Budget 2019: Electric Vehicles To Get More Affordable

The NDA 2.0 government made some major announcements for pushing electric mobility in India as part of the Union Budget 2019. While the Indian auto sector did not witness any dramatic changes in tax norms, Finance Minister Nirmala Sitharaman recommended reducing the GST rate on electric vehicles from the current 12 per cent to five per cent in a bid to push the sale of EVs in the country. In addition, there will be an income tax deduction of Rs. 1.5 lakh on the interest paid on the loans taken to purchase electric vehicles. The push for EV purchase is expected to boost sales for the alternate fuelled vehicles, which has been a major agenda for the government since the previous term.

The Union Budget 2019 also included the proposal for custom duty exemption on import of specific components. The new proposals will be in addition to the Rs. 10,000 crore allocated for EVs under the FAME II scheme and includes solar storage batteries and charging infrastructure as well. The GST council will have to consider and revise the norms, so it can be passed to customers.

The announcement has bode well with the EV industry that has welcomed the reduction in the taxation norms. Most manufacturers have welcomed the move, especially considering the high cost of EVs and the limited range has been a deterrent in the faster adoption of the vehicles. The move will also help the two-wheeler segment particularly, with NITI Aayog suggesting to ban two-wheelers below 150 cc by 2025. Meanwhile, the deadline recommended for conventional three-wheelers is 2023, to be replaced by electric derivatives.

Commenting on the Budget announcements, Chetan Maini, Co-Founder and Vice-Chairman, SUN Mobility said, "The decision to reduce GST on EVs from 12 per cent to 5 per cent is a reassuring move by the government and furthers the country's commitment to transition to an EV future. As an EV energy infrastructure provider, we welcome the move; however it would be more beneficial for the end-user, if the government also focus on reducing GST on charging/battery swapping services from 18 per cent to 5 per cent (same as that for public transport services)."

Appreciating the government's move, Dr. Pawan Goenka, MD - Mahindra & Mahindra said, "As an industry, we cannot ask for more. The government has done what it could do and now the onus is on the industry and the service providers to make the electric vehicle dream happen. For fleet applications and for commercial applications, electric three-wheelers are now commercially viable. An electric three-wheeler operator will earn more and save more per month than he/she does from an ICE engine (vehicle). Earlier, the passenger vehicles for falling short in an aggregate taxi application. But now I think with all the changes with the FAME II benefit and the registration tax not happening, and if the income tax benefit applies for fleet buyers, then it definitely would make overall electric vehicles viable for four-wheelers. And viability is the best way to spur demand."

The electric two-wheeler sector will greatly benefit from the GST reduction & push customers to switch from ICE powered vehicles

Mercedes-Benz India too welcomed the move. Martin Schwenk, Managing Director & CEO said, "We welcome the Government's vision of achieving a 3 trillion dollar economy and becoming the 6th largest economy in the world by end of this year. However, the decision to increase the custom duty on automotive parts was not expected and it is not going to help create demand in the industry which already is facing continued strong macro-economic headwinds, resulting in subdued consumer interest. The increase in custom duty coupled with increased input costs due to fuel price hike, could lead to an increase in the price of our model range. Though the budget has given a boost to green mobility, we wished for the inclusion of Plug-In-Hybrids for duty exemption as well, as that would have further given a push to the green mobility efforts."

Emphasising on the benefits of green mobility, Shekar Viswanathan, Vice Chairman & Whole-time Director - Toyota Kirloskar Motor said, "EVs do bring the benefits towards fossil fuel conservation & lowering of carbon emissions. There are other forms of green mobility which will help the government achieve the same objective. The government should also align its taxation policies towards such green mobilities which promote the reduction of fossil fuel & betterment of the environment. Thus, the focus of taxation should not only be restricted to promote and facilitate the shift to all types of green mobilities but should also be towards all other means which contribute effectively to increased fuel economy and reduced tailpipe emissions. The electric two-wheeler segment will greatly benefit from the reduction in GST given the massive explosion of manufacturers in India. Homegrown companies including Hero Electric, Ather Energy, Revolt Intellicorp, among other have welcomed the move, which will help lower the acquisition cost by a substantial margin for the end customer."

