Vehicle Scrappage Policy: What It Means For Existing Car Owners

- The scrappage policy was one of the highlights of the Union Budget speech

- There might be incentives or rebates for customers looking to scrap cars

- Details of the scrappage policy are yet to be confirmed by the government

The 'Vehicle Scrappage Policy' has been under development for a long period, and we did see some conclusive details in the 2021 Union Budget speech made by Finance Minister Nirmala Sitharaman. The FM revealed a number of details about the upcoming policy that is expected to provide a big boost to the tune of Rs. 43,000 crore to the auto sector. That being said, the final policy is yet to be announced and opens room for a number of questions and concerns. While we expect more clarity with the official announcement sometime later this year, we answer a few queries about the upcoming Vehicle Scrappage Policy and how it will affect you - the car owner.

Also Read: Union Budget 2021: Voluntary Vehicle Scrappage Policy To Be Announced Soon

Cars old than 20 years and commercial vehicles older than 15 years will be eligible for voluntary scrapping

Which vehicles will be eligible for voluntary scrapping?

Under the proposed vehicle scrappage policy, passenger vehicles older than 20 years and commercial vehicles old than 15 years will be eligible for voluntary scrapping. In essence, passenger cars built in 2000 are eligible to be scrapped under the proposed policy. That being said, the vehicles will still have to undergo a fitness test and re-registration at the end of the 15-year cycle. The government will set-up more automated fitness centres across India to test if the vehicle is fit for the road or needs to be sent for scrap. The FM also said that if a vehicle fails the fitness test more than thrice, it could be sent for mandatory scrapping.

What about the cost of re-registration and taxes involved?

According to a recent proposal floated by the Ministry of Road Transport and Highways, the ministry plans to increase the re-registration cost by 25 times on vehicles older than 15 years. If approved, the fitness test cost of a commercial vehicle will be about Rs. 25,000, as opposed to just Rs. 200 per year. Similarly, the renewal of registration cost for cars will go up to Rs. 15,000 from the current charges of Rs. 600. The proposal also plans to increase the registration renewal fee for two and three-wheelers to around about Rs. 2,000-3,000, from the current cost of Rs. 300. In addition, the government is also planning to levy Green Tax at the time of renewal. The renewed registrations will remain valid for a period of five years.

Also Read: Vehicle Scrappage Policy Approved For 15-Year-Old Government And PSU Vehicles From April 1, 2022

The Green tax levied on vehicles will be once in 5 years and will have to be paid at the time of the fitness test

What is Green Tax and why should one pay it?

Green tax is not a completely alien concept to those living in Maharashtra and Delhi. Both regions already levy a green tax or Environment Compensation Charge (ECC) on vehicles older than 15 years. Currently, petrol car owners in Maharashtra pay about Rs. 3000 for the green tax, which goes up to Rs. 3500 for diesel cars. The green tax on two-wheelers stands at Rs. 2000. For commercial vehicle owners, a green tax is levied after a period of eight years. Under the new proposal, a green tax will be levied pan India and will require you to pay 10-25 per cent of your road tax at the time of the registration renewal. In Delhi-NCR, the green tax could be as high as 50 per cent of the road tax.

How does having a vehicle scrappage policy help?

The whole purpose of having the vehicle scrappage policy in place and the subsequent taxes is to dissuade older vehicles from public roads. The government says that this will help reduce air pollution and dependency on oil imports. At the same time, the government is also pushing the adoption of electric vehicles that also intend to meet the same purpose. According to the Federation of Dealers Association (FADA), there are about 37 lakh commercial vehicles and 52 lakh passenger vehicles eligible for voluntary scrappage with 1990 taken as the base year. About 10 per cent CVs and 5 per cent PVs might still be plying on the road, says FADA. This does open room for more retail purchase in the auto sector, giving it the much-needed boost especially in the medium and heavy vehicles segment.

Also Read: A Scrap Vehicle Designed For Leisure Activities

The scrappage policy proposal reportedly will include incentives to customers for voluntary scrapping vehicles in exchange for buying a new vehicle

Will there be any incentives for voluntary scrapping vehicles?

While there has been no confirmation on the same, the government was devising a compensation plan for those voluntarily scrapping their old vehicles as part of the policy. The proposal includes providing incentives to customers in the form of discounts or waving off road tax or registration charges.

Also Read: M&M Becomes India's First Authorized Vehicles' Recycler

What about vehicle scrapping centres?

