Note Ban, GST, BS-IV Norms Dent Pre-Owned Car Market: Report

- Pre-owned car market sales reduced by six per cent from previous fiscal

- The projected growth was at 15 per cent

- Demonetization reduced market size by two lakh units

The demonetization coupled with GST and BS-IV norms seem to have made a dent in the domestic pre-owned car market with the segment growing six per cent lesser in the previous fiscal against the projected growth of 15 per cent, as per an industry report. However, at the same time, the Centre's decision in November last year to ban Rs 500 and Rs 1,000 notes, which were subsequently replaced with new Rs 500 and Rs 2,000 notes, and greater access to credit have allowed for increased finance penetration in the organized segment, Indian Bluebook, a vehicle pricing research platform, said in a report released today.

Also Read: GST Cess Hike On Luxury Cars Approved By Cabinet; SUVs To Get Pricier

The 3.6 million pre-owned car markets grew at nine per cent as the demonetization reduced market size by two lakh units or an estimated six per cent of the overall used car sales market, it said. Over the past year, the market has been hit by significant "jolts" in the form of three major market reforms -- demonetization, BSIII/BSIV and GST, it said.

"While these reforms have no doubt disrupted the status quo, they have necessitated that all stakeholders change with the times and become more organized," Mahindra First Choice Wheels Ltd's managing director and chief executive officer Nagendra Palle said at the launch of the second edition of 'India Pre-Owned Car Market Report' 2017.

Also Read: BS III Vehicles Sales: Heavy Discounting Begins As April Deadline Looms

"Notwithstanding the short term hiccups, we strongly believe these market reforms are good for the organized industry in the long term," he said. Mahindra First Choice Wheels is Mahindra group's pre-owned vehicle selling arm.

According to the report, the current GST regime imposes a significantly higher burden on the dealer - on a pan-India basis - roughly twice the rate that was otherwise being incurred.

As per the report, in 70 per cent of states, dealers will have to pay higher taxes post-GST, compared to the old tax regime but the current GST structure is expected to give a fillip to C2C transactions. The highly fragmented pre-owned car market is divided into four categories -- the organized, semi-organized, unorganized and consumer-to-consumer market.

Also Read: Auto Industry Recovers From Demonetisation Impact

While the organized category accounts for 15 per cent of the total market pie, the semi-organized market accounts for 6 per cent of all used car sales in the country. The unorganized market commands a 17 per cent share in the overall sales and the consumer to consumer market 32 per cent of the total pie.

The report also noted that the pre-owned car market continues to organize rapidly with both organized and semi- organized segments growing by 36 per cent and 12 respectively by volume, while C2C and unorganized segments have remained flat.

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)

Trending News

1 min readYamaha YZF-R2 Name Trademarked In India

1 min readYamaha YZF-R2 Name Trademarked In India 1 min readTriumph Tracker 400: In Pictures

1 min readTriumph Tracker 400: In Pictures

Latest News

car&bike Team | Dec 19, 2025Yamaha YZF-R2 Name Trademarked In IndiaThe Yamaha R15, one of Yamaha India’s most popular motorcycle models, is likely to continue, even when the R2 finally makes it debut.1 min read

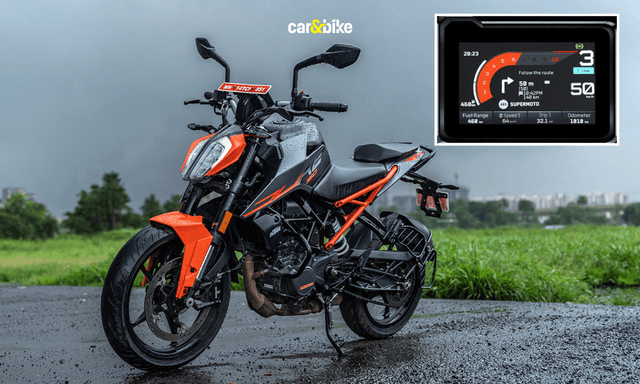

car&bike Team | Dec 19, 2025Yamaha YZF-R2 Name Trademarked In IndiaThe Yamaha R15, one of Yamaha India’s most popular motorcycle models, is likely to continue, even when the R2 finally makes it debut.1 min read car&bike Team | Dec 18, 2025KTM 160 Duke With TFT Dash launched At Rs 1.79 LakhThe 5-inch colour TFT dash is borrowed from the 390 Duke and is shared across the brand’s sub-400cc lineup.2 mins read

car&bike Team | Dec 18, 2025KTM 160 Duke With TFT Dash launched At Rs 1.79 LakhThe 5-inch colour TFT dash is borrowed from the 390 Duke and is shared across the brand’s sub-400cc lineup.2 mins read car&bike Team | Dec 18, 2025Lamborghini Urus Seized By Cops Following Viral Clip Of Speeding On Bandra-Worli Sea LinkThe car was seized after a video of it allegedly overspeeding on the Bandra–Worli Sea Link, where the speed limit is capped at 80 kmph, went viral.2 mins read

