Trump's China Tech War Backfires On Automakers As Chips Run Short

Automakers around the world are shutting assembly lines because of a global shortage of semiconductors that in some cases has been exacerbated by the Trump administration's actions against key Chinese chip factories, industry officials said.

The shortage, which caught much of the industry off-guard and could continue for many months, is now causing Ford Motor Co, Subaru Corp and Toyota Motor Corp to curtail production in the United States.

Automakers affected in other markets include Volkswagen, Nissan Motor Co Ltd and Fiat Chrysler Automobiles.

The problems stem from a confluence of factors as auto manufacturers compete against the sprawling consumer electronics industry for chip supplies. Consumers have stocked up on laptops, gaming consoles and other electronic products during the pandemic, creating tight chip supplies throughout 2020.

They have also bought more cars than industry officials expected last spring, further straining supplies.

In at least one case, the shortage ties back to President Donald Trump's policies aimed at curtailing technology transfers to China.

One automaker moved chip production from China's Semiconductor Manufacturing International, or SMIC, which was hit with U.S. government restrictions in December, to Taiwan Semiconductor Manufacturing Co in Taiwan, which in turn was overbooked, a person familiar with the matter told Reuters.

Ford also will idle its Focus plant in Saarlouis, Germany, for a month starting next week because of chip shortages.

An auto supplier confirmed TSMC has been unable to keep up with demand.

"The systemic aspect of the crisis is giving us a headache," said a supplier executive, who asked not to be identified. "In some cases, we find substitution parts that could make us independent from TSMC, only to discover that the alternative wafer manufacturer has no capacity available."

TSMC and SMIC did not immediately respond to requests for comment.

On an earnings call with investors Thursday, TSMC Chief Executive C.C. Wei said there was a shortage of automotive chips made with "mature technology" and that it is working with customers "to mitigate the shortage impact."

It only takes the tiniest of chips to throw off production: a Ford plant in Kentucky that makes the Escape sport utility vehicle idled because of a shortage of a chip in the vehicle's brake system, a union official in the plant said.

Ford also will idle its Focus plant in Saarlouis, Germany, for a month starting next week because of chip shortages.

The situation is unlikely to improve quickly, since all chips, whether bound for a laptop or a Lexus, start life as a silicon wafer that takes about 90 days to process into a chip.

The chipmaking industry has always strained to keep up with sudden demand spikes. The factories that produce wafers cost tens of billions of dollars to build, and expanding their capacity can take up to a year for testing and qualifying complex tools.

"The long and short of it is, demand is up about 50%. And there's no asset-intensive industry like ours that has 50% capacity lying around," said Mike Hogan, senior vice president at chip manufacturer GlobalFoundries and head of its automotive unit.

Latest News

Jaiveer Mehra | Mar 1, 2026Mahindra XEV 9e Cineluxe Edition Launched At Rs 29.35 LakhNew special edition of the 9e electric SUV is based on the fully-loaded 9e Pack 3 but costs about Rs 1.15 lakh less.2 mins read

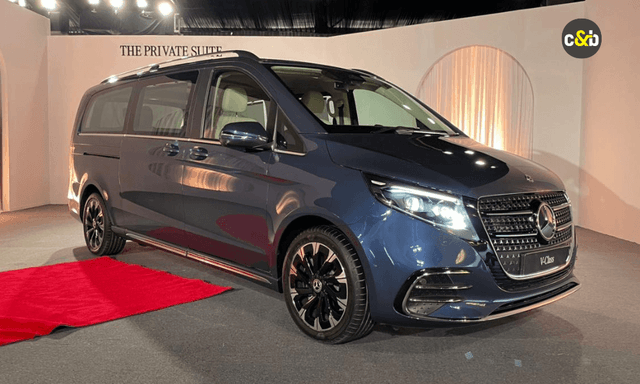

Jaiveer Mehra | Mar 1, 2026Mahindra XEV 9e Cineluxe Edition Launched At Rs 29.35 LakhNew special edition of the 9e electric SUV is based on the fully-loaded 9e Pack 3 but costs about Rs 1.15 lakh less.2 mins read Jaiveer Mehra | Mar 1, 2026New Mercedes-Benz V-Class Makes India Debut; Launch TomorrowUnlike the previous diesel-only V-class, the latest model will be offered with petrol and diesel engine options.1 min read

