Oil Gains Ahead Of OPEC+ Meeting; Russian Oil Price Cap Looms

Oil prices climbed on Friday on bets that OPEC+ will discuss output cuts at a meeting on Sept. 5, though fears of China's COVID-19 curbs and weak global growth continued to limit gains and a potential cap on the price of Russian exports loomed.

Brent crude futures rose $1.23, or 1.3%, to $93.59 a barrel at 0630 GMT, while U.S. West Texas Intermediate (WTI) crude futures advanced $1.25, or 1.4%, to $87.86 a barrel.

Both benchmark contracts slid 3% in the previous session to two-week lows. Brent was headed for a weekly drop of nearly 7%, and WTI was on track to fall about 5% for the week.

The Organization of the Petroleum Exporting Countries (OPEC and allies, together called OPEC+, are due to meet on Sept. 5 against a backdrop of sliding prices and falling demand, even as top producer Saudi Arabia says supply remains tight.

"We expect the group to leave output targets unchanged. Their own numbers show a tighter-than-expected market and they would probably also want some more clarity on Iranian supply before making any big changes to output policy," said Warren Patterson, head of commodity research at ING.

OPEC+ this week slashed its demand outlook, now forecasting demand to lag supply by 400,000 barrels per day (bpd) in 2022, but it expects a market deficit of 300,000 bpd in its base case for 2023.

The market is also keeping a lookout for a potential price cap on Russian oil exports.

G7 finance ministers are expected to firm up plans on Friday to impose a price cap on Russian oil aimed at slashing revenue for Moscow's war in Ukraine, but keeping crude flowing to avoid price spikes. Russia calls its actions in Ukraine "a special operation".

Meanwhile, investors remain worried about the impact of the latest COVID-19 curbs in China. The city of Chengdu on Thursday ordered a lockdown that has hit manufacturers like Volvo.

"Oil prices have been facing a confluence of headwinds lately, with recent virus lockdowns in China coming after its lacklustre PMI readings pointing to a lower-for-longer growth picture and puts demand outlook at risk," said Yeap Jun Rong, market strategist at IG.

Data showed Chinese factory activity in August contracted for the first time in three months amid weakening demand, while power shortages and COVID-19 outbreaks disrupted production.

Latest News

car&bike Team | Dec 28, 2025Nissan Gravite MPV Spied Testing Yet Again Ahead Of Jan 2026 DebutNissan’s subcompact MPV will share its underpinnings with the Renault Triber.1 min read

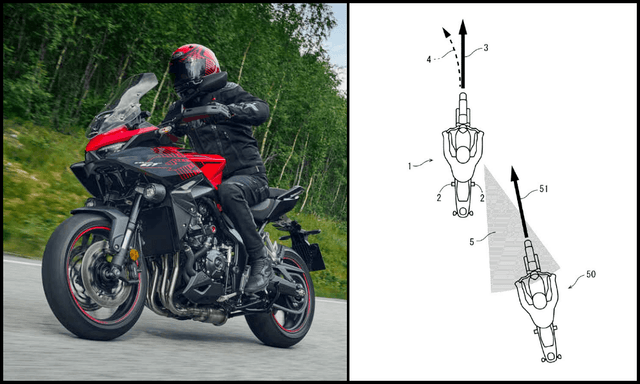

car&bike Team | Dec 28, 2025Nissan Gravite MPV Spied Testing Yet Again Ahead Of Jan 2026 DebutNissan’s subcompact MPV will share its underpinnings with the Renault Triber.1 min read car&bike Team | Dec 27, 2025Honda Patents Steering Assist Tech For MotorcyclesHonda patents a steering assist concept that subtly intervenes during blind-spot risks.1 min read

car&bike Team | Dec 27, 2025Honda Patents Steering Assist Tech For MotorcyclesHonda patents a steering assist concept that subtly intervenes during blind-spot risks.1 min read Jafar Rizvi | Dec 27, 2025Listed: Car Manufacturers That Will Hike Prices From January 2026Based on the announcements made so far, the price increase across car models is expected to range between 2 and 3 per cent.3 mins read

Jafar Rizvi | Dec 27, 2025Listed: Car Manufacturers That Will Hike Prices From January 2026Based on the announcements made so far, the price increase across car models is expected to range between 2 and 3 per cent.3 mins read Jaiveer Mehra | Dec 26, 2025India-Spec New Renault Duster Teased Ahead Of Jan 26 DebutA new teaser video provides brief glimpses of the upcoming all-new SUV which seems to get some notable styling differences over its global sibling.1 min read

