Hero Eyes Brazil, Future Growth

After announcing its split with Honda in 2010, Hero had very clearly stated it wanted at least 10% of its production to go overseas by 2017. It has made small yet significant strides in that direction since. And while the target is now moved to 2020, there have been important steps like the stake-buy in Eric Buell Racing (EBR), or the $70 million investment in a 100% subsidiary greenfield manufacturing plant in Colombia.

Now Hero wants to bite into Brazil. The country is not only the largest in South America by size, it is so by volume too. The Brazilian two wheeler market is just over 2 million units a year. Now compared to ours, that's nothing, right? But to make or break it in this region, Brazil simply has to be an important strategy. The market has long been dominated by guess who? Honda! With a monopolistic marketshare.

So it won't be easy to break into it, says Pawan Munjal, the man at the helm of Hero MotoCorp. Yet he believes there is a space for his brand. The co's R&D team in Haryana, in conjunction with the guys at EBR, is already at work to develop engines specially for Brazil, that can go into its current 100-230cc portfolio. This is because the Brazilian market has a high-level of ethanol blending in fuel, mandated by law. And so there is a need for specialized engines that work more suitably with this blended fuel type.

But it won't be enough to simply have the right engines, and so Munjal says he has an aggressive entry strategy in mind too. The company will target a market entry with its bikes in August 2016 - yes to coincide beautifully with the 2016 Summer Olympic Games (which it might even look at as a potential local sponsor). And at that time, the plan is to look at very aggressively competitive pricing to attract attention.

Let's not forget that both Bajaj and TVS have already been selling in Latin America, and so have an edge over Hero. Pawan Munjal says this too is an advantage, as it simply means that his two rivals have already created an acceptance for Indian-made products. And in recognition of their prowess, adds that it's also good they have established a certain quality benchmark for Indian bikes. This will only help Hero he feels.

Initially, the company plans to sell bikes assembled at its Colombia plant, which will be operational before its August 2016 deadline for a Brazil-market entry. But Munjal believes it will be imperative to also consider a standalone plant in Brazil as well. The Colombian production unit would have its hands full in the long run supplying to the rest of Latin America. So, Hero is actively scouting for a local partner to sign on for the Brazil foray.

Alongside all this, Hero will continue to also expand operations in the rest of LatAm and Africa - the company's first two target regions for global expansion. The next step would be South-East Asia and then the United States. In fact, the US entry may just come much sooner, as its partner EBR is already in talks with potential distributors, who believe the American market will see a spike in demand for low displacement city runabout motorcycles.

To keep pace with all these plans, Hero is going to continue to add capacity in India, which will help support future export and domestic demand. The company is all set to commission its Neemrana plant in the next few weeks, where trial production has just begun this month. It will then look to expedite its Gujarat project - where construction is due to begin imminently. But all eyes are on the company's big decision that will also be declared soon - a site for a manufacturing unit down south. This is expected to be Karnataka as previously speculated, or neighbouring Tamil Nadu, where there may be better fiscal incentives to be had.

So the next few months are going to be crucial for the company as it plots and plans its long term growth plan.

Latest News

Jaiveer Mehra | Mar 1, 2026Mahindra XEV 9e Cineluxe Edition Launched At Rs 29.35 LakhNew special edition of the 9e electric SUV is based on the fully-loaded 9e Pack 3 but costs about Rs 1.15 lakh less.2 mins read

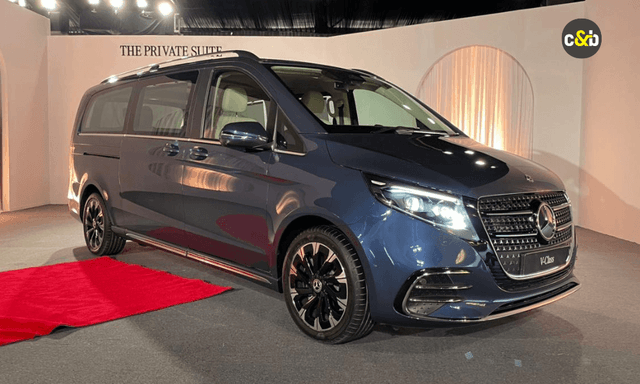

Jaiveer Mehra | Mar 1, 2026Mahindra XEV 9e Cineluxe Edition Launched At Rs 29.35 LakhNew special edition of the 9e electric SUV is based on the fully-loaded 9e Pack 3 but costs about Rs 1.15 lakh less.2 mins read Jaiveer Mehra | Mar 1, 2026New Mercedes-Benz V-Class Makes India Debut; Launch TomorrowUnlike the previous diesel-only V-class, the latest model will be offered with petrol and diesel engine options.1 min read

