Renault-Nissan Sets Up $200 Million Fund To Tap Startups

The Renault-Nissan-Mitsubishi alliance is pooling $200 million in a new mobility tech fund, three sources said, in the latest move by major carmakers to adapt to rapid industry change by investing in startups through their own venture capital arms. The fund, due to be unveiled by Chief Executive Carlos Ghosn at the CES tech industry show in Las Vegas next Tuesday, will be 40 percent financed by Renault, 40 percent by Nissan and 20 percent by Mitsubishi.

Also Read: Electric Cars: Renault-Nissan-Mitsubishi Alliance Announce Future Plans

"It will allow us to move faster on acquisitions ahead of our competition," one of the alliance sources told Reuters.

Frederique Le Greves, a spokeswoman for the Renault-Nissan-Mitsubishi alliance, declined to comment.

The traditional auto industry model based on individual ownership is threatened by pay-per-use services such as Uber, as well as ride- and car-sharing platforms, a challenge heightened by parallel shifts towards electrified and self-driving cars.

Wary carmakers are struggling to embrace changes and technologies that some of their executives are only beginning to grasp. To accelerate the process, many are investing directly in the new services - and gaining access to intellectual property - via their own corporate venture capital (CVC) funds.

BMW has purchased stakes in a plethora of ride-sharing, smart-charging and autonomous vehicle software firms through its 500 million euro ($600 million) iVentures fund, the biggest such in-house facility belonging to a carmaker.

Also Read: Renault-Nissan Alliance Makes Announcement For A Six-Year Plan

Among others that have been increasingly active are General Motors' GM Ventures, with $240 million, and Peugeot-maker PSA Group's 100 million-euro investment arm.

CVC funds, a familiar feature of innovative sectors such as tech and pharmaceuticals, have become more commonplace among carmakers since the 2008-9 financial crisis. They let companies skip some of the formalities otherwise required for new investments, and pounce more swiftly on promising startups.

The Renault-Nissan-Mitsubishi venture will also obviate the current need to thrash out the ownership split for each new alliance acquisition.

(This story has not been edited by NDTV staff and is auto-generated from a syndicated feed.)

Latest News

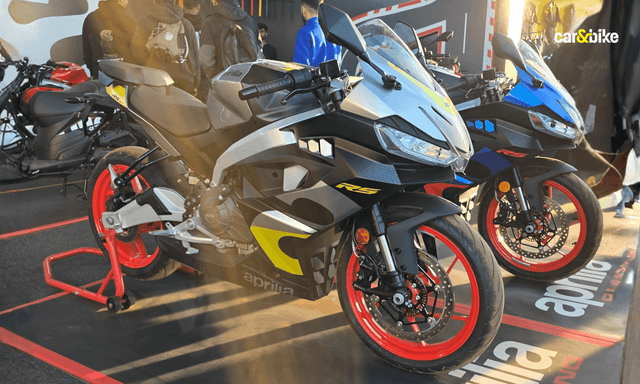

Jafar Rizvi | Feb 10, 20262026 Aprilia RS 457 Launched At Rs 4.22 LakhThe RS 457 gets three new paint options for 2026, including the GP Replica livery sitting at the top of the lineup.2 mins read

Jafar Rizvi | Feb 10, 20262026 Aprilia RS 457 Launched At Rs 4.22 LakhThe RS 457 gets three new paint options for 2026, including the GP Replica livery sitting at the top of the lineup.2 mins read Jaiveer Mehra | Feb 9, 2026Tata Motors Inaugurates New Tamil Nadu Plant; Range Rover Evoque First Vehicle To Roll OutTata says that the plant will become the production base for next-gen vehicles from both Tata and its subsidiary JLR.1 min read

Jaiveer Mehra | Feb 9, 2026Tata Motors Inaugurates New Tamil Nadu Plant; Range Rover Evoque First Vehicle To Roll OutTata says that the plant will become the production base for next-gen vehicles from both Tata and its subsidiary JLR.1 min read car&bike Team | Feb 9, 2026New Cars Coming In February: New SUVs, MPV & EV Lined Up For LaunchJust like January, even February will see a good number new car launches and unveils. We list them for you1 min read

car&bike Team | Feb 9, 2026New Cars Coming In February: New SUVs, MPV & EV Lined Up For LaunchJust like January, even February will see a good number new car launches and unveils. We list them for you1 min read car&bike Team | Feb 9, 2026Hero Vida Ubex Electric Bike Design Patented In IndiaThe Vida Ubex will be the first electric motorcycle from the brand when launched.1 min read

car&bike Team | Feb 9, 2026Hero Vida Ubex Electric Bike Design Patented In IndiaThe Vida Ubex will be the first electric motorcycle from the brand when launched.1 min read car&bike Team | Feb 8, 2026Select Harley-Davidson Motorcycles To Attract Zero Duty Under Upcoming India-US FTA Interim Agreement: ReportPrimary beneficiaries are expected to include models in the 800 to 1600 cc segment2 mins read

car&bike Team | Feb 8, 2026Select Harley-Davidson Motorcycles To Attract Zero Duty Under Upcoming India-US FTA Interim Agreement: ReportPrimary beneficiaries are expected to include models in the 800 to 1600 cc segment2 mins read Jaiveer Mehra | Feb 8, 2026Tata Punch EV Facelift Revealed Ahead Of LaunchSole image of the updated EV previews some of the design updates ahead of its launch on February 20.1 min read

Jaiveer Mehra | Feb 8, 2026Tata Punch EV Facelift Revealed Ahead Of LaunchSole image of the updated EV previews some of the design updates ahead of its launch on February 20.1 min read

Bilal Firfiray | Feb 4, 2026Volkswagen Tayron R-Line Review: Sensible Flagship For IndiaVolkswagen has introduced a made-in-India flagship SUV that offers space, comfort, performance, and German driving finesse in a practical three-row package. But is the Tayron R-Line good enough?6 mins read

Bilal Firfiray | Feb 4, 2026Volkswagen Tayron R-Line Review: Sensible Flagship For IndiaVolkswagen has introduced a made-in-India flagship SUV that offers space, comfort, performance, and German driving finesse in a practical three-row package. But is the Tayron R-Line good enough?6 mins read Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read

Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read

Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read

Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read

Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read