Jaiveer Mehra | Dec 26, 2025India-Spec New Renault Duster Teased Ahead Of Jan 26 DebutA new teaser video provides brief glimpses of the upcoming all-new SUV which seems to get some notable styling differences over its global sibling.1 min read Jaiveer Mehra | Dec 26, 2025New Mahindra XUV 7XO Teaser Confirms 540 Degree CamerasLatest teaser video confirms the SUV will get the new 540 degree camera set-up from the XEV series as well as a few other features.1 min read

Jaiveer Mehra | Dec 26, 2025New Mahindra XUV 7XO Teaser Confirms 540 Degree CamerasLatest teaser video confirms the SUV will get the new 540 degree camera set-up from the XEV series as well as a few other features.1 min read car&bike Team | Dec 24, 2025Updated Bajaj Pulsar 150 Launched At Rs 1.09 Lakh: Gets LED Lighting, New ColoursThe Pulsar 150 is offered in three variants with prices topping out at Rs 1.15 lakh (ex-showroom).2 mins read

car&bike Team | Dec 24, 2025Updated Bajaj Pulsar 150 Launched At Rs 1.09 Lakh: Gets LED Lighting, New ColoursThe Pulsar 150 is offered in three variants with prices topping out at Rs 1.15 lakh (ex-showroom).2 mins read

Jafar Rizvi | Dec 24, 2025MG Windsor EV 38 kWh Long-Term Report: IntroductionThe Windsor EV has joined our garage, and before it settles into daily duty, I took it out to get a sense of what living with an electric car is like.4 mins read

Jafar Rizvi | Dec 24, 2025MG Windsor EV 38 kWh Long-Term Report: IntroductionThe Windsor EV has joined our garage, and before it settles into daily duty, I took it out to get a sense of what living with an electric car is like.4 mins read Seshan Vijayraghvan | Dec 23, 20252026 Kia Seltos Review: Formula Is Spot On, But Is The Timing Right?The 2nd-gen Kia Seltos has arrived, but it has the challenge of facing strong rivals like the Victoris and Sierra. The question is simple - Does it still have what it takes?9 mins read

Seshan Vijayraghvan | Dec 23, 20252026 Kia Seltos Review: Formula Is Spot On, But Is The Timing Right?The 2nd-gen Kia Seltos has arrived, but it has the challenge of facing strong rivals like the Victoris and Sierra. The question is simple - Does it still have what it takes?9 mins read car&bike Team | Dec 26, 2025Tata Punch EV Long-Term Second Report: Highway Performance, Pros & ConsAfter a week of living with the Tata Punch EV Long Range—including a proper Mumbai-Nashik highway test—we've learned what this little electric SUV is really made of.1 min read

car&bike Team | Dec 26, 2025Tata Punch EV Long-Term Second Report: Highway Performance, Pros & ConsAfter a week of living with the Tata Punch EV Long Range—including a proper Mumbai-Nashik highway test—we've learned what this little electric SUV is really made of.1 min read Seshan Vijayraghvan | Dec 22, 20252026 Tata Harrier & Safari 1.5 Hyperion Review: By The Power Of Petrol!The new Tata Harrier and Safari petrol packs a new 1.5-litre TGDI Hyperion engine, but is it an ideal alternative to the diesel version?7 mins read

Seshan Vijayraghvan | Dec 22, 20252026 Tata Harrier & Safari 1.5 Hyperion Review: By The Power Of Petrol!The new Tata Harrier and Safari petrol packs a new 1.5-litre TGDI Hyperion engine, but is it an ideal alternative to the diesel version?7 mins read Bilal Firfiray | Dec 19, 2025Maruti Suzuki e-Vitara Review: Worth The Wait?After a long wait, the first-ever electric Maruti Suzuki is here. It’s the e-Vitara, and it comes with a few promises. But arriving this late, is it worth the wait? Or is it a case of too little, too late?9 mins read

Bilal Firfiray | Dec 19, 2025Maruti Suzuki e-Vitara Review: Worth The Wait?After a long wait, the first-ever electric Maruti Suzuki is here. It’s the e-Vitara, and it comes with a few promises. But arriving this late, is it worth the wait? Or is it a case of too little, too late?9 mins read