GST Impact On Cars And SUVs: Prices In India

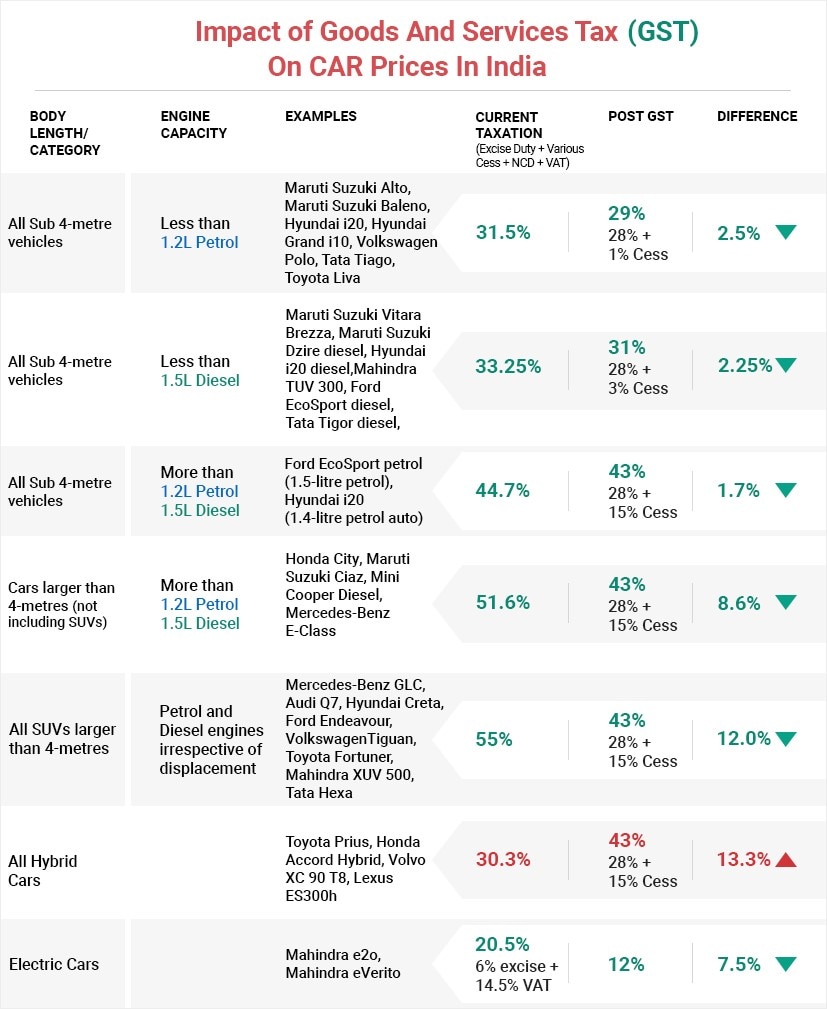

- Cars and SUVs with internal combustion engines to get cheaper

- Hybrid cars will become more expensive post GST

- The GST effect on electric cars will make them much cheaper

GST! For those who are living under a rock, it stands for Goods and Services Tax. The idea of bringing in this particular brand of tax with the aim of unifying the entire country as one whole market with one individual tax instead of having different taxes and different rates in different states of India. Questions have been asked with regards to the GST impact on cars in India and how will it affect the pricing strategies as well. We try to decode the GST impact on cars in India and bring you a detailed report on how the GST impact on cars with a category-wise breakup and also tell you which segment of cars will become affordable and which ones will become costlier. We already have a report on GST impact on two-wheelers where you can brush up on your GST understanding and we also have a report on how the GST impact on cars will affect car buying decisions for the masses.

(The GST impact on cars and SUVs decoded)

(The GST impact on cars and SUVs decoded)All Sub 4-metre vehicles: Petrol Engines Less than 1.2-litre

The sub 4-meter petrol segment for cars with engines less than 1.2-litres is one of the largest and most popular segments in the country. It includes the likes of the top selling Maruti Suzuki Alto, Maruti Suzuki Baleno, Maruti Suzuki Dzire, Hyundai i20, Hyundai Grand i10, Volkswagen Polo, Tata Tiago, Tata Tigor, Toyota Etios Liva, Ford EcoSport (with ecoboost engine) etc.The previous tax structure, with the sub 4-metre relief on the hatchbacks, sedans and SUVs in the category is at 31.5 per cent. That included the excise duties, various added cess and value added tax or VAT. The new post GST structure has changed that figure to a total tax of 29 per cent. This will include the 28 per cent GST slab plus an additional 1 per cent cess that will be levied on cars of this category. In essence, cars of this category will be cheaper by 2.5 per cent (Before insurance and registration charges) as a pert of GST effect. This makes it the least tax segment for all cars and SUVs in the country (with an internal combustion engine).

