RBI's Repo Rate Hike Likely To Have Nominal Impact On Car Loans And Sales

- RBI has revised the repo rate and CRR by 40 bps and 50 bps, respectively.

- The hike in lending rate is nominal and will have minimal impact on sales

- Increase in interest rate and deposit rate will affect buyers' sentiments

The Reserve Bank of India (RBI) pulled a surprise announcing a hike of 40 basis points (bps) or 0.40 per cent on its lending rate to commercial banks and a 50 bps or 0.50 per cent increase in the Cash Reserve Ratio (CRR). After a hiatus of four years, the repo rate has gone up to 4.40 per cent from the previous 4 per cent, while CRR has been hiked to 4.5 per cent. And the sudden revision has raised concerns among car buyers and automakers on the impact it will likely have on sales.

Vinkesh Gulati, President, Federation of Automobile Dealers' Association (FADA) said, "The RBI's move of increasing repo rate by 40 bps has clearly taken everyone off guard. This move will curb excess liquidity in the system and will make auto loans expensive."

Also Read: RBI Repo Rate Hike: How It Will Affect Two-Wheeler Loans

RBI has announced a hike of 40 basis points (bps) or 0.40 per cent on its lending rate to commercial banks and a 50 bps or 0.50 per cent increase in the Cash Reserve Ratio (CRR).

The revisions made by the central bank are likely to have a nominal impact on interest rates on loans. But according to our sources in the State Bank of India (SBI), interest rates on any loan across sectors will not see an upward revision exceeding 0.40 per cent. In fact, the hike made by commercial banks is likely to be well within the 40 bps mark and same goes for car loans. At present, interest rates on car loans mostly range from 7.4 per cent - 8.3 per cent across the banking sector which could be revised to a maximum of 7.8 per cent - 8.7 per cent, if commercial banks decide to pass on the entire burden on customers.

For your perspective, increase in actual interest per lakh is likely to be just Rs. 400 per annum (P.A.) if the entire burden is passed on, which in-turn will be an increase of Rs. 33.33 per lakh per month. So let's say if you take a loan of Rs. 10 lakh, your interest rate is likely to go up by a maximum of Rs. 4000 P.A. which will translate into a increase of Rs. 333.33 in your monthly car loan EMIs.

At the moment, pacing up production in a bid to mainting adequate inventory and reducing long waiting periods remains the bigger concern of automakers and stakeholders.

Sharing his views with carandbike, R C Bhargava, Chairman - Maruti Suzuki said, "We already have a huge backlog due to chip shortage, so the revision in rates won't have a major impact on our sales. It's a nominal revision so interest rates will have a very nominal affect, so customer sentiments won't be severely impacted as they won't really feel the impact."

Sharing his views on the overall impact, Sridhar V, Auto Analyst, Grant Thornton LLP said, "The impact of RBI rate revision will be felt minimally on auto loans in the near term and could have customers holding back their instinct to purchase since cost of acquisition of vehicles could go up. But on a medium to longer term it will get neutralised as the regime of low interest rates is possibly behind us now and one cannot expect a drop in interest rates in the near future. However the greater challenge is for the OEM's as currently they are faced with higher input costs, higher fuel prices and availability of critical input materials and this could be another additional aspect which could hamper their sales. The industry will soon be looking at some demand creating sops like reduction of GST, which they have been seeking for a long time."

The industry has been bearing the brunt of a global supply crisis of semiconductors and at the moment, pacing up production in a bid to maintaining adequate inventory and reducing long waiting periods remains the bigger concern of automakers and stakeholders.

Increase in interest rate on both loans and desposits is likely to have impact on buyers' sentiments.

Even observers have said that 40 bps impact on interest and EMIs will be minimal. So, overall volume outlook remains more or less the same. The volume segments which range from Rs. 5 lakh to Rs. 18 lakh brackets (hatchbacks and compact cars and SUVs) will likely see a very nominal impact as the standard amount of loan taken for these cars ranges from Rs. 4 lakh - Rs. 12 lakh and the maximum increase in monthly EMIs in this case will be around Rs. 500. Having said that, the overall sentiment is likely to be one of caution, with rising fuel prices and periodic hikes by OEMs, since general buyers will take time to understand the impact of the quantum of the interest hike.

