Stocks Eye 3% Weekly Loss, Dollar Sky High Before U.S. Jobs Data

World stocks were heading for a 3% loss on the week while the dollar hit 24-year highs against the yen for a second day on Friday ahead of key U.S. jobs data, as investors brace for aggressive rate hikes from the Federal Reserve.

Fresh lockdowns in China are also fuelling concerns about global growth, while high energy costs as a result of the war in Ukraine are weighing on European markets.

"The market is laser-focused on how aggressive the Fed is going to be with its hiking cycle," said Giles Coghlan, chief currency analyst at HYCM, pointing out that expectations for higher rates have solidified since a speech last week by Fed chair Jerome Powell at the Jackson Hole central banking conference.

The markets are worried about "China slowing, euro zone recession and a hawkish Fed," he added.

The MSCI world equity index steadied above 6-week lows set in the previous session but was heading for its third straight week of losses.

U.S. S&P futures were flat after the S&P 500 index rose 0.3% on Thursday.

U.S. August nonfarm payroll figures due at 1230 GMT on Friday are expected to show 300,000 jobs were added last month, while unemployment hovered at 3.5%.

Strong data is seen strengthening the Fed's ability to raise rates to curb inflation without crimping growth.

Futures markets have priced in as much as a 75% chance the Fed will hike by 75 basis points at its September policy meeting, compared with a 69% probability a day ago..

European stocks also pulled back from Thursday's 6-week lows, gaining 0.5%, while Britain's FTSE rose 0.4%.

In Europe, fears of a recession are on the rise, with a survey showing on Thursday that manufacturing activity across the euro zone declined again last month, as consumers feeling the pinch from a deepening cost of living crisis cut spending.

The U.S. dollar hit 24-year highs against the low-yielding yen before trimming gains to steady at 140.28.

The dollar index, which measures its performance against a basket of six currencies, dipped 0.24% after hitting a 20-year high in the previous session.

The euro rose 0.4% to $0.9985.

In bond markets, the yield on benchmark two-year notes edged 2 basis points lower to 3.5006%, while the yield on 10-year bonds dipped 1 bp to 3.2537%.

German 10-year bond yields rose 1.5 bps to 1.579%.

MSCI's broadest index of Asia-Pacific shares outside Japan fell 0.5%, heading for its worst weekly performance since mid-June with a tumble of 3.6%, as rising expectations of aggressive global rate hikes hit risky assets.

Japan's Nikkei dipped 0.1%, Chinese blue chips dropped 0.5%, Hong Kong's Hang Seng index fell 0.9% and South Korea fell 0.3%.

The southwestern Chinese metropolis of Chengdu on Thursday announced a lockdown of its 21.2 million residents, while the technology hub of Shenzhen also rolled out new social distancing rules as more Chinese cities tried to battle recurring COVID-19 outbreaks.

Analysts at Nomura said what is becoming more concerning is that COVID-19 hotspots in China are shifting away from remote regions and cities to provinces that matter much more to China's national economy.

"We maintain the view that China will keep its zero-COVID policy until March 2023, when the (leadership) reshuffle is fully completed, but we now expect a slower pace of easing of the zero-COVID policy after March 2023," Nomura said.

Oil prices tumbled 3% overnight before recovering some ground on Friday but were on track to post sharp weekly losses on fears COVID-19 curbs in China and weak global growth will hit demand.

Brent crude futures rose 2% to $94.15 a barrel while U.S. West Texas Intermediate (WTI) crude futures were up by 1.75% to $88.34 a barrel.

Spot gold rose 0.35% to $1701 per ounce.

Latest News

car&bike Team | Feb 21, 2026Norton Atlas Spotted Testing In India Once AgainThe spied model appears to be the base version of the mid-capacity adventure tourer.1 min read

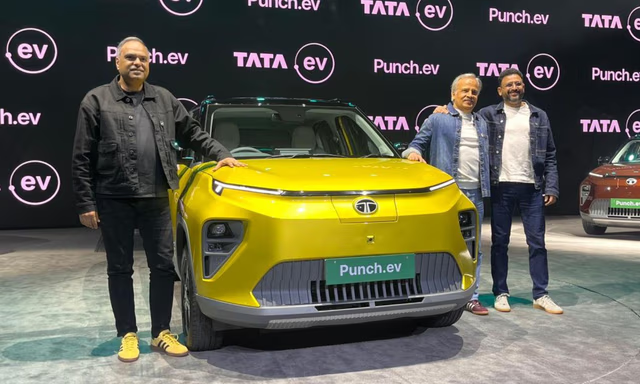

car&bike Team | Feb 21, 2026Norton Atlas Spotted Testing In India Once AgainThe spied model appears to be the base version of the mid-capacity adventure tourer.1 min read car&bike Team | Feb 21, 20262026 Tata Punch EV Facelift: Variants, Features, Prices ExplainedThe Punch EV facelift is offered in six variants and with two battery pack options. Here is a rundown of what each variant has to offer.1 min read