The reduction in the GST rates will greatly benefit the two-wheeler industry that has been spurt of growth in the number of EV players in recent times. Homegrown manufacturers including Hero Electric, Ather Energy, Okinawa Autotech, Revolt Motors and more welcomed the move.

Tarun Mehta, CEO, Cofounder, Ather Energy said, "Government has already moved GST Council to lower GST on EVs from 12 percent to 5 percent and the additional income tax reduction is a major boost for end consumers to purchase EVs. It addresses the concern of the upfront cost of purchasing electric vehicles. This is the best example of a consumer-driven change and is also how Ather envisions the EV sector to achieve scale and growth. It now becomes imperative that OEMs chalk out plans that allows the industry to scale up and meet the demand for compelling products."

Hero Electric - MD, Naveen Munjal said, "The electric vehicle industry needed a substantial boost & support from the government and we welcome the government's recommendation of reduction of GST on EVs from 12% to 5%. In addition to this, income tax reduction of up to Rs 1.5 lakh on the interest paid on EV loans is an extremely positive move which will encourage customers to make a switch from ICE vehicles to EVs. Reduction in custom duty on lithium-ion cells would help local component manufacturers in scaling up the production thereby further reducing the overall upfront cost of electric vehicles in India. Government's continued emphasis on FAME II initiative and strengthening of EV infrastructure will definitely encourage manufacturers to further invest in the ecosystem thereby lowering both crude oil imports and air pollution leading to a cleaner and greener future."

Beyond the incentives, reductions and benefits, there are still concerns regarding the implementation of all the factors contributing to boosting the demand for electric vehicles. Then, there's the infrastructure needed to support the demand that needs to be pushed as well and the government will have to play a more active roll in doing so in the coming years.

Latest News

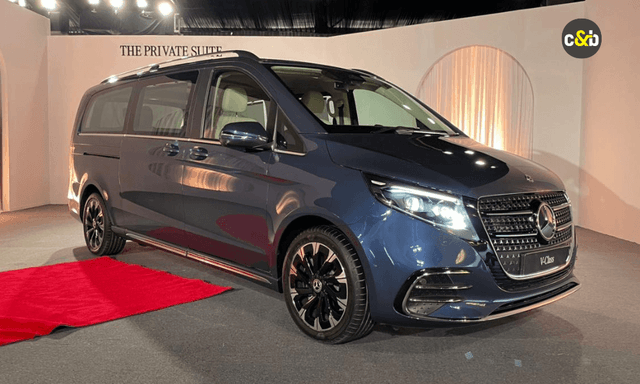

Bilal Firfiray | Mar 2, 2026New Mercedes-Benz V-Class Vs Toyota Vellfire: The Luxury Van ShowdownNew V-Class is here after a long hiatus. And it’s aiming squarely at the Toyota Vellfire in the luxury MPV space. So let us break down design, comfort, features, powertrains and real-world usability to help you choose the right one.5 mins read

Bilal Firfiray | Mar 2, 2026New Mercedes-Benz V-Class Vs Toyota Vellfire: The Luxury Van ShowdownNew V-Class is here after a long hiatus. And it’s aiming squarely at the Toyota Vellfire in the luxury MPV space. So let us break down design, comfort, features, powertrains and real-world usability to help you choose the right one.5 mins read Jafar Rizvi | Mar 2, 2026Yamaha XSR 155 Prices Hiked; New Colour IntroducedPrices for the XSR 155 now range between Rs 1.50 lakh and Rs 1.59 lakh (ex-showroom).1 min read