The scrapping industry is unorganised and there are no official centres just yet. Mahindra & Mahindra partnered with MSTC, a Government of India company, to open India's first recycling centre in 2018. That said, there's no word more such organisations and players in the market. However, we expect the policy to have answers to these concerns when it is officially announced.

Latest News

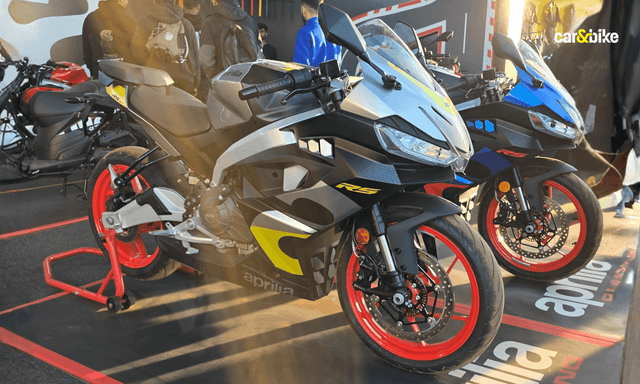

Jafar Rizvi | Feb 10, 20262026 Aprilia RS 457 Launched At Rs 4.22 LakhThe RS 457 gets three new paint options for 2026, including the GP Replica livery sitting at the top of the lineup.2 mins read

Jafar Rizvi | Feb 10, 20262026 Aprilia RS 457 Launched At Rs 4.22 LakhThe RS 457 gets three new paint options for 2026, including the GP Replica livery sitting at the top of the lineup.2 mins read Jaiveer Mehra | Feb 9, 2026Tata Motors Inaugurates New Tamil Nadu Plant; Range Rover Evoque First Vehicle To Roll OutTata says that the plant will become the production base for next-gen vehicles from both Tata and its subsidiary JLR.1 min read

Jaiveer Mehra | Feb 9, 2026Tata Motors Inaugurates New Tamil Nadu Plant; Range Rover Evoque First Vehicle To Roll OutTata says that the plant will become the production base for next-gen vehicles from both Tata and its subsidiary JLR.1 min read car&bike Team | Feb 9, 2026New Cars Coming In February: New SUVs, MPV & EV Lined Up For LaunchJust like January, even February will see a good number new car launches and unveils. We list them for you1 min read

car&bike Team | Feb 9, 2026New Cars Coming In February: New SUVs, MPV & EV Lined Up For LaunchJust like January, even February will see a good number new car launches and unveils. We list them for you1 min read car&bike Team | Feb 9, 2026Hero Vida Ubex Electric Bike Design Patented In IndiaThe Vida Ubex will be the first electric motorcycle from the brand when launched.1 min read

car&bike Team | Feb 9, 2026Hero Vida Ubex Electric Bike Design Patented In IndiaThe Vida Ubex will be the first electric motorcycle from the brand when launched.1 min read car&bike Team | Feb 8, 2026Select Harley-Davidson Motorcycles To Attract Zero Duty Under Upcoming India-US FTA Interim Agreement: ReportPrimary beneficiaries are expected to include models in the 800 to 1600 cc segment2 mins read

car&bike Team | Feb 8, 2026Select Harley-Davidson Motorcycles To Attract Zero Duty Under Upcoming India-US FTA Interim Agreement: ReportPrimary beneficiaries are expected to include models in the 800 to 1600 cc segment2 mins read Jaiveer Mehra | Feb 8, 2026Tata Punch EV Facelift Revealed Ahead Of LaunchSole image of the updated EV previews some of the design updates ahead of its launch on February 20.1 min read

Jaiveer Mehra | Feb 8, 2026Tata Punch EV Facelift Revealed Ahead Of LaunchSole image of the updated EV previews some of the design updates ahead of its launch on February 20.1 min read

Bilal Firfiray | Feb 4, 2026Volkswagen Tayron R-Line Review: Sensible Flagship For IndiaVolkswagen has introduced a made-in-India flagship SUV that offers space, comfort, performance, and German driving finesse in a practical three-row package. But is the Tayron R-Line good enough?6 mins read

Bilal Firfiray | Feb 4, 2026Volkswagen Tayron R-Line Review: Sensible Flagship For IndiaVolkswagen has introduced a made-in-India flagship SUV that offers space, comfort, performance, and German driving finesse in a practical three-row package. But is the Tayron R-Line good enough?6 mins read Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read

Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read

Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read

Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read

Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read