Mercedes-Benz Wants Taxes On Luxury Cars To Be Reduced In India

- Mercedes-Benz claims the move will help in job creation

- Currently these cars attract cess of 15 per cent over the 28 per cent tax

- Better treatment in terms of taxation could lead to growth of the segment

German carmaker Mercedes-Benz has pitched for lower taxes on luxury cars in India, saying the move will help in job creation as well as increase tax collection from the segment. The company reasoned that "better treatment" in terms of taxation could lead to growth of luxury car segment in the country. Under the GST regime, large cars with engine capacity greater than 1,500 cc and SUVs with length more than 4 metres and engine greater than 1,500 cc attract cess of 15 per cent in addition to the top tax rate of 28 per cent.

"We have seen in India that if in one hand something is given then on the other hand something is taken back," Mercedes-Benz India Managing Director and CEO Roland Folger told PTI. This is the basic reason why the luxury segment has not been performing better in the country, he added. "We (auto industry) are 7-8 per cent of the GDP and we can have a bigger share in the growth of the country but we also need some better treatment as far as taxation is concerned because there are few countries in the world which have higher taxes than what we see in India," Folger said.

Incidentally, overall tax incidence on locally-assembled luxury cars has come down from around 55 per cent earlier to 43 per cent in the GST regime. Several luxury car makers, including Mercedes, Audi and Jaguar Land Rover, have already reduced prices to pass on the benefit to customers. Elaborating on the need to have a standard tax structure across various auto segments, he said: "If you give same tax base as other car segments, we have to pay 28 per cent instead of 43 per cent and we can double our volume."

He further added that doubling the sales volume at 28 per cent taxation would bring in more tax overall, far outweighing the loss which would accrue by reducing the levy from 43 per cent to 28 per cent. "It will also lead us to create more jobs...Make in India can be massively pushed forward if that could be done," Folger said.

He further said: "Unfortunately, the government has not decided to give us 28 per cent so again the overall development is rather flat and not anywhere close to its real potential."

The country would not have lost revenue if it had kept the luxury car segment at 28 per cent tax rate, he said. "Jobs need to come from somewhere and if you don't make it attractive for us by increasing the volume you simply cannot create jobs," Folger said. "We can really contribute something to the betterment of the country. We are ready, we are able and we are interested to do that but you also need to let us do that," he added.

Folger noted that luxury car segment is far away from its full potential in the country. The segment accounts for less than 2 per cent of the overall car market in India. Under the GST regime, passenger vehicles now attract top rate of 28 per cent with a cess in the range of 1 to 15 per cent. Small petrol cars with engine less than 1,200 cc will attract 1 per cent cess, while those with a diesel engine of less than 1,500 cc attract 3 per cent cess.

(Except for the headline, this story has not been edited by NDTV staff and is published from a syndicated feed.)

Latest News

Jaiveer Mehra | Mar 1, 2026Mahindra XEV 9e Cineluxe Edition Launched At Rs 29.35 LakhNew special edition of the 9e electric SUV is based on the fully-loaded 9e Pack 3 but costs about Rs 1.15 lakh less.2 mins read

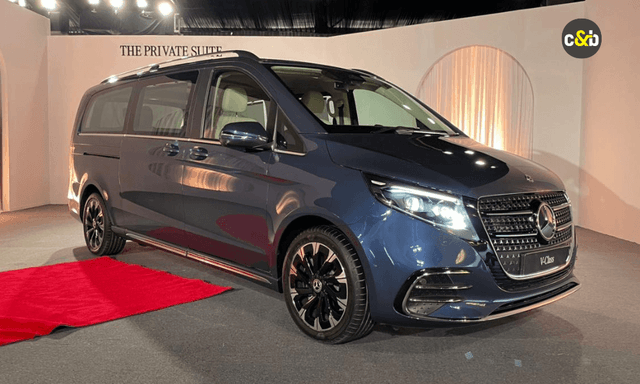

Jaiveer Mehra | Mar 1, 2026Mahindra XEV 9e Cineluxe Edition Launched At Rs 29.35 LakhNew special edition of the 9e electric SUV is based on the fully-loaded 9e Pack 3 but costs about Rs 1.15 lakh less.2 mins read Jaiveer Mehra | Mar 1, 2026New Mercedes-Benz V-Class Makes India Debut; Launch TomorrowUnlike the previous diesel-only V-class, the latest model will be offered with petrol and diesel engine options.1 min read