Trending News

1 min readTriumph Tracker 400: In Pictures

1 min readTriumph Tracker 400: In Pictures

Latest News

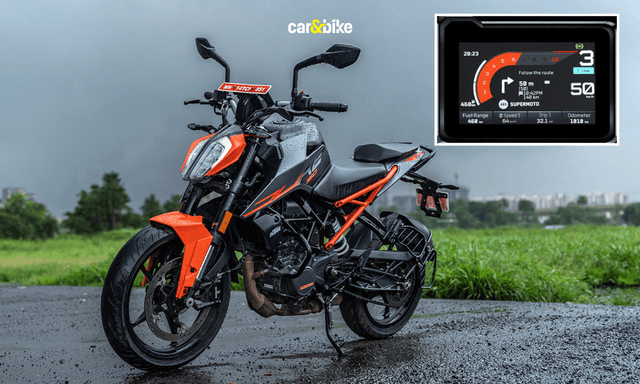

car&bike Team | Dec 18, 2025KTM 160 Duke With TFT Dash launched At Rs 1.79 LakhThe 5-inch colour TFT dash is borrowed from the 390 Duke and is shared across the brand’s sub-400cc lineup.2 mins read

car&bike Team | Dec 18, 2025KTM 160 Duke With TFT Dash launched At Rs 1.79 LakhThe 5-inch colour TFT dash is borrowed from the 390 Duke and is shared across the brand’s sub-400cc lineup.2 mins read car&bike Team | Dec 18, 2025Lamborghini Urus Seized By Cops Following Viral Clip Of Speeding On Bandra-Worli Sea LinkThe car was seized after a video of it allegedly overspeeding on the Bandra–Worli Sea Link, where the speed limit is capped at 80 kmph, went viral.2 mins read

car&bike Team | Dec 18, 2025Lamborghini Urus Seized By Cops Following Viral Clip Of Speeding On Bandra-Worli Sea LinkThe car was seized after a video of it allegedly overspeeding on the Bandra–Worli Sea Link, where the speed limit is capped at 80 kmph, went viral.2 mins read car&bike Team | Dec 18, 20252025 Ducati XDiavel V4 India Launch Details RevealedThe new Ducati XDiavel V4 will be launched towards the end of December 2025 and will sit alongside the standard Ducati Diavel V4.3 mins read

car&bike Team | Dec 18, 20252025 Ducati XDiavel V4 India Launch Details RevealedThe new Ducati XDiavel V4 will be launched towards the end of December 2025 and will sit alongside the standard Ducati Diavel V4.3 mins read Amaan Ahmed | Dec 18, 2025Maruti WagonR Swivel Front Seat Kit Launched: Check Price, AvailabilityBangalore-based startup TrueAssist Technology Private Limited has developed a mechanism that allows the front passenger seat to swivel outwards, in a bid to improve accessibility for the aged and persons with disabilities.2 mins read

Amaan Ahmed | Dec 18, 2025Maruti WagonR Swivel Front Seat Kit Launched: Check Price, AvailabilityBangalore-based startup TrueAssist Technology Private Limited has developed a mechanism that allows the front passenger seat to swivel outwards, in a bid to improve accessibility for the aged and persons with disabilities.2 mins read Amaan Ahmed | Dec 18, 2025Nissan Gravite MPV (Renault Triber Derivative) To Be Launched Early In 2026Nearly seven years on from the launch of the MPV it shares its underpinnings with arrives Nissan's entry-level 7-seat model; to debut in January.2 mins read

