FADA Sales December 2022: Auto Sales Slide 5 Per Cent As Two-Wheeler Sales Fall

- December 2022 sales down 11.89 per cent over pre-pandemic 2019

- 2022 sales up 15.28 per cent over calendar year 2021

- Demand for three-wheeler, commercial vehicles showing strong recovery

Apex dealer body, the Federation Of Automobile Dealers Associations (FADA), released vehicle sales numbers for the month of December 2022 reporting a 5.4 per cent cumulative decline in sales in the month – 16,22,317 units as against 17,14,942 units in December 2021. The cumulative decline was attributed to the fall in sales in the two-wheeler segment which reported a 11.19 per cent year-on-year decline. The decline in sales in December also held true against pre-pandemic 2019 with a 11.89 per cent drop compared to 18,41,183 units sold in the pre-pandemic month.

Cumulative industry sales for 2022 meanwhile stood at 2,11,20,441 units – up 15.28 per cent over 2021 (1,83,21,760 units). Sales however remained down compared to pre-pandemic 2019 (2,34,17,776 units).

Commenting on the industry sales performance in how December’22, FADA President, Manish Raj Singhania said, “The month of December went into lull after 2 super months of October and November which witnessed adrenaline rush in the entire Auto Industry. December’22 saw an overall fall of -5%. While all other categories were in green, it was the 2W segment which once again dragged total sales by falling -11%. 3W, PV, Tractor and CV during the same period showed growth of 42%, 8%, 5% and 11%.”

Two-wheeler sales for December stood at 11,33,138 units compared to 12,75,894 units in 2021. Numbers were down a more significant 29.07 per cent over December 2020 (15,97,554 units) and 20.54 per cent over pre-pandemic 2019 (14,25,994 units). The segment had seemed to be on the path to recovery in recent months with strong growth over 2021 with October also seeing sales exceed pre-covid 2019 while sales in November were down 0.86 per cent over 2019.

In terms of sales in the calendar year 2022 (CY2022), the two-wheeler segment reported sales of 1,53,88,062 units, up 13.37 per cent over 2021 (1,35,73,682 units) though down 15.47 per cent over 2019 (1,82,04,593 units).

“The 2W segment once again failed to impress as retail sales during Dec’22 continued to fall after 2 good months. Reasons like rise in inflation, increased cost of ownership rural market yet to pick up fully and increased EV sales, the ICE 2W segment is yet to see any green shoots,” Singhania said.

Passenger vehicle sales meanwhile continued to show steady growth with 2,80,016 units sold. Numbers were up 8.15 per cent over December 2021 (2,58,921 units) though down 4.84 percent over the same month in 2020. Compared to pre-pandemic Dec 2019 (2,30,939 units), PV sales grew a notable 21.25 per cent in the month.

The steady growth in PV sales also reflected in sales for CY2022 with 34,31,497 units sold – up 16.35 per cent from 2021 (29,49,182 units) and 15.56 per cent over 2019 (29,69,574 units).

2022 also marked a year of recovery for the commercial vehicle segment. Sales for the month of December 2022 stood at 66,945 units – up 10.67 per cent from 60,491 units in the same period a year ago. Sales were also up 9.08 per cent from 61,370 units reported in December 2021. Moving to 2022, CV sales stood at 8,65,344 units down just 1.77 per cent over pre-pandemic 2019 (8,80,904 units sold). Growth over 2021 and 2020 were a lot stronger in comparison at 31.97 per cent and 54.51 per cent respectively.

“The CV segment has continued to grow during entire CY2022 and is now almost at part with CY2019 retails. With uptick in demand in LCV, HCV, Buses and Construction equipment, the government’s continued push for infrastructure development has kept this segment going,” Singhania commented.

The three-wheeler segment too showed signs of recovery in sales post the pandemic with 6,40,559 units retailed in CY2022. Numbers were up over 70 per cent over 2021 and 2020 while the gap to pre-pandemic 2019 (7,18,093 units) was narrowed down. Sales were down 10.8 per cent over pre-pandemic 2019. Moving to December 2022, three-wheeler sales stood at 63,655 units – up from 44,983 units in the same period in 2021 and up 4.22 per cent over December 2019.

Tractor sales meanwhile also remained on the uptick with 78,563 units sold in December 2022 – up 5.24 per cent over December 2021 (74,653 units) and up 27.12 per cent over Dec 2019 (61,803 units). Cumulative sales for 2022 in the segment meanwhile stood at 7,94,979 units – up 3.29 per cent over 2021 (7,69,638 units) and up 23.33 per cent over 2019 (6,44,612 units).

FADA said that geopolitical headwinds, tightening monetary policy and lingering effects of the pandemic continued to paint a gloomy global outlook in the near term. The dealer body also cautioned that rising inflation and the new vehicle norms set to come into place in the coming months would result in price hikes across brands which could affect customer buying sentiment though it suggested OEMs could look to offer special schemes to keep sales momentum going. The dealer body said that it would continue to be cautious for the last quarter for the financial year.

