Oil Edges Off Low As Strong Export Demand Drains U.S. Crude Stocks

Oil prices rose about 1.5% after hitting a six-month low on Wednesday, as a steeper-than-expected drawdown in U.S. crude stocks outweighed concerns over rising Russian output and exports as well as recession fears.

U.S. crude stocks fell by 7.1 million barrels in the week to Aug. 12 to 425 million barrels, Energy Information Administration (EIA) data showed, compared with analysts' forecasts for a 275,000-barrel drop in a Reuters poll.

Brent crude settled $1.31, or 1.42% higher at $93.65 per barrel. Earlier in the day, recession worries had pushed the benchmark price to its lowest since February at $91.51.

U.S. West Texas Intermediate (WTI) crude rose $1.58, or 1.8%, to $88.11 per barrel.

U.S crude exports hit 5 million barrels per day, the highest on record, EIA data showed, as WTI has traded at a steep discount to Brent, making purchases of U.S. crude more attractive to foreign buyers.

In a sign of strong demand, gasoline stocks drew 4.6 million barrels, much higher than the expected 1.1 million barrel draw.

"It was expected to be a friendly report and it was pretty much across the board. Some of those demand destruction concerns that the market was going through seem to be alleviated a little bit," said Phil Flynn, an analyst at Price Futures group.

The American Petroleum Institute had on Tuesday flagged a 448,000 barrel draw in crude stocks and 4.5 million barrels in gasoline inventories, according to sources.

Oil has soared in 2022, coming close to an all-time high of $147 in March after Russia's invasion of Ukraine.

However, Russia has started to gradually increase oil production after sanctions-related curbs and as Asian buyers have increased purchases, leading Moscow to raise its forecasts for output and exports until the end of 2025, an economy ministry document seen by Reuters showed.

Russia's earnings from energy exports are expected to rise 38% this year partly due to higher oil export volumes, according to the document, in a sign that supply from the country has not been affected as much as markets originally had expected.

The prospect of recession has also more recently weighed on oil prices. British consumer price inflation jumped to 10.1% in July, its highest since February 1982, intensifying a squeeze on households, and pushing oil prices lower earlier in the day.

"There are growing downside risks as a result of the growth outlook and ongoing uncertainty around Chinese COVID restrictions," said Craig Erlam of brokerage OANDA.

An exodus of participants, especially hedge funds and speculators, has made daily price swings far greater than in previous years.

On the oil supply front, the market is awaiting developments from talks to revive Iran's 2015 nuclear deal with world powers, which could eventually lead to a boost in Iranian oil exports.

The European Union and United States said on Tuesday they were studying Iran's response to what the EU has called its "final" proposal to save the deal.

Analysts at Goldman Sachs said a return of Iranian crude supply would reduce their 2023 forecast by $5-10 per barrel from $125 per barrel.

Latest News

Jaiveer Mehra | Mar 1, 2026Mahindra XEV 9e Cineluxe Edition Launched At Rs 29.35 LakhNew special edition of the 9e electric SUV is based on the fully-loaded 9e Pack 3 but costs about Rs 1.15 lakh less.2 mins read

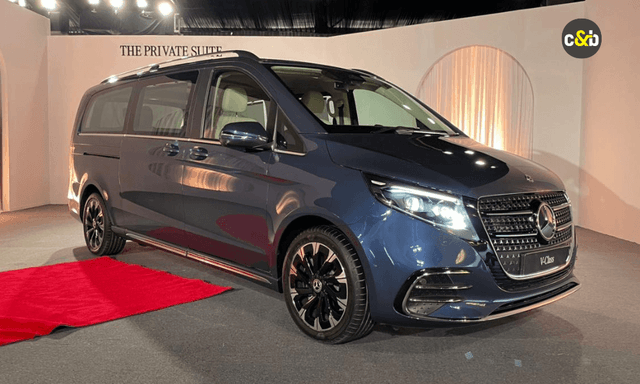

Jaiveer Mehra | Mar 1, 2026Mahindra XEV 9e Cineluxe Edition Launched At Rs 29.35 LakhNew special edition of the 9e electric SUV is based on the fully-loaded 9e Pack 3 but costs about Rs 1.15 lakh less.2 mins read Jaiveer Mehra | Mar 1, 2026New Mercedes-Benz V-Class Makes India Debut; Launch TomorrowUnlike the previous diesel-only V-class, the latest model will be offered with petrol and diesel engine options.1 min read

