Carmakers: Interest Rates on Car Loans Should be Reduced Further

Carmakers in the country believe the reduction in interest rates announced by State Bank of India (SBI) and HDFC Bank is not enough to help in increasing sales. A consortium led by Maruti Suzuki India said the complete benefits of RBI's rate cuts should be passed on. Furthermore, they insisted that lenders should cut interest rates by at least 50 basis points.

After RBI nudged banks to pass on the benefits of its two recent policy rate cuts, SBI cut its base lending rate by 0.15 percentage point to 9.85 per cent. HDFC Bank also followed suit and announced a similar reduction. ICICI Bank also lowered its base lending rate by 0.25 percentage point to 9.75 per cent.

RS Kalsi, Executive Director - Marketing and Sales, Maruti Suzuki India, believe that though the 15bps cut is a positive step, it is too small to have a concrete impact on EMIs and demand.

P Balendran, Vice President, General Motors India, said, "We were expecting at least 50 bps cut in interest rates. As the commercial banks have not passed on the benefits of the previous two policy rate cuts by RBI, the market continues to be very tough." Honda Cars India, and Hyundai Motor India, also believe it is a good development albeit with minor effects.

(With inputs from PTI)

Trending News

10 mins readTata Sierra Review: India’s New Favourite?

10 mins readTata Sierra Review: India’s New Favourite?

Latest News

car&bike Team | Dec 19, 2025Next-gen Audi Q3 Spied In India Ahead Of Launch In 2026Third-gen Q3 made its global debut in mid-2025, getting notable tech upgrades and electrified powertrain options.2 mins read

car&bike Team | Dec 19, 2025Next-gen Audi Q3 Spied In India Ahead Of Launch In 2026Third-gen Q3 made its global debut in mid-2025, getting notable tech upgrades and electrified powertrain options.2 mins read car&bike Team | Dec 19, 2025Yamaha YZF-R2 Name Trademarked In IndiaThe Yamaha R15, one of Yamaha India’s most popular motorcycle models, is likely to continue, even when the R2 finally makes it debut.1 min read

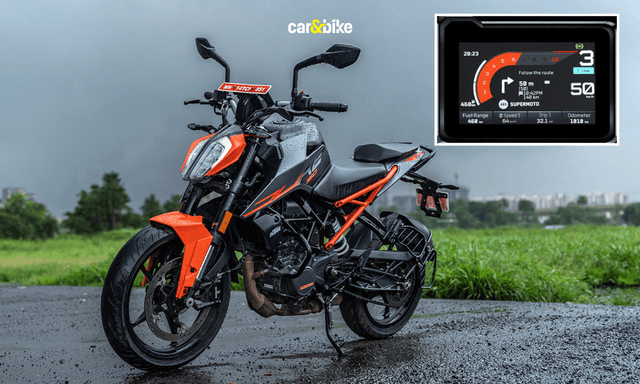

car&bike Team | Dec 19, 2025Yamaha YZF-R2 Name Trademarked In IndiaThe Yamaha R15, one of Yamaha India’s most popular motorcycle models, is likely to continue, even when the R2 finally makes it debut.1 min read car&bike Team | Dec 18, 2025KTM 160 Duke With TFT Dash launched At Rs 1.79 LakhThe 5-inch colour TFT dash is borrowed from the 390 Duke and is shared across the brand’s sub-400cc lineup.2 mins read

car&bike Team | Dec 18, 2025KTM 160 Duke With TFT Dash launched At Rs 1.79 LakhThe 5-inch colour TFT dash is borrowed from the 390 Duke and is shared across the brand’s sub-400cc lineup.2 mins read car&bike Team | Dec 18, 2025Lamborghini Urus Seized By Cops Following Viral Clip Of Speeding On Bandra-Worli Sea LinkThe car was seized after a video of it allegedly overspeeding on the Bandra–Worli Sea Link, where the speed limit is capped at 80 kmph, went viral.2 mins read

