GST Cess Hike On Luxury Cars Approved By Cabinet; SUVs To Get Pricier

- Hike in cess on luxury cars and SUVs is now 25% from 15%

- Government will now push for a Presidential nod

- A formal notification will be presented to the GST Council on September 9

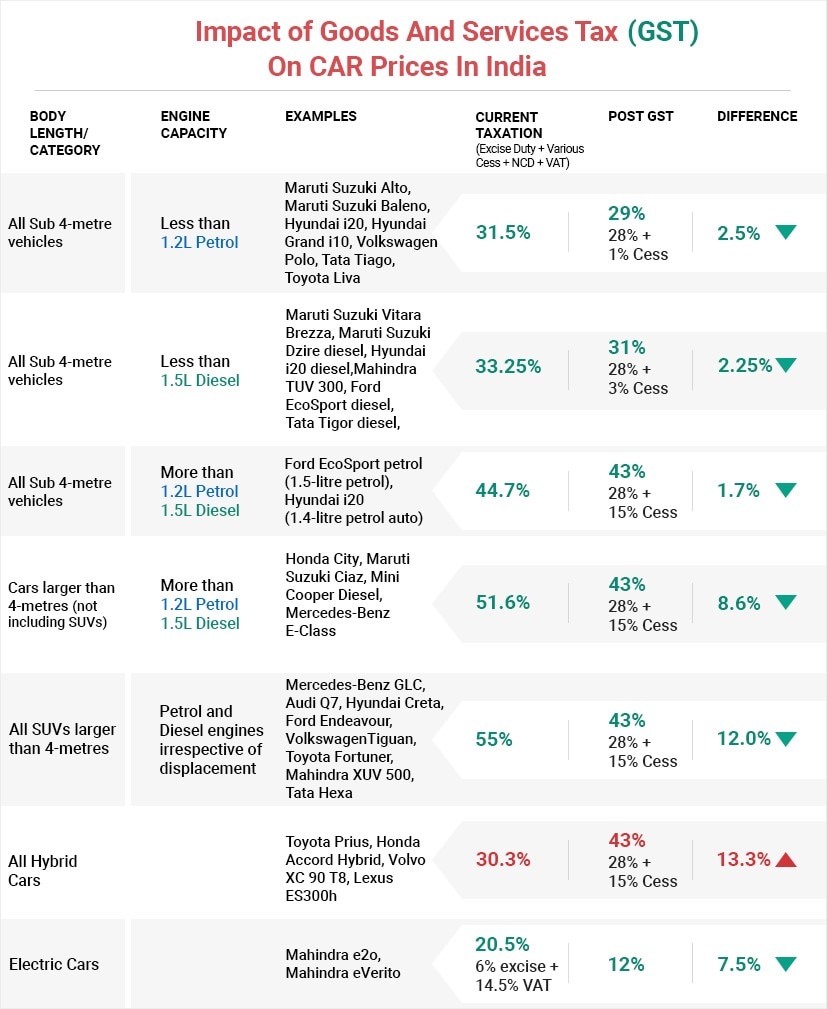

Affecting mid-size, luxury cars and SUVs, the Cabinet has cleared promulgation of an Ordinance to increase the GST cess from current 15 per cent under the new tax regime. The proposal before the cabinet was to hike the GST cess rate on premium cars to 25 per cent and the ordinance is the first step in that direction. In July this year, the new GST taxation regime rolled into the country bringing a host of state and central taxes under one umbrella. This led to a reduction in taxes over premium vehicles, bringing down prices as well. The government will now push for a Presidential approval soon for hiking maximum cap of GST cess. The Central Board of Excise and Customs (CBEC) will issue cess hike notification post the President gives his approval.

Also Read: 10 Per Cent Cess Hike: 10 Things To Know

The Cabinet's nod allows the government to increase the GST cess on luxury cars, SUVs via an ordinance. It will now put forward a formal notification to the GST Council in a meeting on September 9. "The proposal of imposition of higher cess has been cleared," a source said after the Cabinet meeting.

Prices of most SUVs were cut between Rs 1.1 lakh and Rs 3 lakh following the implementation of GST, which subsumed over a dozen central and state levies like excise duty, service tax, and VAT from July 1. Cars attract the top tax rate of 28 per cent. On top of this, a cess of 1 to 15 per cent is levied for the creation of the state compensation corpus.

Also Read: Mercedes-Benz Warn Of Prices Going Back To Pre-GST Level

To rectify the anomaly, the GST Council, headed by Union Finance Minister Arun Jaitley and comprising representatives of all states, had on August 5 recommended that the Central government move legislative amendments required for increasing the maximum ceiling of cess leviable on motor vehicles to 25 per cent from present 15 per cent.