Jafar Rizvi | Mar 2, 2026Yamaha XSR 155 Prices Hiked; New Colour IntroducedPrices for the XSR 155 now range between Rs 1.50 lakh and Rs 1.59 lakh (ex-showroom).1 min read Jaiveer Mehra | Mar 2, 2026Auto Sales February 2026: Tata Retains Second Place Ahead Of Mahindra; Maruti Sales FlatHyundai and Kia reported their best ever wholesales numbers for February, while Toyota and Mahindra also reported sales growth.6 mins read

Jaiveer Mehra | Mar 2, 2026Auto Sales February 2026: Tata Retains Second Place Ahead Of Mahindra; Maruti Sales FlatHyundai and Kia reported their best ever wholesales numbers for February, while Toyota and Mahindra also reported sales growth.6 mins read Jafar Rizvi | Mar 2, 2026New Mercedes-Benz V-Class Launched In India At Rs 1.40 CroreThe luxury MPV makes a return to the Indian market after being discontinued in 2022.3 mins read

Jafar Rizvi | Mar 2, 2026New Mercedes-Benz V-Class Launched In India At Rs 1.40 CroreThe luxury MPV makes a return to the Indian market after being discontinued in 2022.3 mins read Jaiveer Mehra | Mar 1, 2026Mahindra XEV 9e Cineluxe Edition Launched At Rs 29.35 LakhNew special edition of the 9e electric SUV is based on the fully-loaded 9e Pack 3 but costs about Rs 1.15 lakh less.2 mins read

Jaiveer Mehra | Mar 1, 2026Mahindra XEV 9e Cineluxe Edition Launched At Rs 29.35 LakhNew special edition of the 9e electric SUV is based on the fully-loaded 9e Pack 3 but costs about Rs 1.15 lakh less.2 mins read Jaiveer Mehra | Mar 1, 2026New Mercedes-Benz V-Class Makes India Debut; Launch TomorrowUnlike the previous diesel-only V-class, the latest model will be offered with petrol and diesel engine options.1 min read

Jaiveer Mehra | Mar 1, 2026New Mercedes-Benz V-Class Makes India Debut; Launch TomorrowUnlike the previous diesel-only V-class, the latest model will be offered with petrol and diesel engine options.1 min read

Bilal Firfiray | Feb 28, 2026Tata Punch EV Facelift Review: More Range, More Sense, Less MoneyThe Tata Punch EV facelift gets a bigger 40 kWh battery, faster 60 kW DC charging, improved thermal management, and better real-world range, and all of that at a lower introductory price. But does it become a more complete package now?6 mins read

Bilal Firfiray | Feb 28, 2026Tata Punch EV Facelift Review: More Range, More Sense, Less MoneyThe Tata Punch EV facelift gets a bigger 40 kWh battery, faster 60 kW DC charging, improved thermal management, and better real-world range, and all of that at a lower introductory price. But does it become a more complete package now?6 mins read Preetam Bora | Feb 24, 2026Hero Destini 110 Review: Simplicity, RefinedThe Hero Destini 110 is a no-nonsense commuter that is simple, comfortable and above all, fuel efficient. In 2026, when buyers are spoilt for choice, is it good enough to consider?1 min read

Preetam Bora | Feb 24, 2026Hero Destini 110 Review: Simplicity, RefinedThe Hero Destini 110 is a no-nonsense commuter that is simple, comfortable and above all, fuel efficient. In 2026, when buyers are spoilt for choice, is it good enough to consider?1 min read Preetam Bora | Feb 23, 2026TVS Apache RTX Road Test Review: Redefining the Entry-Level ADVAfter spending some time with the TVS Apache RTX in traffic, the daily commute, as well as on open highways, one thing becomes clear: the RTX is trying to redefine the entry-level ADV segment. But is it without fault?1 min read

Preetam Bora | Feb 23, 2026TVS Apache RTX Road Test Review: Redefining the Entry-Level ADVAfter spending some time with the TVS Apache RTX in traffic, the daily commute, as well as on open highways, one thing becomes clear: the RTX is trying to redefine the entry-level ADV segment. But is it without fault?1 min read Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read

Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read

Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read