Budget 2019: Electric Vehicle Makers Demand Reduction In GST And Import Duties

- EV makers have asked to bring EVs under the 5 per cent GST bracket.

- Audi has also demanded reduction in import duties on EVs.

- Ather has also asked for reduction in rates charged on raw material.

The Faster Adoption And Manufacturing Of Electric Vehicles II (FAME II) scheme came as a silver lining for electric vehicles makers in India. The government is aiming for 30 per cent electrification on vehicles by 2030 and FAME II is definitely a step in the right direction. Things got fasttracked after the centre allotted Rs. 10,000 crores for setting up the requisite infrastructure gave subsidies on the imported components used to assemble EVs. However, electric vehicle manufacturers have further demands which can help pave a smoother path for the industry. EV makers have raised several demands like to reduce import duties on EVs and to bring electric vehicles under the 5 per cent GST bracket from 12 per cent. Some of the Indian EV makers have also requested to further subsidise completely knocked down (CKD) units in a bid to promote local manufacturing of EVs.

Also Read: Budget 2019: SIAM Asks Budget Committee To Reduce GST Rates And Incentivise R&D Expenses

Audi Will launch the e-Tron in India this year.

Audi Will launch the e-Tron in India this year.Ahead of the budget session, Rahil Ansari, Head, Audi India said, "The e-tron is a global product from Audi that will be a perfect match for the Indian market that is moving towards clean and green mobility solutions. To that effect, tangible measures by the government towards e-mobility infrastructure and adequate support for introducing the electric vehicles import in India market would be a welcome move as this also increases the local knowledge on global EV technologies." Audi has recently unveiled the e-Tron electric SUV in India and is planning to launch it this year.

Also Read: Budget 2019: Auto Industry Demands Budget Committee To Bring Down GST Rates

Ather has requested the budget committee to reduce GST rates to 5 peer cent on EVs.

Ather has requested the budget committee to reduce GST rates to 5 peer cent on EVs.Giving suggestions ahead of the upcoming budget session, Tarun Mehta, CEO & Co-Founder, Ather Energy said, "As a manufacturer, we would like the Centre to review the current taxation framework applicable on raw material and the final product. There is an inherent inverted duty structure as the GST input on raw material and other overheads are on average of 18 % wherein the output is pegged at 12%. The proposed reduction of the GST on EVs to 5% will increase this delta. This structure results in significant working capital blockage. Even with the existing GST inverted duty refund framework in place, there is working capital blockage on the overheads and capital investments." Mehta has also asked the government to for some more time to implement sourcing of indigenous electric motors as the industry is not ready yet. "Under the Phased Manufacturing Project, the timeline to source indigenous electric motors has been set as April 2020. This will need to be extended by 6-9 months to account for the validation and certification of the components and the vehicles, Similarly, the timeline to localise lithium-ion cells by April 2021 will not be sufficient for manufacturers to scale to meet demand and should be extended to 2023," Mehta added.

Okinawa has asked the government to support electric two-wheeler makers.

Okinawa has asked the government to support electric two-wheeler makers.Speaking on similar lines, Jeetender Sharma, Founder & Managing Director, Okinawa Autotech said, "The government has placed a definitive emphasis on Electric Vehicles and had already announced a reduction of customs duty on the imported electric vehicles in completely knocked-down or semi-knocked down state, to 10-15% from 15-30%. The Fame-2 Policy is also actively supporting the electric two-wheeler industry. In the upcoming budget we would like to see reduced import duties on lithium-ion cells, motors and motor controllers so that the batteries can be produced locally aligning with Governments' Make In India initiative. We also want GST on batteries to be reduced from the current 18 percent slab to the lowest possible slab. We hope the government would soon announce a concrete plan of action with its time-bound implementation in order to fulfil its stated vision."

Also Read: Delhi Government To Come Up With A Dedicated EV Policy Next Month

EV makers in India today are predominantly dependent on importing batteries and components which on an average add over 65 per cent to their cost. The demand for incentives on local manufacturing and imported component is to reduce the cost of local assembly which will help them to bring down the cost by a significant margin. Moreover, reduced GST rates will also help to cut down the final cost of electric vehicles and will be a huge favour in promoting their faster adoption.

Trending News

1 min readYamaha YZF-R2 Name Trademarked In India

1 min readYamaha YZF-R2 Name Trademarked In India 1 min readTriumph Tracker 400: In Pictures

1 min readTriumph Tracker 400: In Pictures

Latest News

car&bike Team | Dec 19, 2025Yamaha YZF-R2 Name Trademarked In IndiaThe Yamaha R15, one of Yamaha India’s most popular motorcycle models, is likely to continue, even when the R2 finally makes it debut.1 min read

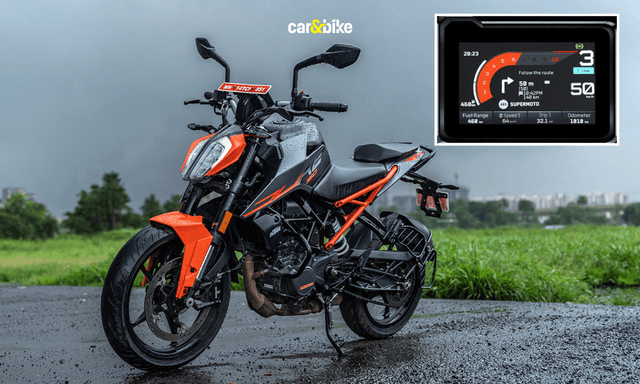

car&bike Team | Dec 19, 2025Yamaha YZF-R2 Name Trademarked In IndiaThe Yamaha R15, one of Yamaha India’s most popular motorcycle models, is likely to continue, even when the R2 finally makes it debut.1 min read car&bike Team | Dec 18, 2025KTM 160 Duke With TFT Dash launched At Rs 1.79 LakhThe 5-inch colour TFT dash is borrowed from the 390 Duke and is shared across the brand’s sub-400cc lineup.2 mins read

