Nissan To Pump $9.5 Billion Into China Business, Eyes Top Three Spot

Nissan Motor Co plans to invest 60 billion yuan ($9.5 billion) in China over the next five years with its joint-venture partner as it seeks to become a top three automaker in the world's biggest market. Long stuck as a second-tier player in China, Nissan and Dongfeng Group said on Monday they plan to boost their volume to 2.6 million vehicles a year by 2022, up from 1.5 million vehicles last year. Nissan plans to achieve the objective, dubbed its "Triple One" strategy, by focusing on electric cars and Venucia, a no-frills local brand Nissan operates in China - two market segments expected to see a surge in demand. It also aims to boost sales of light commercial vans and trucks.

China's auto market has been dominated by General Motors Co and Volkswagen AG for nearly two decades, with each of them selling 4 million vehicles last year. Nissan, along with Toyota Motor Corp , Ford Motor Co, and Honda Motor Co, lag far behind, each selling 1 million-plus vehicles a year.

"We aim to break away from this second-tier group and become a top-3 China automaker," Nissan's China chief Jun Seki said in an interview with Reuters.

"We need to go full-throttle aggressive," Seki said. "If we didn't do that, we would fall behind and fail to grab market share otherwise we could take."

Electric Strategy

Part of the strategy is to keep growing the Nissan brand and the company's premium Infiniti brand, Seki said.

Nissan and Dongfeng plan to increase the Nissan brand's annual sales by 500,000 vehicles to 1.6 million vehicles a year by 2022. It also plans to boost Infiniti's annual sales by 100,000 vehicles to about 150,000 vehicles a year over the same time frame.

Still, more critical a strategy is Nissan's electrification plan.

Seki said the joint venture will launch as many as 20 electrified vehicle models across all brands in an effort to sell roughly 700,000 such cars a year by 2022 excluding electric light commercial vehicles, using a combination of all-electric battery vehicles and so-called "e-Power" hybrids.

Part of the strategy is to keep growing the Nissan brand and the company's premium Infiniti brand, Seki said.

Nissan and Dongfeng plan to increase the Nissan brand's annual sales by 500,000 vehicles to 1.6 million vehicles a year by 2022. It also plans to boost Infiniti's annual sales by 100,000 vehicles to about 150,000 vehicles a year over the same time frame.

Still, more critical a strategy is Nissan's electrification plan.

Seki said the joint venture will launch as many as 20 electrified vehicle models across all brands in an effort to sell roughly 700,000 such cars a year by 2022 excluding electric light commercial vehicles, using a combination of all-electric battery vehicles and so-called "e-Power" hybrids.

Automakers are scrambling to launch an array of electric and plug-in hybrid vehicles over the coming years, in part to comply with China's production quotas for such cars. Nissan's joint venture with Dongfeng sold about 22,000 electric vehicles last year, but they were mostly light commercial e-vans.

In order to generate large enough EV volume, Nissan plans to come up with lower-cost electric cars by locally sourcing electric motors and other key EV components from suppliers in China.

In 2019, Nissan for example plans to launch three such lower-cost EVs under the Venucia name. "We expect EV and e-power hybrid business to become profitable," Seki said, without elaborating.

No-Frills

Venucia, which Nissan established jointly with Dongfeng, is another key focus. The brand began selling cars in 2012, competing with China's low-cost, no-frills indigenous brands such as those run by Geely and Great Wall Motor.

Seki said shoring up Venucia is a must because indigenous Chinese brands will likely collectively sell as many cars as global brands sell in China. Last year indigenous Chinese brands sold a total of 10.3 million vehicles, compared with global brands' 13.9 million vehicles.

Venucia, which uses retired Nissan technologies such as platforms and transmissions, last year sold 143,000 vehicles, up 22.7 percent from 2016.

Seki said Nissan wants to boost Venucia's annual volume by more than 400,000 vehicles to be able to sell as many as 600,000 vehicles a year by 2022.

The effort is likely to face tough competition, however, from established local players such as Baojun, which GM operates jointly with its local China partners.

"No global automakers have a brand that competes with low-cost local brands except for us and GM," Seki said. In addition to Baojun, GM operates the Wuling brand in a joint venture with Chinese partner SAIC Motor Corp and Guangxi Automobile Group.

"Venucia is our clear advantage and we are going to milk it to grow rapidly," Seki said.

