Budget 2019: Electric Vehicle Makers Demand Reduction In GST And Import Duties

- EV makers have asked to bring EVs under the 5 per cent GST bracket.

- Audi has also demanded reduction in import duties on EVs.

- Ather has also asked for reduction in rates charged on raw material.

The Faster Adoption And Manufacturing Of Electric Vehicles II (FAME II) scheme came as a silver lining for electric vehicles makers in India. The government is aiming for 30 per cent electrification on vehicles by 2030 and FAME II is definitely a step in the right direction. Things got fasttracked after the centre allotted Rs. 10,000 crores for setting up the requisite infrastructure gave subsidies on the imported components used to assemble EVs. However, electric vehicle manufacturers have further demands which can help pave a smoother path for the industry. EV makers have raised several demands like to reduce import duties on EVs and to bring electric vehicles under the 5 per cent GST bracket from 12 per cent. Some of the Indian EV makers have also requested to further subsidise completely knocked down (CKD) units in a bid to promote local manufacturing of EVs.

Also Read: Budget 2019: SIAM Asks Budget Committee To Reduce GST Rates And Incentivise R&D Expenses

Audi Will launch the e-Tron in India this year.

Audi Will launch the e-Tron in India this year.Ahead of the budget session, Rahil Ansari, Head, Audi India said, "The e-tron is a global product from Audi that will be a perfect match for the Indian market that is moving towards clean and green mobility solutions. To that effect, tangible measures by the government towards e-mobility infrastructure and adequate support for introducing the electric vehicles import in India market would be a welcome move as this also increases the local knowledge on global EV technologies." Audi has recently unveiled the e-Tron electric SUV in India and is planning to launch it this year.

Also Read: Budget 2019: Auto Industry Demands Budget Committee To Bring Down GST Rates

Ather has requested the budget committee to reduce GST rates to 5 peer cent on EVs.

Ather has requested the budget committee to reduce GST rates to 5 peer cent on EVs.Giving suggestions ahead of the upcoming budget session, Tarun Mehta, CEO & Co-Founder, Ather Energy said, "As a manufacturer, we would like the Centre to review the current taxation framework applicable on raw material and the final product. There is an inherent inverted duty structure as the GST input on raw material and other overheads are on average of 18 % wherein the output is pegged at 12%. The proposed reduction of the GST on EVs to 5% will increase this delta. This structure results in significant working capital blockage. Even with the existing GST inverted duty refund framework in place, there is working capital blockage on the overheads and capital investments." Mehta has also asked the government to for some more time to implement sourcing of indigenous electric motors as the industry is not ready yet. "Under the Phased Manufacturing Project, the timeline to source indigenous electric motors has been set as April 2020. This will need to be extended by 6-9 months to account for the validation and certification of the components and the vehicles, Similarly, the timeline to localise lithium-ion cells by April 2021 will not be sufficient for manufacturers to scale to meet demand and should be extended to 2023," Mehta added.

Okinawa has asked the government to support electric two-wheeler makers.

Okinawa has asked the government to support electric two-wheeler makers.Speaking on similar lines, Jeetender Sharma, Founder & Managing Director, Okinawa Autotech said, "The government has placed a definitive emphasis on Electric Vehicles and had already announced a reduction of customs duty on the imported electric vehicles in completely knocked-down or semi-knocked down state, to 10-15% from 15-30%. The Fame-2 Policy is also actively supporting the electric two-wheeler industry. In the upcoming budget we would like to see reduced import duties on lithium-ion cells, motors and motor controllers so that the batteries can be produced locally aligning with Governments' Make In India initiative. We also want GST on batteries to be reduced from the current 18 percent slab to the lowest possible slab. We hope the government would soon announce a concrete plan of action with its time-bound implementation in order to fulfil its stated vision."

Also Read: Delhi Government To Come Up With A Dedicated EV Policy Next Month

EV makers in India today are predominantly dependent on importing batteries and components which on an average add over 65 per cent to their cost. The demand for incentives on local manufacturing and imported component is to reduce the cost of local assembly which will help them to bring down the cost by a significant margin. Moreover, reduced GST rates will also help to cut down the final cost of electric vehicles and will be a huge favour in promoting their faster adoption.

