LG Energy Solution Gets Preliminary Approval For IPO

Battery maker LG Energy Solution (LGES) has received preliminary approval for what has been widely tipped to be South Korea's biggest-ever initial public offering, the Korea Exchange said on Tuesday.

A supplier to Tesla Inc, General Motor Co and Hyundai Motor Co, among others, LGES filed for a review of its IPO plans in June.

In October, the wholly owned subsidiary of LG Chem Ltd resumed work on its IPO, which was suspended in August due to a lack of clarity regarding the recall costs involving GM's Bolt electric vehicles.

LG Energy Solution reported an operating loss of 373 billion won ($313 million) in the July-September quarter

The IPO could raise $10 billion to $12 billion, according to publication IFR.

A $10 billion-$12 billion IPO would be more than double the biggest ever listing in South Korea, the 2010 IPO of Samsung Life Insurance, which was worth 4.9 trillion won ($4.39 billion).

The company has mandated KB Securities and Morgan Stanley to lead the proposed deal. Bank of America, Citigroup, Daishin Securities, Goldman Sachs and Shinhan Investment Corp were also mandated as bookrunners.

LG Energy Solution reported an operating loss of 373 billion won ($313 million) in the July-September quarter versus an operating profit of 169 billion won a year earlier, a regulatory filing showed.

Latest News

car&bike Team | Feb 20, 2026Production-Ready Royal Enfield Flying Flea C6 Spotted On TestTest mules of the Flying Flea C6 have been spotted sans camouflage.2 mins read

car&bike Team | Feb 20, 2026Production-Ready Royal Enfield Flying Flea C6 Spotted On TestTest mules of the Flying Flea C6 have been spotted sans camouflage.2 mins read Jaiveer Mehra | Feb 20, 2026New Audi RS5 Debuts With 630 bhp V6 PHEV PowertrainThe RS5 features a twin-turbo 2.9-litre V6 paired with an electric motor and a 25.9 kWh battery and offers over 80 km of EV-only driving.1 min read

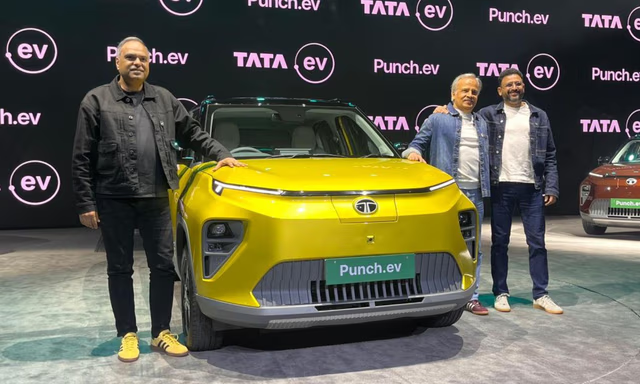

Jaiveer Mehra | Feb 20, 2026New Audi RS5 Debuts With 630 bhp V6 PHEV PowertrainThe RS5 features a twin-turbo 2.9-litre V6 paired with an electric motor and a 25.9 kWh battery and offers over 80 km of EV-only driving.1 min read Jaiveer Mehra | Feb 20, 2026Tata Punch EV Facelift Launched In India; Prices Start From Rs 9.69 LakhNotable changes to the Punch EV include faster DC fast charging and larger battery packs.3 mins read

Jaiveer Mehra | Feb 20, 2026Tata Punch EV Facelift Launched In India; Prices Start From Rs 9.69 LakhNotable changes to the Punch EV include faster DC fast charging and larger battery packs.3 mins read Jaiveer Mehra | Feb 20, 2026Level 2 ADAS Systems To Be Mainstay Of Auto IndustryUse of Level 2+ ADAS technologies to gain popularity in the coming year and overtake the basic Level 2 system by 20354 mins read

Jaiveer Mehra | Feb 20, 2026Level 2 ADAS Systems To Be Mainstay Of Auto IndustryUse of Level 2+ ADAS technologies to gain popularity in the coming year and overtake the basic Level 2 system by 20354 mins read car&bike Team | Feb 20, 2026Tata Punch EV Facelift Launch Highlights: Price, Specifications, Features, Images0 mins read

car&bike Team | Feb 20, 2026Tata Punch EV Facelift Launch Highlights: Price, Specifications, Features, Images0 mins read car&bike Team | Feb 19, 2026KTM 390, 250 Adventure Offered With Free Accessories And 10-Year Extended WarrantyThis limited-run scheme is offered until February 28 on both motorcycles.2 mins read

car&bike Team | Feb 19, 2026KTM 390, 250 Adventure Offered With Free Accessories And 10-Year Extended WarrantyThis limited-run scheme is offered until February 28 on both motorcycles.2 mins read

Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read

Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read

Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read Jafar Rizvi | Feb 15, 2026Maruti Suzuki Victoris: Long-Term Review - Report 1The Victoris is Maruti’s latest offering for the Indian market, and after spending some time with it, here are a few early impressions.1 min read

Jafar Rizvi | Feb 15, 2026Maruti Suzuki Victoris: Long-Term Review - Report 1The Victoris is Maruti’s latest offering for the Indian market, and after spending some time with it, here are a few early impressions.1 min read Bilal Firfiray | Feb 12, 2026BMW X3 30 xDrive M Sport Review: The Driver’s SUV ReturnsRange-toppingX3 30 xDrive M Sport brings back the fun with 255bhp and genuine enthusiast appeal. Does this performance-focused SUV stand out?5 mins read

Bilal Firfiray | Feb 12, 2026BMW X3 30 xDrive M Sport Review: The Driver’s SUV ReturnsRange-toppingX3 30 xDrive M Sport brings back the fun with 255bhp and genuine enthusiast appeal. Does this performance-focused SUV stand out?5 mins read Bilal Firfiray | Feb 11, 2026Mercedes-AMG CLE 53 Coupe Review: The Goldilocks AMG?The Mercedes-AMG CLE 53 Coupe is a concoction of hooliganistic performance and everyday usability. Here’s why this Rs 1.5 crore two-door AMG might be the perfect modern sports coupe for India.6 mins read

Bilal Firfiray | Feb 11, 2026Mercedes-AMG CLE 53 Coupe Review: The Goldilocks AMG?The Mercedes-AMG CLE 53 Coupe is a concoction of hooliganistic performance and everyday usability. Here’s why this Rs 1.5 crore two-door AMG might be the perfect modern sports coupe for India.6 mins read