No GST On Petrol, Diesel In Near Future As Centre, States Not In Favour

Petrol and diesel will not come under the purview of Goods and Services Tax (GST) in the immediate future as neither the Central government nor any of the states is in favour on fears of heavy revenue loss, a top source said today. When the one-nation-one-tax regime of GST was implemented in July last year, five petro-products - petrol, diesel, crude oil, natural gas, and aviation turbine fuel (ATF) were kept out of its purview for the time being.

Though there have been talks in the industry and by some ministers, including by Oil Minister Dharmendra Pradhan and Road Transport Minister Nitin Gadkari, for the need to bring them under GST at the earliest to deal with volatility in prices, there is no immediate plans on the anvil to do so, the source, who wished not to be named, said.

The Union finance ministry, he said, has not mooted any proposal to bring petrol and diesel or even natural gas under GST but took up the issue at the last GST Council meeting on August 4 based on media reports.

"All states were opposed to the idea," he said.

If the two fuels are put under GST, the Centre will have to let go Rs 20,000 crore input tax credit it currently pockets by keeping petrol, diesel, natural gas, jet fuel and crude oil out of the GST regime. States, on the other hand, want to keep a revenue tool in their hand to meet any contingency like the floods in Kerala, he said.

The Centre currently levies a total of Rs 19.48 per litre of excise duty on petrol and Rs 15.33 per litre on diesel. On top of this, states levy Value Added Tax (VAT) - the lowest being in Andaman and Nicobar Islands where a 6 per cent sales tax is charged on both the fuel.

Mumbai has the highest VAT of 39.12 per cent on petrol, while Telangana levies highest VAT of 26 per cent on diesel. Delhi charges a VAT of 27 per cent on petrol and 17.24 per cent on diesel.

The total tax incidence on petrol comes to 45-50 per cent and on diesel, it is 35-40 per cent.

Under GST, the total incidence of taxation on a particular good or a service has been kept at the same level as the sum total of central and state levies existing pre-July 1, 2017. This was done by fitting them into one of the four GST tax slabs of 5, 12, 18 and 28 per cent.

For petrol and diesel, the total incidence of present taxation is already beyond the peak rate and if the tax rate was to be kept at just 28 per cent it will result in a big loss of revenue to both centre and states.

The source said there was no case for GST on CNG in near future as its sale is restricted in a few cities.

GST has been spoken of as a panacea for high fuel prices but there seems to be no consensus on bringing petro-products under the new regime in immediate future, he said.

After hitting an all-time high of Rs 78.43 a litre for petrol and Rs 69.31 for diesel on May 29, rates have marginally fallen during the subsequent days on softening in international oil prices and rupee strengthening against the US dollar. Petrol costs Rs 77.49 a litre and diesel Rs 69.04 in Delhi.

More importantly, GST being an ad valorem levy -- charged as a percentage on ex-factory price --- would have a cascading impact on retail prices whenever refinery gate prices are increased because of a rise benchmark international oil prices. The inverse would also be true.

The source justified high excise duty on the fuel saying the earning from the same is used to pay for unpaid oil subsidy bill left by the previous UPA government as well as fund developmental needs. The Central government had raised excise duty on petrol by Rs 11.77 a litre and that on diesel by 13.47 a litre in nine installments between November 2014 and January 2016 to shore up finances as global oil prices fell, but then cut the tax just once in October last year by Rs 2 a litre.

This led to its excise collections from petro goods more than doubling in last four years - from Rs 99,184 crore in 2014-15 to Rs 2,29,019 crore in 2017-18. States saw their VAT revenue from petro goods rise from Rs 1,37,157 crore in 2014-15 to Rs 1,84,091 crore in 2017-18. GST subsumed more than a dozen central and state levies like excise duty, service tax and VAT when it was implemented on July 1, 2017.

However, its implementation on five petro products - petrol, diesel, natural gas, crude oil and ATF was deferred. This resulted in the industry losing on revenue as they were not able to offset GST tax they paid on input from those paid on the sale of products like petrol, diesel and ATF.