car&bike Team | Dec 18, 2025Lamborghini Urus Seized By Cops Following Viral Clip Of Speeding On Bandra-Worli Sea LinkThe car was seized after a video of it allegedly overspeeding on the Bandra–Worli Sea Link, where the speed limit is capped at 80 kmph, went viral.2 mins read car&bike Team | Dec 18, 20252025 Ducati XDiavel V4 India Launch Details RevealedThe new Ducati XDiavel V4 will be launched towards the end of December 2025 and will sit alongside the standard Ducati Diavel V4.3 mins read

car&bike Team | Dec 18, 20252025 Ducati XDiavel V4 India Launch Details RevealedThe new Ducati XDiavel V4 will be launched towards the end of December 2025 and will sit alongside the standard Ducati Diavel V4.3 mins read Amaan Ahmed | Dec 18, 2025Maruti WagonR Swivel Front Seat Kit Launched: Check Price, AvailabilityBangalore-based startup TrueAssist Technology Private Limited has developed a mechanism that allows the front passenger seat to swivel outwards, in a bid to improve accessibility for the aged and persons with disabilities.2 mins read

Amaan Ahmed | Dec 18, 2025Maruti WagonR Swivel Front Seat Kit Launched: Check Price, AvailabilityBangalore-based startup TrueAssist Technology Private Limited has developed a mechanism that allows the front passenger seat to swivel outwards, in a bid to improve accessibility for the aged and persons with disabilities.2 mins read

Bilal Firfiray | Dec 19, 2025Maruti Suzuki e-Vitara Review: Worth The Wait?After a long wait, the first-ever electric Maruti Suzuki is here. It’s the e-Vitara, and it comes with a few promises. But arriving this late, is it worth the wait? Or is it a case of too little, too late?9 mins read

Bilal Firfiray | Dec 19, 2025Maruti Suzuki e-Vitara Review: Worth The Wait?After a long wait, the first-ever electric Maruti Suzuki is here. It’s the e-Vitara, and it comes with a few promises. But arriving this late, is it worth the wait? Or is it a case of too little, too late?9 mins read Bilal Firfiray | Dec 18, 2025Mercedes-Benz G450d: The Subtle Power of EvolutionThe Mercedes-Benz G 450d evolves subtly with more power, improved efficiency, and modern tech, while staying true to the timeless G-Class design. And character.4 mins read

Bilal Firfiray | Dec 18, 2025Mercedes-Benz G450d: The Subtle Power of EvolutionThe Mercedes-Benz G 450d evolves subtly with more power, improved efficiency, and modern tech, while staying true to the timeless G-Class design. And character.4 mins read Janak Sorap | Dec 11, 2025Harley-Davidson X440 T First Ride Review: Smarter and SharperHarley-Davidson has taken the X440 and given it a more focused and engaging twist. The result is the X440 T—essentially the same platform but updated in areas that give the motorcycle more appeal and riders more thrill.5 mins read

Janak Sorap | Dec 11, 2025Harley-Davidson X440 T First Ride Review: Smarter and SharperHarley-Davidson has taken the X440 and given it a more focused and engaging twist. The result is the X440 T—essentially the same platform but updated in areas that give the motorcycle more appeal and riders more thrill.5 mins read Shams Raza Naqvi | Dec 10, 20252025 Mini Cooper Convertible Review: More Colour On Indian RoadsThe updated Mini Cooper Convertible is set to be launched in the Indian market in the next few days. We drive it around Jaisalmer for a quick review.5 mins read

Shams Raza Naqvi | Dec 10, 20252025 Mini Cooper Convertible Review: More Colour On Indian RoadsThe updated Mini Cooper Convertible is set to be launched in the Indian market in the next few days. We drive it around Jaisalmer for a quick review.5 mins read Bilal Firfiray | Dec 8, 2025Tata Sierra Review: India’s New Favourite?Marking its return after a few decades, the reborn Sierra has made everyone sit up and take notice. But is it worth the hype?10 mins read

Bilal Firfiray | Dec 8, 2025Tata Sierra Review: India’s New Favourite?Marking its return after a few decades, the reborn Sierra has made everyone sit up and take notice. But is it worth the hype?10 mins read