car&bike Team | Dec 18, 2025Lamborghini Urus Seized By Cops Following Viral Clip Of Speeding On Bandra-Worli Sea LinkThe car was seized after a video of it allegedly overspeeding on the Bandra–Worli Sea Link, where the speed limit is capped at 80 kmph, went viral.2 mins read car&bike Team | Dec 18, 20252025 Ducati XDiavel V4 India Launch Details RevealedThe new Ducati XDiavel V4 will be launched towards the end of December 2025 and will sit alongside the standard Ducati Diavel V4.3 mins read

car&bike Team | Dec 18, 20252025 Ducati XDiavel V4 India Launch Details RevealedThe new Ducati XDiavel V4 will be launched towards the end of December 2025 and will sit alongside the standard Ducati Diavel V4.3 mins read Amaan Ahmed | Dec 18, 2025Maruti WagonR Swivel Front Seat Kit Launched: Check Price, AvailabilityBangalore-based startup TrueAssist Technology Private Limited has developed a mechanism that allows the front passenger seat to swivel outwards, in a bid to improve accessibility for the aged and persons with disabilities.2 mins read

Amaan Ahmed | Dec 18, 2025Maruti WagonR Swivel Front Seat Kit Launched: Check Price, AvailabilityBangalore-based startup TrueAssist Technology Private Limited has developed a mechanism that allows the front passenger seat to swivel outwards, in a bid to improve accessibility for the aged and persons with disabilities.2 mins read Amaan Ahmed | Dec 18, 2025Nissan Gravite MPV (Renault Triber Derivative) To Be Launched Early In 2026Nearly seven years on from the launch of the MPV it shares its underpinnings with arrives Nissan's entry-level 7-seat model; to debut in January.2 mins read

Amaan Ahmed | Dec 18, 2025Nissan Gravite MPV (Renault Triber Derivative) To Be Launched Early In 2026Nearly seven years on from the launch of the MPV it shares its underpinnings with arrives Nissan's entry-level 7-seat model; to debut in January.2 mins read

Bilal Firfiray | Dec 19, 2025Maruti Suzuki e-Vitara Review: Worth The Wait?After a long wait, the first-ever electric Maruti Suzuki is here. It’s the e-Vitara, and it comes with a few promises. But arriving this late, is it worth the wait? Or is it a case of too little, too late?9 mins read

Bilal Firfiray | Dec 19, 2025Maruti Suzuki e-Vitara Review: Worth The Wait?After a long wait, the first-ever electric Maruti Suzuki is here. It’s the e-Vitara, and it comes with a few promises. But arriving this late, is it worth the wait? Or is it a case of too little, too late?9 mins read Bilal Firfiray | Dec 18, 2025Mercedes-Benz G450d: The Subtle Power of EvolutionThe Mercedes-Benz G 450d evolves subtly with more power, improved efficiency, and modern tech, while staying true to the timeless G-Class design. And character.4 mins read

Bilal Firfiray | Dec 18, 2025Mercedes-Benz G450d: The Subtle Power of EvolutionThe Mercedes-Benz G 450d evolves subtly with more power, improved efficiency, and modern tech, while staying true to the timeless G-Class design. And character.4 mins read Janak Sorap | Dec 11, 2025Harley-Davidson X440 T First Ride Review: Smarter and SharperHarley-Davidson has taken the X440 and given it a more focused and engaging twist. The result is the X440 T—essentially the same platform but updated in areas that give the motorcycle more appeal and riders more thrill.5 mins read

Janak Sorap | Dec 11, 2025Harley-Davidson X440 T First Ride Review: Smarter and SharperHarley-Davidson has taken the X440 and given it a more focused and engaging twist. The result is the X440 T—essentially the same platform but updated in areas that give the motorcycle more appeal and riders more thrill.5 mins read Shams Raza Naqvi | Dec 10, 20252025 Mini Cooper Convertible Review: More Colour On Indian RoadsThe updated Mini Cooper Convertible is set to be launched in the Indian market in the next few days. We drive it around Jaisalmer for a quick review.5 mins read

Shams Raza Naqvi | Dec 10, 20252025 Mini Cooper Convertible Review: More Colour On Indian RoadsThe updated Mini Cooper Convertible is set to be launched in the Indian market in the next few days. We drive it around Jaisalmer for a quick review.5 mins read Bilal Firfiray | Dec 8, 2025Tata Sierra Review: India’s New Favourite?Marking its return after a few decades, the reborn Sierra has made everyone sit up and take notice. But is it worth the hype?10 mins read

Bilal Firfiray | Dec 8, 2025Tata Sierra Review: India’s New Favourite?Marking its return after a few decades, the reborn Sierra has made everyone sit up and take notice. But is it worth the hype?10 mins read