Latest News

Jaiveer Mehra | Mar 1, 2026Mahindra XEV 9e Cineluxe Edition Launched At Rs 29.35 LakhNew special edition of the 9e electric SUV is based on the fully-loaded 9e Pack 3 but costs about Rs 1.15 lakh less.2 mins read

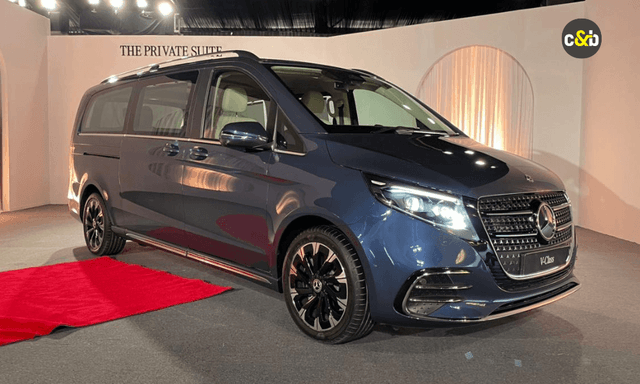

Jaiveer Mehra | Mar 1, 2026Mahindra XEV 9e Cineluxe Edition Launched At Rs 29.35 LakhNew special edition of the 9e electric SUV is based on the fully-loaded 9e Pack 3 but costs about Rs 1.15 lakh less.2 mins read Jaiveer Mehra | Mar 1, 2026New Mercedes-Benz V-Class Makes India Debut; Launch TomorrowUnlike the previous diesel-only V-class, the latest model will be offered with petrol and diesel engine options.1 min read

Jaiveer Mehra | Mar 1, 2026New Mercedes-Benz V-Class Makes India Debut; Launch TomorrowUnlike the previous diesel-only V-class, the latest model will be offered with petrol and diesel engine options.1 min read car&bike Team | Feb 28, 2026Zero-Dep Cover: The Renewal Add-on That Ensures You Don’t Pay for Parts1 min read

car&bike Team | Feb 28, 2026Zero-Dep Cover: The Renewal Add-on That Ensures You Don’t Pay for Parts1 min read car&bike Team | Feb 28, 2026Toyota Land Cruiser, Lexus LX Recalled Over Transmission Malfunction RiskThe recall affects 969 units of the Toyota Land Cruiser and 117 units of the Lexus LX.1 min read

car&bike Team | Feb 28, 2026Toyota Land Cruiser, Lexus LX Recalled Over Transmission Malfunction RiskThe recall affects 969 units of the Toyota Land Cruiser and 117 units of the Lexus LX.1 min read Jaiveer Mehra | Feb 27, 2026New Tata Tiago EV Spied Testing On Indian Roads: Enhanced Range Incoming?Launched in India in 2022, the Tiago EV received a notable update last year, adding in newer features and some styling tweaks.3 mins read

Jaiveer Mehra | Feb 27, 2026New Tata Tiago EV Spied Testing On Indian Roads: Enhanced Range Incoming?Launched in India in 2022, the Tiago EV received a notable update last year, adding in newer features and some styling tweaks.3 mins read car&bike Team | Feb 27, 2026VLF Mobster 135 Price Hiked As Introductory Offer EndsThe Mobster 135 is now priced at Rs 1.37 lakh (ex-showroom), which marks an increase of Rs 7,000.2 mins read

car&bike Team | Feb 27, 2026VLF Mobster 135 Price Hiked As Introductory Offer EndsThe Mobster 135 is now priced at Rs 1.37 lakh (ex-showroom), which marks an increase of Rs 7,000.2 mins read

Bilal Firfiray | Feb 28, 2026Tata Punch EV Facelift Review: More Range, More Sense, Less MoneyThe Tata Punch EV facelift gets a bigger 40 kWh battery, faster 60 kW DC charging, improved thermal management, and better real-world range, and all of that at a lower introductory price. But does it become a more complete package now?6 mins read

Bilal Firfiray | Feb 28, 2026Tata Punch EV Facelift Review: More Range, More Sense, Less MoneyThe Tata Punch EV facelift gets a bigger 40 kWh battery, faster 60 kW DC charging, improved thermal management, and better real-world range, and all of that at a lower introductory price. But does it become a more complete package now?6 mins read Preetam Bora | Feb 24, 2026Hero Destini 110 Review: Simplicity, RefinedThe Hero Destini 110 is a no-nonsense commuter that is simple, comfortable and above all, fuel efficient. In 2026, when buyers are spoilt for choice, is it good enough to consider?1 min read

Preetam Bora | Feb 24, 2026Hero Destini 110 Review: Simplicity, RefinedThe Hero Destini 110 is a no-nonsense commuter that is simple, comfortable and above all, fuel efficient. In 2026, when buyers are spoilt for choice, is it good enough to consider?1 min read Preetam Bora | Feb 23, 2026TVS Apache RTX Road Test Review: Redefining the Entry-Level ADVAfter spending some time with the TVS Apache RTX in traffic, the daily commute, as well as on open highways, one thing becomes clear: the RTX is trying to redefine the entry-level ADV segment. But is it without fault?1 min read

Preetam Bora | Feb 23, 2026TVS Apache RTX Road Test Review: Redefining the Entry-Level ADVAfter spending some time with the TVS Apache RTX in traffic, the daily commute, as well as on open highways, one thing becomes clear: the RTX is trying to redefine the entry-level ADV segment. But is it without fault?1 min read Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read

Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read

Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read