Latest News

car&bike Team | Feb 20, 2026Production-Ready Royal Enfield Flying Flea C6 Spotted On TestTest mules of the Flying Flea C6 have been spotted sans camouflage.2 mins read

car&bike Team | Feb 20, 2026Production-Ready Royal Enfield Flying Flea C6 Spotted On TestTest mules of the Flying Flea C6 have been spotted sans camouflage.2 mins read Jaiveer Mehra | Feb 20, 2026New Audi RS5 Debuts With 630 bhp V6 PHEV PowertrainThe RS5 features a twin-turbo 2.9-litre V6 paired with an electric motor and a 25.9 kWh battery and offers over 80 km of EV-only driving.1 min read

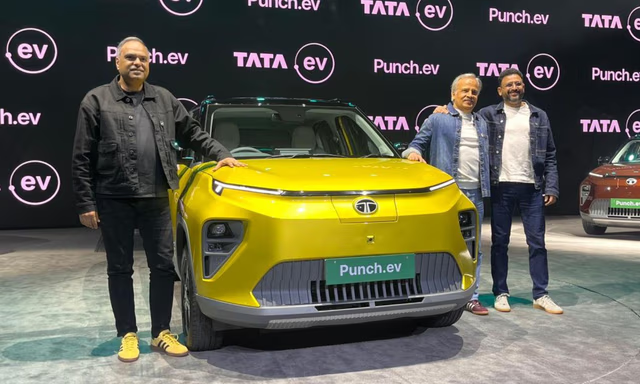

Jaiveer Mehra | Feb 20, 2026New Audi RS5 Debuts With 630 bhp V6 PHEV PowertrainThe RS5 features a twin-turbo 2.9-litre V6 paired with an electric motor and a 25.9 kWh battery and offers over 80 km of EV-only driving.1 min read Jaiveer Mehra | Feb 20, 2026Tata Punch EV Facelift Launched In India; Prices Start From Rs 9.69 LakhNotable changes to the Punch EV include faster DC fast charging and larger battery packs.3 mins read

Jaiveer Mehra | Feb 20, 2026Tata Punch EV Facelift Launched In India; Prices Start From Rs 9.69 LakhNotable changes to the Punch EV include faster DC fast charging and larger battery packs.3 mins read Jaiveer Mehra | Feb 20, 2026Level 2 ADAS Systems To Be Mainstay Of Auto IndustryUse of Level 2+ ADAS technologies to gain popularity in the coming year and overtake the basic Level 2 system by 20354 mins read

Jaiveer Mehra | Feb 20, 2026Level 2 ADAS Systems To Be Mainstay Of Auto IndustryUse of Level 2+ ADAS technologies to gain popularity in the coming year and overtake the basic Level 2 system by 20354 mins read car&bike Team | Feb 20, 2026Tata Punch EV Facelift Launch Highlights: Price, Specifications, Features, Images0 mins read

car&bike Team | Feb 20, 2026Tata Punch EV Facelift Launch Highlights: Price, Specifications, Features, Images0 mins read car&bike Team | Feb 19, 2026KTM 390, 250 Adventure Offered With Free Accessories And 10-Year Extended WarrantyThis limited-run scheme is offered until February 28 on both motorcycles.2 mins read

car&bike Team | Feb 19, 2026KTM 390, 250 Adventure Offered With Free Accessories And 10-Year Extended WarrantyThis limited-run scheme is offered until February 28 on both motorcycles.2 mins read

Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read

Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read

Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read Jafar Rizvi | Feb 15, 2026Maruti Suzuki Victoris: Long-Term Review - Report 1The Victoris is Maruti’s latest offering for the Indian market, and after spending some time with it, here are a few early impressions.1 min read

Jafar Rizvi | Feb 15, 2026Maruti Suzuki Victoris: Long-Term Review - Report 1The Victoris is Maruti’s latest offering for the Indian market, and after spending some time with it, here are a few early impressions.1 min read Bilal Firfiray | Feb 12, 2026BMW X3 30 xDrive M Sport Review: The Driver’s SUV ReturnsRange-toppingX3 30 xDrive M Sport brings back the fun with 255bhp and genuine enthusiast appeal. Does this performance-focused SUV stand out?5 mins read

Bilal Firfiray | Feb 12, 2026BMW X3 30 xDrive M Sport Review: The Driver’s SUV ReturnsRange-toppingX3 30 xDrive M Sport brings back the fun with 255bhp and genuine enthusiast appeal. Does this performance-focused SUV stand out?5 mins read Bilal Firfiray | Feb 11, 2026Mercedes-AMG CLE 53 Coupe Review: The Goldilocks AMG?The Mercedes-AMG CLE 53 Coupe is a concoction of hooliganistic performance and everyday usability. Here’s why this Rs 1.5 crore two-door AMG might be the perfect modern sports coupe for India.6 mins read

Bilal Firfiray | Feb 11, 2026Mercedes-AMG CLE 53 Coupe Review: The Goldilocks AMG?The Mercedes-AMG CLE 53 Coupe is a concoction of hooliganistic performance and everyday usability. Here’s why this Rs 1.5 crore two-door AMG might be the perfect modern sports coupe for India.6 mins read