All Sub 4-metre vehicles: Diesel Engines Less than 1.5-litre

The sub 4-metre diesel segment for cars with engines less than 1.5-litres is also one of the most popular segments in the country catering to the likes of the rapidly growing premium hatchback and sub-compact SUV segment. It includes the likes of the Maruti Suzuki Vitara Brezza, Maruti Suzuki Dzire diesel, Hyundai i20 diesel, Mahindra TUV 300, Mahindra KUV 100, Ford EcoSport diesel, Tata Tigor diesel, Hyundai Xcent diesel, etc.The previous tax structure, with the sub 4-metre relief on the hatchbacks, sedans and SUVs in the category is at 33.25 per cent. This includes the excise duties, various added cess and value added tax or VAT. The new post GST structure had changed that figure to a total tax of 31 per cent. This will include the 28 per cent GST slab plus an additional 3 per cent cess that will be levied on cars of this category as part of GST effect. In essence, cars of this category will be cheaper by 2.25 per cent (Before insurance and registration charges). While this segment doesn’t get a tax slab as low as the sub 4-meter petrol segment for cars with engines less than 1.2-litre segment, it too is one of the least tax slab for cars and SUVs with an internal combustion engine.

(Sub 4-meter petrol cars with engines larger than 1.2-litre or diesel larger than 1.5-litre)

(Sub 4-meter petrol cars with engines larger than 1.2-litre or diesel larger than 1.5-litre)All Sub 4-metre vehicles: Diesel Engines more than 1.5-litre, Petrol Engines more than 1.2-litre

There is a small section of cars that falls under the sub 4-metre length but gets petrol and diesel engines larger than the 1.2-litre limit for petrol motors and the 1.5-litre limit for diesel motors. These include the likes of the ford EcoSport petrol with the 1.5-litre engine, Hyundai i20 1.4-litre automatic, etc.The previous tax structure, without the sub 4-metre relief on the hatchbacks, subcompact SUVs and subcompact sedans as they do not meet engine criteria in the category is at 44.7 per cent. This includes the excise duties, various added cess and value added tax or VAT. The new post GST structure has changed that figure to a total tax of 43 per cent. This will include the 28 per cent GST slab plus an additional 15 per cent cess that will be levied on cars of this category. In essence, cars of this category will be marginally cheaper by 1.7 per cent (Before insurance and registration charges). That said, since this is a very small segment in the Indian automotive scheme, it might not make a larger impact.

(Cars larger than 4-metres not including SUVs irrespective of engine size)

(Cars larger than 4-metres not including SUVs irrespective of engine size)Cars larger than 4-metres (not including SUVs): Petrol and Diesel engines irrespective of displacement

The segment for cars longer than the 4-metre mark with engines larger than 1.2-litres for petrol or 1.5-litres for diesel is a large chunk of the cars sold in India. This segment includes sedans and larger hatchbacks. From the likes of the Honda City, Maruti Suzuki Ciaz to the likes of the Mini 5-door and even the likes of larger cars like the new Mercedes-Benz E-Class or S-Class falls in this segment.The previous tax structure for this segment is at 51.6 per cent. This includes the excise duties, various added cess and value added tax or VAT. The new post GST structure has changed that figure to a total tax of 43 per cent. This will include the 28 per cent GST slab plus an additional 15 per cent cess that will be levied on cars of this category. In essence, cars of this category will be cheaper by a substantial 8.6 per cent. This drop in prices will make this category a lot more popular with the large Indian audience who is moving towards bigger sedans or larger premium hatchbacks.

(SUVs larger than 4-meters irrespective of engine size)

(SUVs larger than 4-meters irrespective of engine size)All SUVs larger than 4-meters: Petrol and Diesel engines irrespective of displacement

This category includes all SUVs larger than the 4-meter mark irrespective of their engine size (displacement). The large range of SUVs that are included in this segment includes the likes of the Mercedes-Benz GLC, Audi Q7, Ford Endeavour, Volkswagen Tiguan, Toyota Fortuner, Mahindra Scorpio, Mahindra XUV 500, Tata Hexa. This segment is extremely popular in India as a huge chunk of the hatchback and sedan buying population is eventually moving to the likes of larger SUVs like the Hyundai Creta and luxury car buyers are choosing SUVs like the BMW X3 instead of conventional luxury cars like the A6 or E-Class.The previous tax structure for this segment is at 55 per cent. This includes the excise duties, various added cess and value added tax or VAT. The new post GST structure has changed that figure to a total tax of 43 per cent. This will include the 28 per cent GST slab plus an additional 15 per cent cess that will be levied on cars of this category. In essence, cars of this category will be cheaper by a huge 12 per cent. This is the biggest drop in any category in the 4-wheeler segment (for cars with a conventional internal combustion engine).

