Tesla Quarter May Hinge On China Factory, Supply Chain Costs

Investors will be closely watching Tesla's quarterly results on Wednesday for indications of its performance in China, where the electric carmaker has posted robust sales in the face of negative publicity and a host of new domestic competitors. The company headed by billionaire entrepreneur Elon Musk is expected to report a jump in revenue driven by record global deliveries in the July to September period. While it has weathered the chip crisis better than rivals, some investors are concerned supply-chain issues could increase costs and weigh down margins. The upside could come from Tesla's Shanghai factory, which has surpassed the company's factory in Fremont, California in terms of production, and has cut costs with the use of more Chinese parts including batteries.

Tesla Inc started deliveries in late August of a less expensive version of the Model Y sport utility vehicle equipped with cheaper, iron-based batteries made by CATL in China, a source familiar with the matter said. "The Giga China efficiency is front and center, moving margins higher," said Dan Ives, an analyst at Wedbush who is bullish on Tesla. Tesla CEO Musk said the Shanghai factory now produced more vehicles than the company's sole U.S. factory. "It's the best quality, lowest cost and also low drama, so it's great," said he at a shareholders' meeting earlier this month.

Some Tesla investors are concerned supply-chain issues could increase costs and weigh down margins

Even so, Tesla was not immune to global supply chain crisis and Tesla has done better partly because it has been willing to pay. "The sheer amount of money we're spending on flying parts around the world is just not great but hopefully temporary," Musk said. Some investors want to see how those costs add up. "I think that there is probably a headwind to margins. They're paying more for components," Gene Munster, managing partner at venture capital firm Loup Ventures, an investor in Tesla. "I think that would be a huge positive if they can raise auto gross margin in this environment."

While Tesla has raised prices in the United States to offset cost pressure, it has cut them in China where it faces more competition from Chinese rivals such as Nio Inc, Li Auto Inc and Xpeng Inc. Tesla had received strong backing from the Chinese government when it built China's first wholly foreign-owned car plant in 2019. But in recent months it has grappled with regulatory scrutiny over how it handles data as well as consumer complaints over product safety and other issues. Tesla's China sales leapt 44% in the third quarter, from the previous quarter, as it boosted exports to Europe and other countries, and it introduced the more affordable Model Y SUVs.

Tesla had received strong backing from the Chinese government when it built China's first wholly foreign-owned car plant in 2019

"It seems the negative news did not really hurt loyal demand. Consumers have very high confidence in Tesla's product," Yale Zhang, managing director at Shanghai-based consultancy Automotive Foresight, said. "Other local competitors are really catching up very quickly, Tesla is still leading the charge," he said. Investors will also keep an eye on the planned expansion of Tesla's so-called full self-driving beta software. Tesla started widening access to the software earlier this month, having tested the new advanced driver-assistant program with about 2,000 people for a year.

Tesla's shares on Monday ended up 3.2% at $870.11, inching closer to its record close-high of $883.09 reached on Jan. 26. Unlike most of his peers at the top of big tech companies, Musk said during a call in July that he was unlikely to attend earnings calls with investors and analysts. The calls have been a colorful quarterly ritual Musk has used for discourses on Tesla technology, or to fire back at analysts, the government and critics.

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)

Latest News

car&bike Team | Feb 21, 2026Norton Atlas Spotted Testing In India Once AgainThe spied model appears to be the base version of the mid-capacity adventure tourer.1 min read

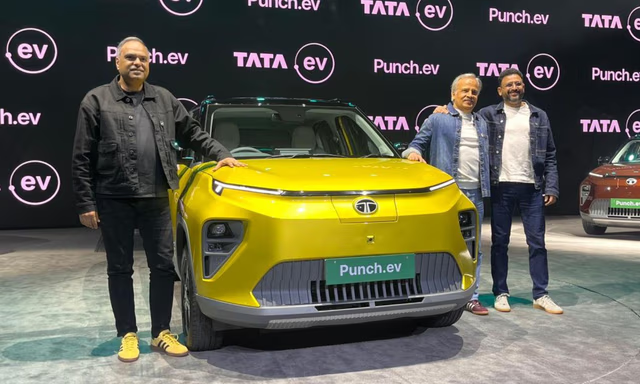

car&bike Team | Feb 21, 2026Norton Atlas Spotted Testing In India Once AgainThe spied model appears to be the base version of the mid-capacity adventure tourer.1 min read car&bike Team | Feb 21, 20262026 Tata Punch EV Facelift: Variants, Features, Prices ExplainedThe Punch EV facelift is offered in six variants and with two battery pack options. Here is a rundown of what each variant has to offer.1 min read