car&bike Team | Feb 21, 20262026 Tata Punch EV Facelift: Variants, Features, Prices ExplainedThe Punch EV facelift is offered in six variants and with two battery pack options. Here is a rundown of what each variant has to offer.1 min read car&bike Team | Feb 20, 2026Production-Ready Royal Enfield Flying Flea C6 Spotted On TestTest mules of the Flying Flea C6 have been spotted sans camouflage.2 mins read

car&bike Team | Feb 20, 2026Production-Ready Royal Enfield Flying Flea C6 Spotted On TestTest mules of the Flying Flea C6 have been spotted sans camouflage.2 mins read Jaiveer Mehra | Feb 20, 2026New Audi RS5 Debuts With 630 bhp V6 PHEV PowertrainThe RS5 features a twin-turbo 2.9-litre V6 paired with an electric motor and a 25.9 kWh battery and offers over 80 km of EV-only driving.1 min read

Jaiveer Mehra | Feb 20, 2026New Audi RS5 Debuts With 630 bhp V6 PHEV PowertrainThe RS5 features a twin-turbo 2.9-litre V6 paired with an electric motor and a 25.9 kWh battery and offers over 80 km of EV-only driving.1 min read Jaiveer Mehra | Feb 20, 2026Tata Punch EV Facelift Launched In India; Prices Start From Rs 9.69 LakhNotable changes to the Punch EV include faster DC fast charging and larger battery packs.3 mins read

Jaiveer Mehra | Feb 20, 2026Tata Punch EV Facelift Launched In India; Prices Start From Rs 9.69 LakhNotable changes to the Punch EV include faster DC fast charging and larger battery packs.3 mins read Jaiveer Mehra | Feb 20, 2026Level 2 ADAS Systems To Be Mainstay Of Auto IndustryUse of Level 2+ ADAS technologies to gain popularity in the coming year and overtake the basic Level 2 system by 20354 mins read

Jaiveer Mehra | Feb 20, 2026Level 2 ADAS Systems To Be Mainstay Of Auto IndustryUse of Level 2+ ADAS technologies to gain popularity in the coming year and overtake the basic Level 2 system by 20354 mins read

Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read

Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read

Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read Jafar Rizvi | Feb 15, 2026Maruti Suzuki Victoris: Long-Term Review - Report 1The Victoris is Maruti’s latest offering for the Indian market, and after spending some time with it, here are a few early impressions.1 min read

Jafar Rizvi | Feb 15, 2026Maruti Suzuki Victoris: Long-Term Review - Report 1The Victoris is Maruti’s latest offering for the Indian market, and after spending some time with it, here are a few early impressions.1 min read Bilal Firfiray | Feb 12, 2026BMW X3 30 xDrive M Sport Review: The Driver’s SUV ReturnsRange-toppingX3 30 xDrive M Sport brings back the fun with 255bhp and genuine enthusiast appeal. Does this performance-focused SUV stand out?5 mins read

Bilal Firfiray | Feb 12, 2026BMW X3 30 xDrive M Sport Review: The Driver’s SUV ReturnsRange-toppingX3 30 xDrive M Sport brings back the fun with 255bhp and genuine enthusiast appeal. Does this performance-focused SUV stand out?5 mins read Bilal Firfiray | Feb 11, 2026Mercedes-AMG CLE 53 Coupe Review: The Goldilocks AMG?The Mercedes-AMG CLE 53 Coupe is a concoction of hooliganistic performance and everyday usability. Here’s why this Rs 1.5 crore two-door AMG might be the perfect modern sports coupe for India.6 mins read

Bilal Firfiray | Feb 11, 2026Mercedes-AMG CLE 53 Coupe Review: The Goldilocks AMG?The Mercedes-AMG CLE 53 Coupe is a concoction of hooliganistic performance and everyday usability. Here’s why this Rs 1.5 crore two-door AMG might be the perfect modern sports coupe for India.6 mins read