Jaiveer Mehra | Mar 1, 2026New Mercedes-Benz V-Class Makes India Debut; Launch TomorrowUnlike the previous diesel-only V-class, the latest model will be offered with petrol and diesel engine options.1 min read car&bike Team | Feb 28, 2026Zero-Dep Cover: The Renewal Add-on That Ensures You Don’t Pay for Parts1 min read

car&bike Team | Feb 28, 2026Zero-Dep Cover: The Renewal Add-on That Ensures You Don’t Pay for Parts1 min read car&bike Team | Feb 28, 2026Toyota Land Cruiser, Lexus LX Recalled Over Transmission Malfunction RiskThe recall affects 969 units of the Toyota Land Cruiser and 117 units of the Lexus LX.1 min read

car&bike Team | Feb 28, 2026Toyota Land Cruiser, Lexus LX Recalled Over Transmission Malfunction RiskThe recall affects 969 units of the Toyota Land Cruiser and 117 units of the Lexus LX.1 min read Jaiveer Mehra | Feb 27, 2026New Tata Tiago EV Spied Testing On Indian Roads: Enhanced Range Incoming?Launched in India in 2022, the Tiago EV received a notable update last year, adding in newer features and some styling tweaks.3 mins read

Jaiveer Mehra | Feb 27, 2026New Tata Tiago EV Spied Testing On Indian Roads: Enhanced Range Incoming?Launched in India in 2022, the Tiago EV received a notable update last year, adding in newer features and some styling tweaks.3 mins read car&bike Team | Feb 27, 2026VLF Mobster 135 Price Hiked As Introductory Offer EndsThe Mobster 135 is now priced at Rs 1.37 lakh (ex-showroom), which marks an increase of Rs 7,000.2 mins read

car&bike Team | Feb 27, 2026VLF Mobster 135 Price Hiked As Introductory Offer EndsThe Mobster 135 is now priced at Rs 1.37 lakh (ex-showroom), which marks an increase of Rs 7,000.2 mins read

Bilal Firfiray | Feb 28, 2026Tata Punch EV Facelift Review: More Range, More Sense, Less MoneyThe Tata Punch EV facelift gets a bigger 40 kWh battery, faster 60 kW DC charging, improved thermal management, and better real-world range, and all of that at a lower introductory price. But does it become a more complete package now?6 mins read

Bilal Firfiray | Feb 28, 2026Tata Punch EV Facelift Review: More Range, More Sense, Less MoneyThe Tata Punch EV facelift gets a bigger 40 kWh battery, faster 60 kW DC charging, improved thermal management, and better real-world range, and all of that at a lower introductory price. But does it become a more complete package now?6 mins read Preetam Bora | Feb 24, 2026Hero Destini 110 Review: Simplicity, RefinedThe Hero Destini 110 is a no-nonsense commuter that is simple, comfortable and above all, fuel efficient. In 2026, when buyers are spoilt for choice, is it good enough to consider?1 min read

Preetam Bora | Feb 24, 2026Hero Destini 110 Review: Simplicity, RefinedThe Hero Destini 110 is a no-nonsense commuter that is simple, comfortable and above all, fuel efficient. In 2026, when buyers are spoilt for choice, is it good enough to consider?1 min read Preetam Bora | Feb 23, 2026TVS Apache RTX Road Test Review: Redefining the Entry-Level ADVAfter spending some time with the TVS Apache RTX in traffic, the daily commute, as well as on open highways, one thing becomes clear: the RTX is trying to redefine the entry-level ADV segment. But is it without fault?1 min read

Preetam Bora | Feb 23, 2026TVS Apache RTX Road Test Review: Redefining the Entry-Level ADVAfter spending some time with the TVS Apache RTX in traffic, the daily commute, as well as on open highways, one thing becomes clear: the RTX is trying to redefine the entry-level ADV segment. But is it without fault?1 min read Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read

Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read

Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read