car&bike Team | Feb 21, 20262026 Tata Punch EV Facelift: Variants, Features, Prices ExplainedThe Punch EV facelift is offered in six variants and with two battery pack options. Here is a rundown of what each variant has to offer.1 min read car&bike Team | Feb 20, 2026Production-Ready Royal Enfield Flying Flea C6 Spotted On TestTest mules of the Flying Flea C6 have been spotted sans camouflage.2 mins read

car&bike Team | Feb 20, 2026Production-Ready Royal Enfield Flying Flea C6 Spotted On TestTest mules of the Flying Flea C6 have been spotted sans camouflage.2 mins read Jaiveer Mehra | Feb 20, 2026New Audi RS5 Debuts With 630 bhp V6 PHEV PowertrainThe RS5 features a twin-turbo 2.9-litre V6 paired with an electric motor and a 25.9 kWh battery and offers over 80 km of EV-only driving.1 min read

Jaiveer Mehra | Feb 20, 2026New Audi RS5 Debuts With 630 bhp V6 PHEV PowertrainThe RS5 features a twin-turbo 2.9-litre V6 paired with an electric motor and a 25.9 kWh battery and offers over 80 km of EV-only driving.1 min read Jaiveer Mehra | Feb 20, 2026Tata Punch EV Facelift Launched In India; Prices Start From Rs 9.69 LakhNotable changes to the Punch EV include faster DC fast charging and larger battery packs.3 mins read

Jaiveer Mehra | Feb 20, 2026Tata Punch EV Facelift Launched In India; Prices Start From Rs 9.69 LakhNotable changes to the Punch EV include faster DC fast charging and larger battery packs.3 mins read Jaiveer Mehra | Feb 20, 2026Level 2 ADAS Systems To Be Mainstay Of Auto IndustryUse of Level 2+ ADAS technologies to gain popularity in the coming year and overtake the basic Level 2 system by 20354 mins read

Jaiveer Mehra | Feb 20, 2026Level 2 ADAS Systems To Be Mainstay Of Auto IndustryUse of Level 2+ ADAS technologies to gain popularity in the coming year and overtake the basic Level 2 system by 20354 mins read

Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read

Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read

Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read Jafar Rizvi | Feb 15, 2026Maruti Suzuki Victoris: Long-Term Review - Report 1The Victoris is Maruti’s latest offering for the Indian market, and after spending some time with it, here are a few early impressions.1 min read

Jafar Rizvi | Feb 15, 2026Maruti Suzuki Victoris: Long-Term Review - Report 1The Victoris is Maruti’s latest offering for the Indian market, and after spending some time with it, here are a few early impressions.1 min read Bilal Firfiray | Feb 12, 2026BMW X3 30 xDrive M Sport Review: The Driver’s SUV ReturnsRange-toppingX3 30 xDrive M Sport brings back the fun with 255bhp and genuine enthusiast appeal. Does this performance-focused SUV stand out?5 mins read

Bilal Firfiray | Feb 12, 2026BMW X3 30 xDrive M Sport Review: The Driver’s SUV ReturnsRange-toppingX3 30 xDrive M Sport brings back the fun with 255bhp and genuine enthusiast appeal. Does this performance-focused SUV stand out?5 mins read Bilal Firfiray | Feb 11, 2026Mercedes-AMG CLE 53 Coupe Review: The Goldilocks AMG?The Mercedes-AMG CLE 53 Coupe is a concoction of hooliganistic performance and everyday usability. Here’s why this Rs 1.5 crore two-door AMG might be the perfect modern sports coupe for India.6 mins read

Bilal Firfiray | Feb 11, 2026Mercedes-AMG CLE 53 Coupe Review: The Goldilocks AMG?The Mercedes-AMG CLE 53 Coupe is a concoction of hooliganistic performance and everyday usability. Here’s why this Rs 1.5 crore two-door AMG might be the perfect modern sports coupe for India.6 mins read