Russia's Delimobil Targets Over $900 Million Valuation In U.S. IPO

Russian car-sharing company Delimobil Holding S.A. said on Monday it would look to raise as much as $240 million in a U.S. initial public offering at a valuation of more than $900 million. The company plans to sell 20 million American Depositary Shares (ADSs) priced between $10 and $12 apiece. Each ADS represents two ordinary shares.

Delimobil was founded in 2015 and is one of Russia's biggest car-sharing providers with a fleet of over 18,000 vehicles in 11 cities. It first announced IPO plans in 2019.

A clutch of companies from the country has gone public this year, clocking the fastest flurry in Russian stock-market listings under the sanctions era that began after Russia annexed Crimea in 2014.

UBS predicted earlier this year that Russian listing volumes could hit $10 billion this year.

Delimobil's revenue rose to 4.93 billion roubles ($70.65 million) in the six months ended June 30, from 2.25 billion roubles a year earlier.

It expects to list on the New York Stock Exchange under the ticker symbol "DMOB". BofA Securities, Citigroup and VTB Capital are the lead underwriters for the offering.

Latest News

car&bike Team | Feb 2, 2026Car Sales January 2026: Six Marutis in Top 10, But Tata Nexon Takes Top SpotTata Motors sold 23,365 units of the Nexon, creating a clear gap to the Maruti Suzuki Dzire, which finished second with 19,629 units.1 min read

car&bike Team | Feb 2, 2026Car Sales January 2026: Six Marutis in Top 10, But Tata Nexon Takes Top SpotTata Motors sold 23,365 units of the Nexon, creating a clear gap to the Maruti Suzuki Dzire, which finished second with 19,629 units.1 min read car&bike Team | Feb 2, 2026Maruti Suzuki Victoris Crosses 50,000 Sales Milestone In 4 monthsThe compact SUV launched at the onset of festive season has crossed the 50,000 sales mark in about 4 months1 min read

car&bike Team | Feb 2, 2026Maruti Suzuki Victoris Crosses 50,000 Sales Milestone In 4 monthsThe compact SUV launched at the onset of festive season has crossed the 50,000 sales mark in about 4 months1 min read car&bike Team | Feb 2, 2026Two-Wheeler Sales January 2026: Hero MotoCorp, TVS, Royal Enfield, Suzuki Report Sustained GrowthMost brands have reported year-on-year growth in the first month of CY26.2 mins read

car&bike Team | Feb 2, 2026Two-Wheeler Sales January 2026: Hero MotoCorp, TVS, Royal Enfield, Suzuki Report Sustained GrowthMost brands have reported year-on-year growth in the first month of CY26.2 mins read car&bike Team | Feb 2, 2026Maruti Suzuki Announces Price Protection Amid Long Waiting PeriodsCountry’s largest carmaker has said that prices of the cars will not be increased for customers who have already made the bookings1 min read

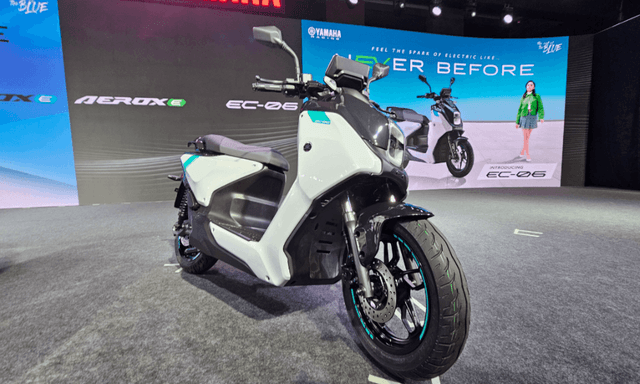

car&bike Team | Feb 2, 2026Maruti Suzuki Announces Price Protection Amid Long Waiting PeriodsCountry’s largest carmaker has said that prices of the cars will not be increased for customers who have already made the bookings1 min read Jafar Rizvi | Feb 2, 2026Yamaha EC-06 vs River Indie: How Different Are The Two Electric Scooters?The EC-06 shares its foundation with the River Indie, and here we look at the differences between the two.3 mins read

Jafar Rizvi | Feb 2, 2026Yamaha EC-06 vs River Indie: How Different Are The Two Electric Scooters?The EC-06 shares its foundation with the River Indie, and here we look at the differences between the two.3 mins read Jafar Rizvi | Feb 2, 2026Yamaha EC-06 E-Scooter Launched In India At Rs 1.68 LakhThe EC-06 marks Yamaha’s entry into the electric scooter segment in India.2 mins read

Jafar Rizvi | Feb 2, 2026Yamaha EC-06 E-Scooter Launched In India At Rs 1.68 LakhThe EC-06 marks Yamaha’s entry into the electric scooter segment in India.2 mins read

Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read

Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read

Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read

Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read

Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read Seshan Vijayraghvan | Jan 8, 20262026 Mahindra XUV 7XO Review: Big On Tech, Bigger On ComfortThe new Mahindra XUV 7XO is flashier, feature packed, and comes with more advanced tech. But are the changes just incremental or actually substantial?1 min read

Seshan Vijayraghvan | Jan 8, 20262026 Mahindra XUV 7XO Review: Big On Tech, Bigger On ComfortThe new Mahindra XUV 7XO is flashier, feature packed, and comes with more advanced tech. But are the changes just incremental or actually substantial?1 min read