Physical Damage Coverage Is Included In Two-Wheeler Insurance Policies

- Two-wheeler insurance coverage protects your bike from physical damage

- There are two types of policies offered by all insurance companies

- As a result of an accident, as well as other risks

There are two types of policies offered by all insurance companies:

- Bike Insurance from a Third-Party

- Comprehensive Bike Insurance

Physical Damage Coverage is a sort of bike insurance policy that protects you financially in the event of a bike accident. It is important to note that purchasing a physical damage policy is not required by law. Purchasing this coverage for your bike, on the other hand, will ensure that you suffer the least amount of financial loss in the event of damage. As a result, many bike owners opt for physical damage protection.

It's not easy to ride a two-wheeler. You must be able to concentrate on many tasks at the same time. You must keep your bike's balance while concentrating on the road and adhering to traffic regulations. Failure to execute any of them could result in an accident, resulting in personal injury and damage to your bike. This is why purchasing a physical damage policy is advantageous.

How can I get physical damage coverage?

Physical Damage Bike insurance reduces your financial liability in the event of a bike accident. Physical damage insurance can cover a variety of things.

- Comprehensive Policy

undefinedA Comprehensive Bike Insurance policy provides a broad range of coverage, including Third-Party Liability and Own Damage Coverage. The best part about a comprehensive policy is that you can customize it with additional coverage and add-ons. Third-party liabilities are the costs of reimbursing a third party for harm you have caused. Injuries, death, and property damage are examples of such damages.undefined

- Own Damage Policy on Its Own

When you choose a long-term third-party liability plan and want to purchase separate own-damage protection, this plan comes into play. The coverage of a standalone policy is similar to that of a physical damage policy. In the following sections, we'll go through this in further detail.

What does the Physical Damage Bike Insurance Policy cover?

Coverages are instances in which the insurance company will cover the cost of repairs if the policy's terms and conditions are met.

Personal Accident: This is an optional add-on that must be purchased in addition to a bike insurance policy. It covers the rider's bodily injuries. Compensation is also available in the event of death or disability.

Accidental damage to your insured bike: coverage for repairing damage to your insured bike in the event of an accident.

Theft: In the event of proven bike theft, compensation up to the insured declared value (IDV) is available. Natural and man-made calamities Floods, earthquakes, vandalism, rioting, and other natural and man-made calamities are covered.

Whole loss: The vehicle's total loss is covered. If the cost of repairing your bike exceeds 75% of the IDV, it is considered a total loss.

Fire: Protection against harm to the bike caused by a fire or explosion.

Latest News

Jaiveer Mehra | Feb 10, 2026Ferrari’s First EV Named Luce; Retro-Style Interior RevealedFerrari has showcased the interior of its first-ever EV ahead of its global debut in the coming months.1 min read

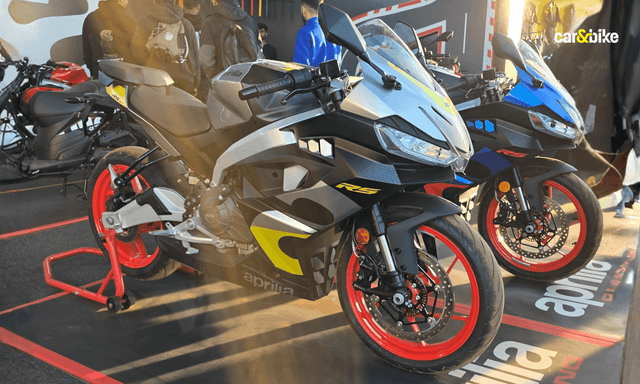

Jaiveer Mehra | Feb 10, 2026Ferrari’s First EV Named Luce; Retro-Style Interior RevealedFerrari has showcased the interior of its first-ever EV ahead of its global debut in the coming months.1 min read Jafar Rizvi | Feb 10, 20262026 Aprilia RS 457 Launched At Rs 4.22 LakhThe RS 457 gets three new paint options for 2026, including the GP Replica livery sitting at the top of the lineup.2 mins read

Jafar Rizvi | Feb 10, 20262026 Aprilia RS 457 Launched At Rs 4.22 LakhThe RS 457 gets three new paint options for 2026, including the GP Replica livery sitting at the top of the lineup.2 mins read Jaiveer Mehra | Feb 9, 2026Tata Motors Inaugurates New Tamil Nadu Plant; Range Rover Evoque First Vehicle To Roll OutTata says that the plant will become the production base for next-gen vehicles from both Tata and its subsidiary JLR.1 min read

Jaiveer Mehra | Feb 9, 2026Tata Motors Inaugurates New Tamil Nadu Plant; Range Rover Evoque First Vehicle To Roll OutTata says that the plant will become the production base for next-gen vehicles from both Tata and its subsidiary JLR.1 min read car&bike Team | Feb 9, 2026New Cars Coming In February: New SUVs, MPV & EV Lined Up For LaunchJust like January, even February will see a good number new car launches and unveils. We list them for you1 min read

car&bike Team | Feb 9, 2026New Cars Coming In February: New SUVs, MPV & EV Lined Up For LaunchJust like January, even February will see a good number new car launches and unveils. We list them for you1 min read car&bike Team | Feb 9, 2026Hero Vida Ubex Electric Bike Design Patented In IndiaThe Vida Ubex will be the first electric motorcycle from the brand when launched.1 min read

car&bike Team | Feb 9, 2026Hero Vida Ubex Electric Bike Design Patented In IndiaThe Vida Ubex will be the first electric motorcycle from the brand when launched.1 min read car&bike Team | Feb 8, 2026Select Harley-Davidson Motorcycles To Attract Zero Duty Under Upcoming India-US FTA Interim Agreement: ReportPrimary beneficiaries are expected to include models in the 800 to 1600 cc segment2 mins read

car&bike Team | Feb 8, 2026Select Harley-Davidson Motorcycles To Attract Zero Duty Under Upcoming India-US FTA Interim Agreement: ReportPrimary beneficiaries are expected to include models in the 800 to 1600 cc segment2 mins read

Bilal Firfiray | Feb 4, 2026Volkswagen Tayron R-Line Review: Sensible Flagship For IndiaVolkswagen has introduced a made-in-India flagship SUV that offers space, comfort, performance, and German driving finesse in a practical three-row package. But is the Tayron R-Line good enough?6 mins read

Bilal Firfiray | Feb 4, 2026Volkswagen Tayron R-Line Review: Sensible Flagship For IndiaVolkswagen has introduced a made-in-India flagship SUV that offers space, comfort, performance, and German driving finesse in a practical three-row package. But is the Tayron R-Line good enough?6 mins read Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read

Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read

Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read

Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read

Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read