car&bike Team | Dec 18, 2025KTM 160 Duke With TFT Dash launched At Rs 1.79 LakhThe 5-inch colour TFT dash is borrowed from the 390 Duke and is shared across the brand’s sub-400cc lineup.2 mins read car&bike Team | Dec 18, 2025Lamborghini Urus Seized By Cops Following Viral Clip Of Speeding On Bandra-Worli Sea LinkThe car was seized after a video of it allegedly overspeeding on the Bandra–Worli Sea Link, where the speed limit is capped at 80 kmph, went viral.2 mins read

car&bike Team | Dec 18, 2025Lamborghini Urus Seized By Cops Following Viral Clip Of Speeding On Bandra-Worli Sea LinkThe car was seized after a video of it allegedly overspeeding on the Bandra–Worli Sea Link, where the speed limit is capped at 80 kmph, went viral.2 mins read car&bike Team | Dec 18, 20252025 Ducati XDiavel V4 India Launch Details RevealedThe new Ducati XDiavel V4 will be launched towards the end of December 2025 and will sit alongside the standard Ducati Diavel V4.3 mins read

car&bike Team | Dec 18, 20252025 Ducati XDiavel V4 India Launch Details RevealedThe new Ducati XDiavel V4 will be launched towards the end of December 2025 and will sit alongside the standard Ducati Diavel V4.3 mins read Amaan Ahmed | Dec 18, 2025Maruti WagonR Swivel Front Seat Kit Launched: Check Price, AvailabilityBangalore-based startup TrueAssist Technology Private Limited has developed a mechanism that allows the front passenger seat to swivel outwards, in a bid to improve accessibility for the aged and persons with disabilities.2 mins read

Amaan Ahmed | Dec 18, 2025Maruti WagonR Swivel Front Seat Kit Launched: Check Price, AvailabilityBangalore-based startup TrueAssist Technology Private Limited has developed a mechanism that allows the front passenger seat to swivel outwards, in a bid to improve accessibility for the aged and persons with disabilities.2 mins read Amaan Ahmed | Dec 18, 2025Nissan Gravite MPV (Renault Triber Derivative) To Be Launched Early In 2026Nearly seven years on from the launch of the MPV it shares its underpinnings with arrives Nissan's entry-level 7-seat model; to debut in January.2 mins read

Amaan Ahmed | Dec 18, 2025Nissan Gravite MPV (Renault Triber Derivative) To Be Launched Early In 2026Nearly seven years on from the launch of the MPV it shares its underpinnings with arrives Nissan's entry-level 7-seat model; to debut in January.2 mins read

Bilal Firfiray | Dec 19, 2025Maruti Suzuki e-Vitara Review: Worth The Wait?After a long wait, the first-ever electric Maruti Suzuki is here. It’s the e-Vitara, and it comes with a few promises. But arriving this late, is it worth the wait? Or is it a case of too little, too late?9 mins read

Bilal Firfiray | Dec 19, 2025Maruti Suzuki e-Vitara Review: Worth The Wait?After a long wait, the first-ever electric Maruti Suzuki is here. It’s the e-Vitara, and it comes with a few promises. But arriving this late, is it worth the wait? Or is it a case of too little, too late?9 mins read Bilal Firfiray | Dec 18, 2025Mercedes-Benz G450d: The Subtle Power of EvolutionThe Mercedes-Benz G 450d evolves subtly with more power, improved efficiency, and modern tech, while staying true to the timeless G-Class design. And character.4 mins read

Bilal Firfiray | Dec 18, 2025Mercedes-Benz G450d: The Subtle Power of EvolutionThe Mercedes-Benz G 450d evolves subtly with more power, improved efficiency, and modern tech, while staying true to the timeless G-Class design. And character.4 mins read Janak Sorap | Dec 11, 2025Harley-Davidson X440 T First Ride Review: Smarter and SharperHarley-Davidson has taken the X440 and given it a more focused and engaging twist. The result is the X440 T—essentially the same platform but updated in areas that give the motorcycle more appeal and riders more thrill.5 mins read

Janak Sorap | Dec 11, 2025Harley-Davidson X440 T First Ride Review: Smarter and SharperHarley-Davidson has taken the X440 and given it a more focused and engaging twist. The result is the X440 T—essentially the same platform but updated in areas that give the motorcycle more appeal and riders more thrill.5 mins read Shams Raza Naqvi | Dec 10, 20252025 Mini Cooper Convertible Review: More Colour On Indian RoadsThe updated Mini Cooper Convertible is set to be launched in the Indian market in the next few days. We drive it around Jaisalmer for a quick review.5 mins read

Shams Raza Naqvi | Dec 10, 20252025 Mini Cooper Convertible Review: More Colour On Indian RoadsThe updated Mini Cooper Convertible is set to be launched in the Indian market in the next few days. We drive it around Jaisalmer for a quick review.5 mins read Bilal Firfiray | Dec 8, 2025Tata Sierra Review: India’s New Favourite?Marking its return after a few decades, the reborn Sierra has made everyone sit up and take notice. But is it worth the hype?10 mins read

Bilal Firfiray | Dec 8, 2025Tata Sierra Review: India’s New Favourite?Marking its return after a few decades, the reborn Sierra has made everyone sit up and take notice. But is it worth the hype?10 mins read