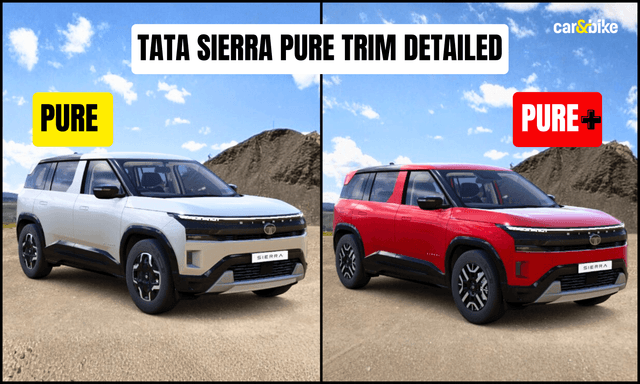

Amaan Ahmed | Dec 18, 2025Nissan Gravite MPV (Renault Triber Derivative) To Be Launched Early In 2026Nearly seven years on from the launch of the MPV it shares its underpinnings with arrives Nissan's entry-level 7-seat model; to debut in January.2 mins read Jafar Rizvi | Dec 18, 2025Tata Sierra Pure, Pure+ Variants Explained In PicturesThe Pure trim of the Sierra is priced from Rs 12.49 lakh to Rs 17.49 lakh (ex-showroom), depending on the powertrain option. Here is a breakdown of what it gets.3 mins read

Jafar Rizvi | Dec 18, 2025Tata Sierra Pure, Pure+ Variants Explained In PicturesThe Pure trim of the Sierra is priced from Rs 12.49 lakh to Rs 17.49 lakh (ex-showroom), depending on the powertrain option. Here is a breakdown of what it gets.3 mins read

Bilal Firfiray | Dec 18, 2025Mercedes-Benz G450d: The Subtle Power of EvolutionThe Mercedes-Benz G 450d evolves subtly with more power, improved efficiency, and modern tech, while staying true to the timeless G-Class design. And character.4 mins read

Bilal Firfiray | Dec 18, 2025Mercedes-Benz G450d: The Subtle Power of EvolutionThe Mercedes-Benz G 450d evolves subtly with more power, improved efficiency, and modern tech, while staying true to the timeless G-Class design. And character.4 mins read Janak Sorap | Dec 11, 2025Harley-Davidson X440 T First Ride Review: Smarter and SharperHarley-Davidson has taken the X440 and given it a more focused and engaging twist. The result is the X440 T—essentially the same platform but updated in areas that give the motorcycle more appeal and riders more thrill.5 mins read

Janak Sorap | Dec 11, 2025Harley-Davidson X440 T First Ride Review: Smarter and SharperHarley-Davidson has taken the X440 and given it a more focused and engaging twist. The result is the X440 T—essentially the same platform but updated in areas that give the motorcycle more appeal and riders more thrill.5 mins read Shams Raza Naqvi | Dec 10, 20252025 Mini Cooper Convertible Review: More Colour On Indian RoadsThe updated Mini Cooper Convertible is set to be launched in the Indian market in the next few days. We drive it around Jaisalmer for a quick review.1 min read

Shams Raza Naqvi | Dec 10, 20252025 Mini Cooper Convertible Review: More Colour On Indian RoadsThe updated Mini Cooper Convertible is set to be launched in the Indian market in the next few days. We drive it around Jaisalmer for a quick review.1 min read Bilal Firfiray | Dec 8, 2025Tata Sierra Review: India’s New Favourite?Marking its return after a few decades, the reborn Sierra has made everyone sit up and take notice. But is it worth the hype?10 mins read

Bilal Firfiray | Dec 8, 2025Tata Sierra Review: India’s New Favourite?Marking its return after a few decades, the reborn Sierra has made everyone sit up and take notice. But is it worth the hype?10 mins read Girish Karkera | Dec 4, 20252026 Honda Prelude First Drive: Domesticated Civic Type RA sporty-looking coupe built to give customers a taste of performance but not at the expense of everyday practicality.5 mins read

Girish Karkera | Dec 4, 20252026 Honda Prelude First Drive: Domesticated Civic Type RA sporty-looking coupe built to give customers a taste of performance but not at the expense of everyday practicality.5 mins read