Benefits of Adding Engine Protection to Two-Wheeler Insurance

- The engine is the most vital component of the bike, and without it.

- It is nothing more than a piece of metal.

- Damage caused by any accident resulting in an oil spill may be costly

The Engine Protection add-on on motorcycle insurance provides financial support in the event that internal engine or gearbox parts need to be repaired or replaced. The basic comprehensive policy does not cover such engine damage. It'll come in handy if you live in a flood-prone location. For a small additional premium, you can rest assured that the most expensive portion of your bike is protected, and you won't have to worry about replacement costs if the bike engine is damaged.

This is an add-on to your Two-Wheeler Package Policy/Stand-Alone Own Damage Bike Insurance Policy:

Engine Protect is an add-on cover that can be purchased as part of a comprehensive plan or separately as a stand-alone Own Damage bike insurance policy. The add-on does not require a separate document, but the stand-alone or package policy must. The Engine Protection add-on has the following exclusions:

- Due to a delay in notifying the insurance provider, damage or loss occurs, including corrosion of the engine and/or gearbox.

- Repair or replacement of internal engine parts as a result of the insured bike's delay in being retrieved from the flooded region.

- Loss or damage caused by a person riding the insured vehicle while inebriated, illegal racing, or riding a bike with an expired driver's license.

- Engine and/or gearbox parts covered by the manufacturer's warranty or recall campaign are repaired or replaced.

- The cost of lubricants in the event of a leak.

- Any claim filed outside of the insurer's specified term.

- Any claim in which the repair is completed prior to notifying the insurance company.

How Do I Get Two-Wheeler Insurance With the Engine Protection Add-On?

The procedure for filing a claim to repair or replace internal parts of the insured bike's engine and/or gearbox is the same as for raising claims under comprehensive insurance.

Register a claim using the Engine Protection add-on by following the procedures below:

Step 1: Contact your insurer right away and inform them of the loss or damage to the insured bike's engine parts.

Step 2: The insurer will appoint a surveyor to assess the loss and continue the claim process.

Step 3: The insurance company will reimburse you for the cost of repairing or replacing internal engine and/or gearbox parts.

Who Should Purchase the Engine Protection Add-On?

The Engine Protection add-on insurance is an extension to your bike's basic comprehensive policy. The following are some of the benefits of purchasing the bike engine protection add-on for your vehicle:

- If you live in an area that is prone to flooding,

- If you've just purchased a new bike, the engine is the most expensive component.

- If you wish to be financially protected against significant engine component damage,

Latest News

car&bike Team | Feb 2, 2026Maruti Suzuki Announces Price Protection Amid Long Waiting PeriodsCountry’s largest carmaker has said that prices of the cars will not be increased for customers who have already made the bookings1 min read

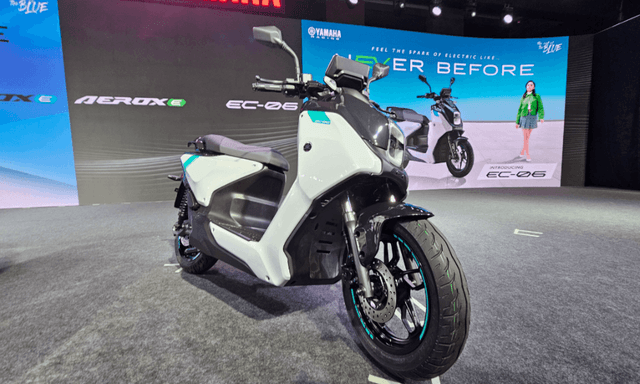

car&bike Team | Feb 2, 2026Maruti Suzuki Announces Price Protection Amid Long Waiting PeriodsCountry’s largest carmaker has said that prices of the cars will not be increased for customers who have already made the bookings1 min read Jafar Rizvi | Feb 2, 2026Yamaha EC-06 vs River Indie: How Different Are The Two Electric Scooters?The EC-06 shares its foundation with the River Indie, and here we look at the differences between the two.3 mins read

Jafar Rizvi | Feb 2, 2026Yamaha EC-06 vs River Indie: How Different Are The Two Electric Scooters?The EC-06 shares its foundation with the River Indie, and here we look at the differences between the two.3 mins read Jafar Rizvi | Feb 2, 2026Yamaha EC-06 E-Scooter Launched In India At Rs 1.68 LakhThe EC-06 marks Yamaha’s entry into the electric scooter segment in India.2 mins read

Jafar Rizvi | Feb 2, 2026Yamaha EC-06 E-Scooter Launched In India At Rs 1.68 LakhThe EC-06 marks Yamaha’s entry into the electric scooter segment in India.2 mins read car&bike Team | Feb 1, 2026Tata Punch Sales Cross 7 Lakh Units; 2 Lakh Units Sold In Last 12 MonthsThe Punch had crossed the 5 lakh unit sales milestone in January 2025.1 min read

car&bike Team | Feb 1, 2026Tata Punch Sales Cross 7 Lakh Units; 2 Lakh Units Sold In Last 12 MonthsThe Punch had crossed the 5 lakh unit sales milestone in January 2025.1 min read Jaiveer Mehra | Feb 1, 2026Auto Sales Jan 2026: Tata Claims Second Place With Over 70,000 Units Sold; Hyundai Reports Best-Ever Domestic SalesTata reported domestic passenger vehicle sales of over 70,000 units on the back of best ever sales of the Nexon and Punch in the month.3 mins read

Jaiveer Mehra | Feb 1, 2026Auto Sales Jan 2026: Tata Claims Second Place With Over 70,000 Units Sold; Hyundai Reports Best-Ever Domestic SalesTata reported domestic passenger vehicle sales of over 70,000 units on the back of best ever sales of the Nexon and Punch in the month.3 mins read Jaiveer Mehra | Jan 31, 2026New Renault Duster For India Vs For Europe: What’s Different?Renault has made notable changes to the Duster to better appeal to the Indian car buyers. But just how different is it from its global sibling?1 min read

Jaiveer Mehra | Jan 31, 2026New Renault Duster For India Vs For Europe: What’s Different?Renault has made notable changes to the Duster to better appeal to the Indian car buyers. But just how different is it from its global sibling?1 min read

Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read

Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read

Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read

Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read Seshan Vijayraghvan | Jan 8, 20262026 Mahindra XUV 7XO Review: Big On Tech, Bigger On ComfortThe new Mahindra XUV 7XO is flashier, feature packed, and comes with more advanced tech. But are the changes just incremental or actually substantial?1 min read

Seshan Vijayraghvan | Jan 8, 20262026 Mahindra XUV 7XO Review: Big On Tech, Bigger On ComfortThe new Mahindra XUV 7XO is flashier, feature packed, and comes with more advanced tech. But are the changes just incremental or actually substantial?1 min read Preetam Bora | Jan 10, 2026Simple One Gen 2 First Ride Review: 265 km Claimed Range!The Gen 2 model of Simple Energy’s first electric scooter gets a fair few updates, including new features, tech, more range and lighter weight. We spent a couple of hours with the Simple One Gen 2 to find out if it manages to impress.6 mins read

Preetam Bora | Jan 10, 2026Simple One Gen 2 First Ride Review: 265 km Claimed Range!The Gen 2 model of Simple Energy’s first electric scooter gets a fair few updates, including new features, tech, more range and lighter weight. We spent a couple of hours with the Simple One Gen 2 to find out if it manages to impress.6 mins read