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)

Latest News

car&bike Team | Feb 2, 2026Car Sales January 2026: Six Marutis in Top 10, But Tata Nexon Takes Top SpotTata Motors sold 23,365 units of the Nexon, creating a clear gap to the Maruti Suzuki Dzire, which finished second with 19,629 units.1 min read

car&bike Team | Feb 2, 2026Car Sales January 2026: Six Marutis in Top 10, But Tata Nexon Takes Top SpotTata Motors sold 23,365 units of the Nexon, creating a clear gap to the Maruti Suzuki Dzire, which finished second with 19,629 units.1 min read car&bike Team | Feb 2, 2026Maruti Suzuki Victoris Crosses 50,000 Sales Milestone In 4 monthsThe compact SUV launched at the onset of festive season has crossed the 50,000 sales mark in about 4 months1 min read

car&bike Team | Feb 2, 2026Maruti Suzuki Victoris Crosses 50,000 Sales Milestone In 4 monthsThe compact SUV launched at the onset of festive season has crossed the 50,000 sales mark in about 4 months1 min read car&bike Team | Feb 2, 2026Two-Wheeler Sales January 2026: Hero MotoCorp, TVS, Royal Enfield, Suzuki Report Sustained GrowthMost brands have reported year-on-year growth in the first month of CY26.2 mins read

car&bike Team | Feb 2, 2026Two-Wheeler Sales January 2026: Hero MotoCorp, TVS, Royal Enfield, Suzuki Report Sustained GrowthMost brands have reported year-on-year growth in the first month of CY26.2 mins read car&bike Team | Feb 2, 2026Maruti Suzuki Announces Price Protection Amid Long Waiting PeriodsCountry’s largest carmaker has said that prices of the cars will not be increased for customers who have already made the bookings1 min read

car&bike Team | Feb 2, 2026Maruti Suzuki Announces Price Protection Amid Long Waiting PeriodsCountry’s largest carmaker has said that prices of the cars will not be increased for customers who have already made the bookings1 min read Jafar Rizvi | Feb 2, 2026Yamaha EC-06 vs River Indie: How Different Are The Two Electric Scooters?The EC-06 shares its foundation with the River Indie, and here we look at the differences between the two.3 mins read

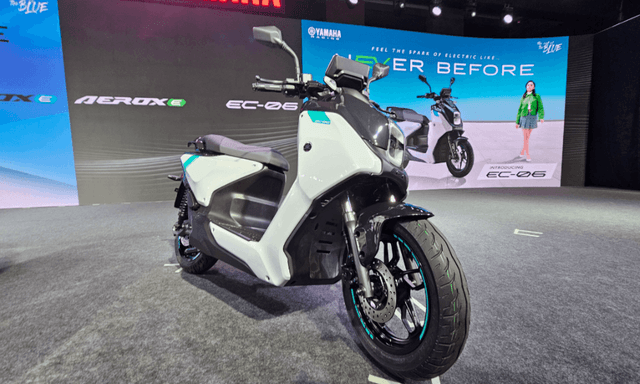

Jafar Rizvi | Feb 2, 2026Yamaha EC-06 vs River Indie: How Different Are The Two Electric Scooters?The EC-06 shares its foundation with the River Indie, and here we look at the differences between the two.3 mins read Jafar Rizvi | Feb 2, 2026Yamaha EC-06 E-Scooter Launched In India At Rs 1.68 LakhThe EC-06 marks Yamaha’s entry into the electric scooter segment in India.2 mins read

Jafar Rizvi | Feb 2, 2026Yamaha EC-06 E-Scooter Launched In India At Rs 1.68 LakhThe EC-06 marks Yamaha’s entry into the electric scooter segment in India.2 mins read

Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read

Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read

Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read

Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read

Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read Seshan Vijayraghvan | Jan 8, 20262026 Mahindra XUV 7XO Review: Big On Tech, Bigger On ComfortThe new Mahindra XUV 7XO is flashier, feature packed, and comes with more advanced tech. But are the changes just incremental or actually substantial?1 min read

Seshan Vijayraghvan | Jan 8, 20262026 Mahindra XUV 7XO Review: Big On Tech, Bigger On ComfortThe new Mahindra XUV 7XO is flashier, feature packed, and comes with more advanced tech. But are the changes just incremental or actually substantial?1 min read