Jaiveer Mehra | Mar 1, 2026New Mercedes-Benz V-Class Makes India Debut; Launch TomorrowUnlike the previous diesel-only V-class, the latest model will be offered with petrol and diesel engine options.1 min read car&bike Team | Feb 28, 2026Zero-Dep Cover: The Renewal Add-on That Ensures You Don’t Pay for Parts1 min read

car&bike Team | Feb 28, 2026Zero-Dep Cover: The Renewal Add-on That Ensures You Don’t Pay for Parts1 min read car&bike Team | Feb 28, 2026Toyota Land Cruiser, Lexus LX Recalled Over Transmission Malfunction RiskThe recall affects 969 units of the Toyota Land Cruiser and 117 units of the Lexus LX.1 min read

car&bike Team | Feb 28, 2026Toyota Land Cruiser, Lexus LX Recalled Over Transmission Malfunction RiskThe recall affects 969 units of the Toyota Land Cruiser and 117 units of the Lexus LX.1 min read Jaiveer Mehra | Feb 27, 2026New Tata Tiago EV Spied Testing On Indian Roads: Enhanced Range Incoming?Launched in India in 2022, the Tiago EV received a notable update last year, adding in newer features and some styling tweaks.3 mins read

Jaiveer Mehra | Feb 27, 2026New Tata Tiago EV Spied Testing On Indian Roads: Enhanced Range Incoming?Launched in India in 2022, the Tiago EV received a notable update last year, adding in newer features and some styling tweaks.3 mins read car&bike Team | Feb 27, 2026VLF Mobster 135 Price Hiked As Introductory Offer EndsThe Mobster 135 is now priced at Rs 1.37 lakh (ex-showroom), which marks an increase of Rs 7,000.2 mins read

car&bike Team | Feb 27, 2026VLF Mobster 135 Price Hiked As Introductory Offer EndsThe Mobster 135 is now priced at Rs 1.37 lakh (ex-showroom), which marks an increase of Rs 7,000.2 mins read

Bilal Firfiray | Feb 28, 2026Tata Punch EV Facelift Review: More Range, More Sense, Less MoneyThe Tata Punch EV facelift gets a bigger 40 kWh battery, faster 60 kW DC charging, improved thermal management, and better real-world range, and all of that at a lower introductory price. But does it become a more complete package now?6 mins read

Bilal Firfiray | Feb 28, 2026Tata Punch EV Facelift Review: More Range, More Sense, Less MoneyThe Tata Punch EV facelift gets a bigger 40 kWh battery, faster 60 kW DC charging, improved thermal management, and better real-world range, and all of that at a lower introductory price. But does it become a more complete package now?6 mins read Preetam Bora | Feb 24, 2026Hero Destini 110 Review: Simplicity, RefinedThe Hero Destini 110 is a no-nonsense commuter that is simple, comfortable and above all, fuel efficient. In 2026, when buyers are spoilt for choice, is it good enough to consider?1 min read

Preetam Bora | Feb 24, 2026Hero Destini 110 Review: Simplicity, RefinedThe Hero Destini 110 is a no-nonsense commuter that is simple, comfortable and above all, fuel efficient. In 2026, when buyers are spoilt for choice, is it good enough to consider?1 min read Preetam Bora | Feb 23, 2026TVS Apache RTX Road Test Review: Redefining the Entry-Level ADVAfter spending some time with the TVS Apache RTX in traffic, the daily commute, as well as on open highways, one thing becomes clear: the RTX is trying to redefine the entry-level ADV segment. But is it without fault?1 min read

Preetam Bora | Feb 23, 2026TVS Apache RTX Road Test Review: Redefining the Entry-Level ADVAfter spending some time with the TVS Apache RTX in traffic, the daily commute, as well as on open highways, one thing becomes clear: the RTX is trying to redefine the entry-level ADV segment. But is it without fault?1 min read Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read

Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read

Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read