Oil Settles Up 5% As Further Interest Rate Hikes Loom

Oil prices settled up by more than 5% on Friday amid uncertainty around future interest rate hikes by the U.S. Federal Reserve, while a looming EU ban on Russian oil and the possibility of China easing some COVID restrictions supported markets.

Though fears of global recession capped gains, Brent crude futures settled up $3.99 to $98.57 per barrel, a weekly gain of 2.9%.

U.S. West Texas Intermediate (WTI) crude futures were up $2.96, or 5%, at $92.61, a 4.7% weekly gain.

China is sticking to its strict COVID-19 curbs after cases rose on Thursday to their highest since August, but a former Chinese disease control official said substantial changes to the country's COVID-19 policy are to take place soon.

China's stock markets have been buoyed this week by the rumours of an end to stringent lockdowns despite the lack of any announced changes.

However, signals about the size of U.S. interest rate hikes caused oil to pare some gains.

The U.S. Labor Department's non-farm payrolls report on Friday showed a rise in the unemployment rate to 3.7% last month from 3.5% in September, suggesting some loosening in labor market conditions that could give the Fed cover to shift towards smaller rate increases.

Richmond Federal Reserve President Thomas Barkin on Friday said he is ready to act more "deliberatively" on consideration of the pace of future U.S. interest rate hikes, but said rates could continue rising for longer and to a higher end point than previously expected.

"The China re-opening talk this morning got oil going, but the various Fed representatives have been making it clear there's a long way to go with respect to interest rate hikes, and oil markets are more sensitive to that," said John Kilduff, partner at Again Capital LLC.

While demand concerns weighed on the market, supply is expected to remain tight because of Europe's planned embargoes on Russian oil and a slide in U.S. crude stockpiles.

"The slight weakness in the dollar, the upcoming ban on Russian oil sales are certainly supportive as focus is shifting from recession fears to supply issues," said PVM Oil Associates analyst Tamas Varga.

"The main catalyst, however, is reports that China may ease its zero-Covid restrictions, which would be a boon to its economy and oil demand."

The EU ban on Russian crude imports is due to take effect from Dec. 5. Details of G7 price cap aimed at alleviating constraints on Russian flows outside the EU are still under discussion.

RECESSION FEARS

On the bearish side, fears of a recession in the United States, the world's biggest oil consumer, grew on Thursday after Fed Chairman Jerome Powell said it was "very premature" to be thinking about pausing interest rate hikes.

"The spectre of further rate hikes dimmed hopes of a pick-up in demand," ANZ Research analysts said in a note.

The Bank of England warned on Thursday that it thinks Britain has entered a recession and the economy might not grow for another two years.

Underscoring demand concerns, Saudi Arabia lowered December official selling prices (OSPs) for its flagship Arab Light crude to Asia by 40 cents to a premium of $5.45 a barrel versus the Oman/Dubai average.

The cut was in line with trade sources' forecasts, which were based on a weaker outlook for Chinese demand.

Looking into next week, investors are awaiting the U.S. Energy Information Administration's short-term energy outlook and the November U.S. Consumer Price Index for insight on the pace of inflation.

Latest News

car&bike Team | Feb 10, 2026Continental launches CrossContact A/T2 tyres in the Indian market1 min read

car&bike Team | Feb 10, 2026Continental launches CrossContact A/T2 tyres in the Indian market1 min read car&bike Team | Feb 10, 2026Tata Motors And Stellantis Sign MoU To Expand Collaboration On Manufacturing And EngineeringThe two brands have been in a 50:50 joint venture for the last 2 decades via Fiat India Automobiles Private Limited (FIAPL).1 min read

car&bike Team | Feb 10, 2026Tata Motors And Stellantis Sign MoU To Expand Collaboration On Manufacturing And EngineeringThe two brands have been in a 50:50 joint venture for the last 2 decades via Fiat India Automobiles Private Limited (FIAPL).1 min read Jaiveer Mehra | Feb 10, 2026Ferrari’s First EV Named Luce; Retro-Style Interior RevealedFerrari has showcased the interior of its first-ever EV ahead of its global debut in the coming months.1 min read

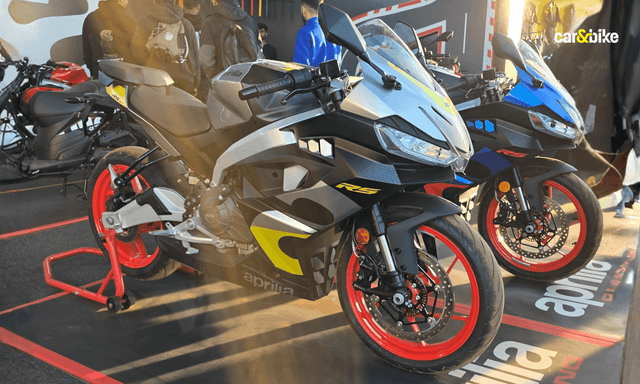

Jaiveer Mehra | Feb 10, 2026Ferrari’s First EV Named Luce; Retro-Style Interior RevealedFerrari has showcased the interior of its first-ever EV ahead of its global debut in the coming months.1 min read Jafar Rizvi | Feb 10, 20262026 Aprilia RS 457 Launched At Rs 4.22 LakhThe RS 457 gets three new paint options for 2026, including the GP Replica livery sitting at the top of the lineup.2 mins read

Jafar Rizvi | Feb 10, 20262026 Aprilia RS 457 Launched At Rs 4.22 LakhThe RS 457 gets three new paint options for 2026, including the GP Replica livery sitting at the top of the lineup.2 mins read Jaiveer Mehra | Feb 9, 2026Tata Motors Inaugurates New Tamil Nadu Plant; Range Rover Evoque First Vehicle To Roll OutTata says that the plant will become the production base for next-gen vehicles from both Tata and its subsidiary JLR.1 min read

Jaiveer Mehra | Feb 9, 2026Tata Motors Inaugurates New Tamil Nadu Plant; Range Rover Evoque First Vehicle To Roll OutTata says that the plant will become the production base for next-gen vehicles from both Tata and its subsidiary JLR.1 min read car&bike Team | Feb 9, 2026New Cars Coming In February: New SUVs, MPV & EV Lined Up For LaunchJust like January, even February will see a good number new car launches and unveils. We list them for you1 min read

car&bike Team | Feb 9, 2026New Cars Coming In February: New SUVs, MPV & EV Lined Up For LaunchJust like January, even February will see a good number new car launches and unveils. We list them for you1 min read

Bilal Firfiray | Feb 4, 2026Volkswagen Tayron R-Line Review: Sensible Flagship For IndiaVolkswagen has introduced a made-in-India flagship SUV that offers space, comfort, performance, and German driving finesse in a practical three-row package. But is the Tayron R-Line good enough?6 mins read

Bilal Firfiray | Feb 4, 2026Volkswagen Tayron R-Line Review: Sensible Flagship For IndiaVolkswagen has introduced a made-in-India flagship SUV that offers space, comfort, performance, and German driving finesse in a practical three-row package. But is the Tayron R-Line good enough?6 mins read Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read

Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read

Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read

Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read

Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read