Nitin Gadkari Says Hybrids Must Get Same Reduced GST Benefit As EVs

It was in July this year that the GST Council decided to reduce the tax rate on electric vehicles (EVs) to 5 per cent from 12 per cent, a move aimed at accelerating the adoption of eco-friendly mobility solutions. The GST rate came into effect from August 1, 2019. However, hybrid cars and SUVs went from being taxed at 30.3 per cent to 43 per cent - an increase of 13.3 per cent. Hybrids, now classified under the highest GST tax slab saw prices of cars sky rocket. However, Nitin Gadkari, Union Transport Minister, today said that hybrid vehicles must get the same reduced GST benefit as electric cars in the country. This means that hybrid cars will attract just 5 per cent GST like electric vehicles and this will see a massive reduction in GST, 38 per cent reduction, to be precise. In fact, he went on to state that the recommendation for this has already been made to the Finance Ministry and now the department is following up.

Mr. Gadkari said, "We have already reduced the GST on electric vehicles and now I am trying to make sure that the hybrid cars too get a similar reduction. I am following up with the Finance Ministry and so should the manufacturers, so that it too can be covered under the same bracket."

Nitin Gadkari, Union Transport Minister, today said that hybrid vehicles must get the same reduced GST benefit as electric cars

Prior to GST, hybrid vehicles were taxed 30.3 percent (12.5 percent excise duty, 12.5 percent value-added tax, 2 percent central sales tax and 1 percent national calamity contingent duty). Under GST, it attracts 28 percent tax and 15 percent cess – like big petrol and diesel luxury cars. The recommendation to reduce GST on hybrid cars will be a welcome move for manufacturers like Volvo, BMW, Toyota and even Maruti Suzuki, all of whom are looking to introduce hybrid vehicles into the market. This is also see other manufacturers changing their plans to include more hybrid vehicles in their portfolio.

Latest News

car&bike Team | Feb 2, 2026Car Sales January 2026: Six Marutis in Top 10, But Tata Nexon Takes Top SpotTata Motors sold 23,365 units of the Nexon, creating a clear gap to the Maruti Suzuki Dzire, which finished second with 19,629 units.1 min read

car&bike Team | Feb 2, 2026Car Sales January 2026: Six Marutis in Top 10, But Tata Nexon Takes Top SpotTata Motors sold 23,365 units of the Nexon, creating a clear gap to the Maruti Suzuki Dzire, which finished second with 19,629 units.1 min read car&bike Team | Feb 2, 2026Maruti Suzuki Victoris Crosses 50,000 Sales Milestone In 4 monthsThe compact SUV launched at the onset of festive season has crossed the 50,000 sales mark in about 4 months1 min read

car&bike Team | Feb 2, 2026Maruti Suzuki Victoris Crosses 50,000 Sales Milestone In 4 monthsThe compact SUV launched at the onset of festive season has crossed the 50,000 sales mark in about 4 months1 min read car&bike Team | Feb 2, 2026Two-Wheeler Sales January 2026: Hero MotoCorp, TVS, Royal Enfield, Suzuki Report Sustained GrowthMost brands have reported year-on-year growth in the first month of CY26.2 mins read

car&bike Team | Feb 2, 2026Two-Wheeler Sales January 2026: Hero MotoCorp, TVS, Royal Enfield, Suzuki Report Sustained GrowthMost brands have reported year-on-year growth in the first month of CY26.2 mins read car&bike Team | Feb 2, 2026Maruti Suzuki Announces Price Protection Amid Long Waiting PeriodsCountry’s largest carmaker has said that prices of the cars will not be increased for customers who have already made the bookings1 min read

car&bike Team | Feb 2, 2026Maruti Suzuki Announces Price Protection Amid Long Waiting PeriodsCountry’s largest carmaker has said that prices of the cars will not be increased for customers who have already made the bookings1 min read Jafar Rizvi | Feb 2, 2026Yamaha EC-06 vs River Indie: How Different Are The Two Electric Scooters?The EC-06 shares its foundation with the River Indie, and here we look at the differences between the two.3 mins read

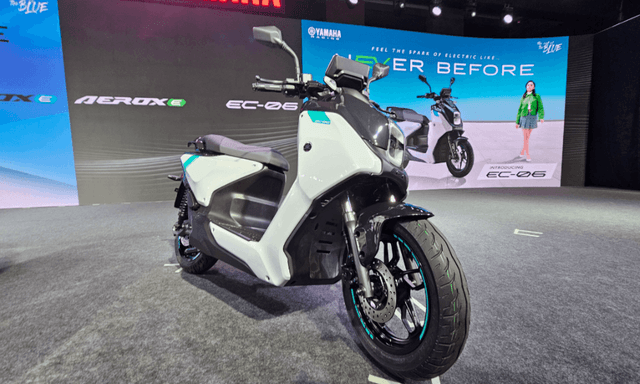

Jafar Rizvi | Feb 2, 2026Yamaha EC-06 vs River Indie: How Different Are The Two Electric Scooters?The EC-06 shares its foundation with the River Indie, and here we look at the differences between the two.3 mins read Jafar Rizvi | Feb 2, 2026Yamaha EC-06 E-Scooter Launched In India At Rs 1.68 LakhThe EC-06 marks Yamaha’s entry into the electric scooter segment in India.2 mins read

Jafar Rizvi | Feb 2, 2026Yamaha EC-06 E-Scooter Launched In India At Rs 1.68 LakhThe EC-06 marks Yamaha’s entry into the electric scooter segment in India.2 mins read

Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read

Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read

Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read

Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read

Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read Seshan Vijayraghvan | Jan 8, 20262026 Mahindra XUV 7XO Review: Big On Tech, Bigger On ComfortThe new Mahindra XUV 7XO is flashier, feature packed, and comes with more advanced tech. But are the changes just incremental or actually substantial?1 min read

Seshan Vijayraghvan | Jan 8, 20262026 Mahindra XUV 7XO Review: Big On Tech, Bigger On ComfortThe new Mahindra XUV 7XO is flashier, feature packed, and comes with more advanced tech. But are the changes just incremental or actually substantial?1 min read