(Reporting By Norihiko Shirouzu; Editing by Lincoln Feast)

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)

Latest News

Jaiveer Mehra | Feb 10, 2026Ferrari’s First EV Named Luce; Retro-Style Interior RevealedFerrari has showcased the interior of its first-ever EV ahead of its global debut in the coming months.1 min read

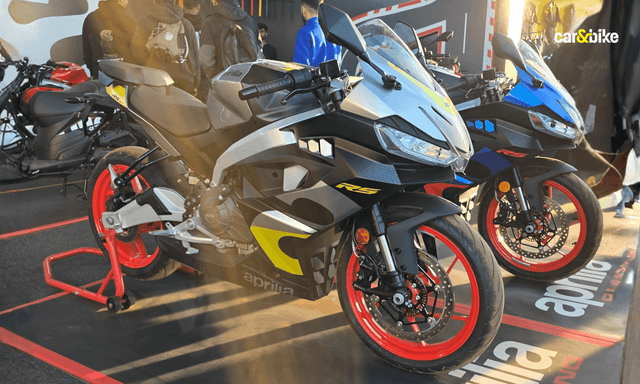

Jaiveer Mehra | Feb 10, 2026Ferrari’s First EV Named Luce; Retro-Style Interior RevealedFerrari has showcased the interior of its first-ever EV ahead of its global debut in the coming months.1 min read Jafar Rizvi | Feb 10, 20262026 Aprilia RS 457 Launched At Rs 4.22 LakhThe RS 457 gets three new paint options for 2026, including the GP Replica livery sitting at the top of the lineup.2 mins read

Jafar Rizvi | Feb 10, 20262026 Aprilia RS 457 Launched At Rs 4.22 LakhThe RS 457 gets three new paint options for 2026, including the GP Replica livery sitting at the top of the lineup.2 mins read Jaiveer Mehra | Feb 9, 2026Tata Motors Inaugurates New Tamil Nadu Plant; Range Rover Evoque First Vehicle To Roll OutTata says that the plant will become the production base for next-gen vehicles from both Tata and its subsidiary JLR.1 min read

Jaiveer Mehra | Feb 9, 2026Tata Motors Inaugurates New Tamil Nadu Plant; Range Rover Evoque First Vehicle To Roll OutTata says that the plant will become the production base for next-gen vehicles from both Tata and its subsidiary JLR.1 min read car&bike Team | Feb 9, 2026New Cars Coming In February: New SUVs, MPV & EV Lined Up For LaunchJust like January, even February will see a good number new car launches and unveils. We list them for you1 min read

car&bike Team | Feb 9, 2026New Cars Coming In February: New SUVs, MPV & EV Lined Up For LaunchJust like January, even February will see a good number new car launches and unveils. We list them for you1 min read car&bike Team | Feb 9, 2026Hero Vida Ubex Electric Bike Design Patented In IndiaThe Vida Ubex will be the first electric motorcycle from the brand when launched.1 min read

car&bike Team | Feb 9, 2026Hero Vida Ubex Electric Bike Design Patented In IndiaThe Vida Ubex will be the first electric motorcycle from the brand when launched.1 min read car&bike Team | Feb 8, 2026Select Harley-Davidson Motorcycles To Attract Zero Duty Under Upcoming India-US FTA Interim Agreement: ReportPrimary beneficiaries are expected to include models in the 800 to 1600 cc segment2 mins read

car&bike Team | Feb 8, 2026Select Harley-Davidson Motorcycles To Attract Zero Duty Under Upcoming India-US FTA Interim Agreement: ReportPrimary beneficiaries are expected to include models in the 800 to 1600 cc segment2 mins read

Bilal Firfiray | Feb 4, 2026Volkswagen Tayron R-Line Review: Sensible Flagship For IndiaVolkswagen has introduced a made-in-India flagship SUV that offers space, comfort, performance, and German driving finesse in a practical three-row package. But is the Tayron R-Line good enough?6 mins read

Bilal Firfiray | Feb 4, 2026Volkswagen Tayron R-Line Review: Sensible Flagship For IndiaVolkswagen has introduced a made-in-India flagship SUV that offers space, comfort, performance, and German driving finesse in a practical three-row package. But is the Tayron R-Line good enough?6 mins read Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read

Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read

Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read

Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read

Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read