(Union Cabinet approves levy on luxury cars and SUVs)

Also Read: GST Impact: Car Buyers To Bear Burden Of Additional Cess If Implemented Before Delivery Date

Once the law is amended, the GST Council will decide on the date when the increased cess will be applicable, the official said, adding the next meeting of the panel is scheduled to be held in Hyderabad on September 9. The highest pre-GST tax incidence on motor vehicles worked out to about 52-54.72 per cent, to which 2.5 per cent was added on account of Central Sales Tax, octroi etc. Against this, post-GST the total tax incidence came to 43 per cent.

Mercedes Benz India, Managing Director, Roland Folger, had said earlier that the situation may go back to "square one" due to levy of cess for large cars and Sports Utility vehicles if government does not intervene.

So, to take the tax incidence to pre-GST level, the highest compensation cess rate required is 25 per cent. Presently, large motor vehicles, SUVs, mid-segment cars, large cars, hybrid cars and hybrid motor vehicles attract a cess of 15 per cent on top of 28 per cent GST. Small petrol cars of less than 4 meters and 1,200 cc attract a cess of 1 per cent, while small diesel cars of less than 4 meters and 1,500 cc engine attract a cess of 3 per cent.

The auto industry is collectively disappointed by the decision. Here's how manufacturers reacted to the decision.

Watch this space for more.

Latest News

- Jaiveer Mehra | Jan 30, 2026Jeep India Confirms ‘First Model of Future Lineup’ To Arrive In 2027: What Could It Be?The SUV maker confirmed its first all-new model for India since 2022.1 min read

Jaiveer Mehra | Jan 30, 2026New Bentley Continental GT S Debuts As Sportier Alternative To Standard CGTThe GT S shaves the 0-100 kmph time down from 3.7 seconds to 3.5 seconds despite not offering any additional power.1 min read

Jaiveer Mehra | Jan 30, 2026New Bentley Continental GT S Debuts As Sportier Alternative To Standard CGTThe GT S shaves the 0-100 kmph time down from 3.7 seconds to 3.5 seconds despite not offering any additional power.1 min read Jaiveer Mehra | Jan 29, 2026Tesla Model S, Model X Production To End By Mid-2026Company CEO Elon Musk made the announcement during the company’s Q4 2025 earnings call.3 mins read

Jaiveer Mehra | Jan 29, 2026Tesla Model S, Model X Production To End By Mid-2026Company CEO Elon Musk made the announcement during the company’s Q4 2025 earnings call.3 mins read car&bike Team | Jan 29, 2026Mahindra Vision S SUV Interior Spied For The First TimeTest mules of the boxy SUV were initially spotted on public roads in mid 2025, with the concept debuting in August.1 min read

car&bike Team | Jan 29, 2026Mahindra Vision S SUV Interior Spied For The First TimeTest mules of the boxy SUV were initially spotted on public roads in mid 2025, with the concept debuting in August.1 min read car&bike Team | Jan 29, 2026Hyundai Exter Facelift Spied Testing Ahead Of India DebutUpdated Exter is expected to make its debut later in the year as Hyundai will look to better compete with the Punch.1 min read

car&bike Team | Jan 29, 2026Hyundai Exter Facelift Spied Testing Ahead Of India DebutUpdated Exter is expected to make its debut later in the year as Hyundai will look to better compete with the Punch.1 min read Janak Sorap | Jan 29, 20262023 World Superbike Championship-winning Ducati Panigale V4 R: Photo GalleryThis one is not tribute bike or a factory replica, but the very machine ridden by Álvaro Bautista during his record-breaking WorldSBK title in the 2023 season.1 min read

Janak Sorap | Jan 29, 20262023 World Superbike Championship-winning Ducati Panigale V4 R: Photo GalleryThis one is not tribute bike or a factory replica, but the very machine ridden by Álvaro Bautista during his record-breaking WorldSBK title in the 2023 season.1 min read

Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read

Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read

Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read

Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read Seshan Vijayraghvan | Jan 8, 20262026 Mahindra XUV 7XO Review: Big On Tech, Bigger On ComfortThe new Mahindra XUV 7XO is flashier, feature packed, and comes with more advanced tech. But are the changes just incremental or actually substantial?1 min read

Seshan Vijayraghvan | Jan 8, 20262026 Mahindra XUV 7XO Review: Big On Tech, Bigger On ComfortThe new Mahindra XUV 7XO is flashier, feature packed, and comes with more advanced tech. But are the changes just incremental or actually substantial?1 min read Preetam Bora | Jan 10, 2026Simple One Gen 2 First Ride Review: 265 km Claimed Range!The Gen 2 model of Simple Energy’s first electric scooter gets a fair few updates, including new features, tech, more range and lighter weight. We spent a couple of hours with the Simple One Gen 2 to find out if it manages to impress.6 mins read

Preetam Bora | Jan 10, 2026Simple One Gen 2 First Ride Review: 265 km Claimed Range!The Gen 2 model of Simple Energy’s first electric scooter gets a fair few updates, including new features, tech, more range and lighter weight. We spent a couple of hours with the Simple One Gen 2 to find out if it manages to impress.6 mins read