting yet challenging demands of the millennials. The general insurance sector needs to keep pace with and adapt to the changing needs of the policyholders," IRDAI said in a statement.

Latest News

car&bike Team | Feb 2, 2026Car Sales January 2026: Six Marutis in Top 10, But Tata Nexon Takes Top SpotTata Motors sold 23,365 units of the Nexon, creating a clear gap to the Maruti Suzuki Dzire, which finished second with 19,629 units.1 min read

car&bike Team | Feb 2, 2026Car Sales January 2026: Six Marutis in Top 10, But Tata Nexon Takes Top SpotTata Motors sold 23,365 units of the Nexon, creating a clear gap to the Maruti Suzuki Dzire, which finished second with 19,629 units.1 min read car&bike Team | Feb 2, 2026Maruti Suzuki Victoris Crosses 50,000 Sales Milestone In 4 monthsThe compact SUV launched at the onset of festive season has crossed the 50,000 sales mark in about 4 months1 min read

car&bike Team | Feb 2, 2026Maruti Suzuki Victoris Crosses 50,000 Sales Milestone In 4 monthsThe compact SUV launched at the onset of festive season has crossed the 50,000 sales mark in about 4 months1 min read car&bike Team | Feb 2, 2026Two-Wheeler Sales January 2026: Hero MotoCorp, TVS, Royal Enfield, Suzuki Report Sustained GrowthMost brands have reported year-on-year growth in the first month of CY26.2 mins read

car&bike Team | Feb 2, 2026Two-Wheeler Sales January 2026: Hero MotoCorp, TVS, Royal Enfield, Suzuki Report Sustained GrowthMost brands have reported year-on-year growth in the first month of CY26.2 mins read car&bike Team | Feb 2, 2026Maruti Suzuki Announces Price Protection Amid Long Waiting PeriodsCountry’s largest carmaker has said that prices of the cars will not be increased for customers who have already made the bookings1 min read

car&bike Team | Feb 2, 2026Maruti Suzuki Announces Price Protection Amid Long Waiting PeriodsCountry’s largest carmaker has said that prices of the cars will not be increased for customers who have already made the bookings1 min read Jafar Rizvi | Feb 2, 2026Yamaha EC-06 vs River Indie: How Different Are The Two Electric Scooters?The EC-06 shares its foundation with the River Indie, and here we look at the differences between the two.3 mins read

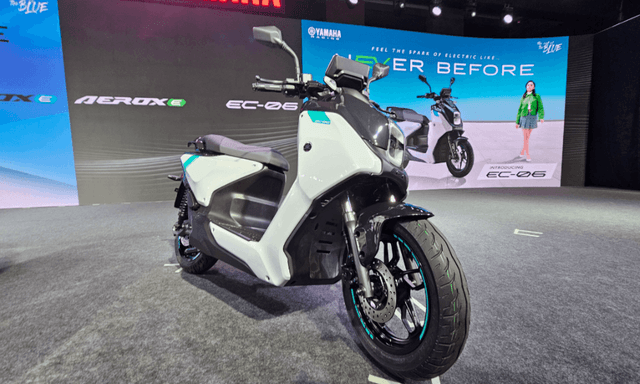

Jafar Rizvi | Feb 2, 2026Yamaha EC-06 vs River Indie: How Different Are The Two Electric Scooters?The EC-06 shares its foundation with the River Indie, and here we look at the differences between the two.3 mins read Jafar Rizvi | Feb 2, 2026Yamaha EC-06 E-Scooter Launched In India At Rs 1.68 LakhThe EC-06 marks Yamaha’s entry into the electric scooter segment in India.2 mins read

Jafar Rizvi | Feb 2, 2026Yamaha EC-06 E-Scooter Launched In India At Rs 1.68 LakhThe EC-06 marks Yamaha’s entry into the electric scooter segment in India.2 mins read

Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read

Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read

Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read

Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read

Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read Seshan Vijayraghvan | Jan 8, 20262026 Mahindra XUV 7XO Review: Big On Tech, Bigger On ComfortThe new Mahindra XUV 7XO is flashier, feature packed, and comes with more advanced tech. But are the changes just incremental or actually substantial?1 min read

Seshan Vijayraghvan | Jan 8, 20262026 Mahindra XUV 7XO Review: Big On Tech, Bigger On ComfortThe new Mahindra XUV 7XO is flashier, feature packed, and comes with more advanced tech. But are the changes just incremental or actually substantial?1 min read