Jaiveer Mehra | Mar 1, 2026New Mercedes-Benz V-Class Makes India Debut; Launch TomorrowUnlike the previous diesel-only V-class, the latest model will be offered with petrol and diesel engine options.1 min read car&bike Team | Feb 28, 2026Zero-Dep Cover: The Renewal Add-on That Ensures You Don’t Pay for Parts1 min read

car&bike Team | Feb 28, 2026Zero-Dep Cover: The Renewal Add-on That Ensures You Don’t Pay for Parts1 min read car&bike Team | Feb 28, 2026Toyota Land Cruiser, Lexus LX Recalled Over Transmission Malfunction RiskThe recall affects 969 units of the Toyota Land Cruiser and 117 units of the Lexus LX.1 min read

car&bike Team | Feb 28, 2026Toyota Land Cruiser, Lexus LX Recalled Over Transmission Malfunction RiskThe recall affects 969 units of the Toyota Land Cruiser and 117 units of the Lexus LX.1 min read Jaiveer Mehra | Feb 27, 2026New Tata Tiago EV Spied Testing On Indian Roads: Enhanced Range Incoming?Launched in India in 2022, the Tiago EV received a notable update last year, adding in newer features and some styling tweaks.3 mins read

Jaiveer Mehra | Feb 27, 2026New Tata Tiago EV Spied Testing On Indian Roads: Enhanced Range Incoming?Launched in India in 2022, the Tiago EV received a notable update last year, adding in newer features and some styling tweaks.3 mins read car&bike Team | Feb 27, 2026VLF Mobster 135 Price Hiked As Introductory Offer EndsThe Mobster 135 is now priced at Rs 1.37 lakh (ex-showroom), which marks an increase of Rs 7,000.2 mins read

car&bike Team | Feb 27, 2026VLF Mobster 135 Price Hiked As Introductory Offer EndsThe Mobster 135 is now priced at Rs 1.37 lakh (ex-showroom), which marks an increase of Rs 7,000.2 mins read

Bilal Firfiray | Feb 28, 2026Tata Punch EV Facelift Review: More Range, More Sense, Less MoneyThe Tata Punch EV facelift gets a bigger 40 kWh battery, faster 60 kW DC charging, improved thermal management, and better real-world range, and all of that at a lower introductory price. But does it become a more complete package now?6 mins read

Bilal Firfiray | Feb 28, 2026Tata Punch EV Facelift Review: More Range, More Sense, Less MoneyThe Tata Punch EV facelift gets a bigger 40 kWh battery, faster 60 kW DC charging, improved thermal management, and better real-world range, and all of that at a lower introductory price. But does it become a more complete package now?6 mins read Preetam Bora | Feb 24, 2026Hero Destini 110 Review: Simplicity, RefinedThe Hero Destini 110 is a no-nonsense commuter that is simple, comfortable and above all, fuel efficient. In 2026, when buyers are spoilt for choice, is it good enough to consider?1 min read

Preetam Bora | Feb 24, 2026Hero Destini 110 Review: Simplicity, RefinedThe Hero Destini 110 is a no-nonsense commuter that is simple, comfortable and above all, fuel efficient. In 2026, when buyers are spoilt for choice, is it good enough to consider?1 min read Preetam Bora | Feb 23, 2026TVS Apache RTX Road Test Review: Redefining the Entry-Level ADVAfter spending some time with the TVS Apache RTX in traffic, the daily commute, as well as on open highways, one thing becomes clear: the RTX is trying to redefine the entry-level ADV segment. But is it without fault?1 min read

Preetam Bora | Feb 23, 2026TVS Apache RTX Road Test Review: Redefining the Entry-Level ADVAfter spending some time with the TVS Apache RTX in traffic, the daily commute, as well as on open highways, one thing becomes clear: the RTX is trying to redefine the entry-level ADV segment. But is it without fault?1 min read Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read

Girish Karkera | Feb 20, 2026Road Test: 2025 VinFast VF7 AWD Sky InfinityFlagship all-electric SUV from the Vietnamese car maker gets most of the basics right.1 min read Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read

Jaiveer Mehra | Feb 18, 2026New BMW X3 30 Vs Mercedes-Benz GLC 300: Midsize Luxury SUV FaceoffWith the new X3 30, BMW has a direct competitor to the petrol GLC 300, but which is the luxury SUV for you?1 min read