Jaiveer Mehra | Mar 1, 2026New Mercedes-Benz V-Class Makes India Debut; Launch TomorrowUnlike the previous diesel-only V-class, the latest model will be offered with petrol and diesel engine options.1 min read car&bike Team | Feb 28, 2026Zero-Dep Cover: The Renewal Add-on That Ensures You Don’t Pay for Parts1 min read

car&bike Team | Feb 28, 2026Zero-Dep Cover: The Renewal Add-on That Ensures You Don’t Pay for Parts1 min read car&bike Team | Feb 28, 2026Toyota Land Cruiser, Lexus LX Recalled Over Transmission Malfunction RiskThe recall affects 969 units of the Toyota Land Cruiser and 117 units of the Lexus LX.1 min read

car&bike Team | Feb 28, 2026Toyota Land Cruiser, Lexus LX Recalled Over Transmission Malfunction RiskThe recall affects 969 units of the Toyota Land Cruiser and 117 units of the Lexus LX.1 min read Jaiveer Mehra | Feb 27, 2026New Tata Tiago EV Spied Testing On Indian Roads: Enhanced Range Incoming?Launched in India in 2022, the Tiago EV received a notable update last year, adding in newer features and some styling tweaks.3 mins read

Jaiveer Mehra | Feb 27, 2026New Tata Tiago EV Spied Testing On Indian Roads: Enhanced Range Incoming?Launched in India in 2022, the Tiago EV received a notable update last year, adding in newer features and some styling tweaks.3 mins read car&bike Team | Feb 27, 2026VLF Mobster 135 Price Hiked As Introductory Offer EndsThe Mobster 135 is now priced at Rs 1.37 lakh (ex-showroom), which marks an increase of Rs 7,000.2 mins read

car&bike Team | Feb 27, 2026VLF Mobster 135 Price Hiked As Introductory Offer EndsThe Mobster 135 is now priced at Rs 1.37 lakh (ex-showroom), which marks an increase of Rs 7,000.2 mins read

Bilal Firfiray | Feb 28, 2026Tata Punch EV Facelift Review: More Range, More Sense, Less MoneyThe Tata Punch EV facelift gets a bigger 40 kWh battery, faster 60 kW DC charging, improved thermal management, and better real-world range, and all of that at a lower introductory price. But does it become a more complete package now?6 mins read

Bilal Firfiray | Feb 28, 2026Tata Punch EV Facelift Review: More Range, More Sense, Less MoneyThe Tata Punch EV facelift gets a bigger 40 kWh battery, faster 60 kW DC charging, improved thermal management, and better real-world range, and all of that at a lower introductory price. But does it become a more complete package now?6 mins read Preetam Bora | Feb 24, 2026Hero Destini 110 Review: Simplicity, RefinedThe Hero Destini 110 is a no-nonsense commuter that is simple, comfortable and above all, fuel efficient. In 2026, when buyers are spoilt for choice, is it good enough to consider?1 min read

Preetam Bora | Feb 24, 2026Hero Destini 110 Review: Simplicity, RefinedThe Hero Destini 110 is a no-nonsense commuter that is simple, comfortable and above all, fuel efficient. In 2026, when buyers are spoilt for choice, is it good enough to consider?1 min read Preetam Bora | Feb 23, 2026TVS Apache RTX Road Test Review: Redefining the Entry-Level ADVAfter spending some time with the TVS Apache RTX in traffic, the daily commute, as well as on open highways, one thing becomes clear: the RTX is trying to redefine the entry-level ADV segment. But is it without fault?1 min read

Preetam Bora | Feb 23, 2026TVS Apache RTX Road Test Review: Redefining the Entry-Level ADVAfter spending some time with the TVS Apache RTX in traffic, the daily commute, as well as on open highways, one thing becomes clear: the RTX is trying to redefine the entry-level ADV segment. But is it without fault?1 min read Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read

Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read

Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read