(All Hybrid cars regardless of body style)

(All Hybrid cars regardless of body style)Hybrids:

Albeit a minuscule section in the Indian car world, vehicles equipped with Hybrid technology are popular around the world. In India, there are a very few Hybrid cars sold which include the likes of the Toyota Camry Hybrid and the Toyota Prius, Honda Accord Hybrid, Volvo XC90 T8 (plug-in hybrid) and the Lexus RX450h SUV and ES300h sedan.The previous tax structure for this segment is at 30.3 per cent. This includes the excise duties, various added cess and value added tax or VAT. The new post GST structure has changed that figure to a total tax of 43 per cent too. This will include the 28 per cent GST slab plus an additional 15 per cent cess that will be levied on cars of this category. In essence, the government wants to dissuade manufacturers from bringing in modern and current hybrid technology by increasing taxes on hybrid cars by a huge 13.3 per cent. As a strategic move, this price increase on hybrid cars will also result in most manufacturers not bringing in the latest tech and platforms to India as it will not make any economic sense as compared to conventional petrol or diesel engines.

Also Read: Maruti Suzuki Ertiga and Ciaz SHVS prices to go up!

(All full electric vehicles irrespective of body style)

(All full electric vehicles irrespective of body style)

Electric Cars:

Currently, only Mahindra Electric sells mainstream electric cars in India. The two cars sold in India that are fully electric are the Mahindra e2o in the new 5-door guise and the Mahindra eVerito. The current pre-GST tax structure for this segment is at 20.5 per cent. This includes the excise duties, various added cess and value added tax or VAT. The new post GST structure will change that figure to a total tax of 20.5 per cent. This will include only the low 12 per cent GST slab and no excess cess that has been levied on all other segments, which will drop the taxes by 7.5 per cent. With the government trying hard to push all-electric motoring and with plans to make India an all electric nation when it comes to cars and SUVs by 2030, the current government’s push to make the electric car tech and thereby electric cars cheaper with the new GST program is a step in the right direction. However, neither is the country in terms of infrastructure or mentality ready yet to adopt all-electric vehicles.Also Read: GST Discounts On Cars!

So as a final footnote, ex-showroom prices for all cars in India apart from those powered by Hybrid drivetrains are expected to go down. The price drop will range from as little as 2.25 per cent to as high as 12 per cent. the biggest beneficiaries will be larger luxury cars and SUVs that are expected to get the largest price drop when it comes to an ex-showroom price. That said, with prices for insurance set to go up by a few percentage points from the current 15 per cent to the new 18 per cent, changes in actual on road prices for most cars might be very minimal.

Latest News

car&bike Team | Feb 3, 2026China Mandates Fitting of Mechanical Door Handles On New Cars From 2027Vehicles already on sale to be given an additional 2 years to conform to the new norms.1 min read

car&bike Team | Feb 3, 2026China Mandates Fitting of Mechanical Door Handles On New Cars From 2027Vehicles already on sale to be given an additional 2 years to conform to the new norms.1 min read car&bike Team | Feb 3, 2026Mercedes-Benz CLA EV India Debut In April 2026The new-gen CLA, in its all-electric avatar, was globally unveiled in March 2025.1 min read

car&bike Team | Feb 3, 2026Mercedes-Benz CLA EV India Debut In April 2026The new-gen CLA, in its all-electric avatar, was globally unveiled in March 2025.1 min read car&bike Team | Feb 3, 2026Two-Wheeler Sales January 2026: Hero MotoCorp, TVS, Royal Enfield, Suzuki Report Sustained GrowthMost brands have reported year-on-year growth in the first month of CY26.4 mins read

car&bike Team | Feb 3, 2026Two-Wheeler Sales January 2026: Hero MotoCorp, TVS, Royal Enfield, Suzuki Report Sustained GrowthMost brands have reported year-on-year growth in the first month of CY26.4 mins read car&bike Team | Feb 2, 2026Car Sales January 2026: Six Marutis in Top 10, But Tata Nexon Takes Top SpotTata Motors sold 23,365 units of the Nexon, creating a clear gap to the Maruti Suzuki Dzire, which finished second with 19,629 units.1 min read

car&bike Team | Feb 2, 2026Car Sales January 2026: Six Marutis in Top 10, But Tata Nexon Takes Top SpotTata Motors sold 23,365 units of the Nexon, creating a clear gap to the Maruti Suzuki Dzire, which finished second with 19,629 units.1 min read car&bike Team | Feb 2, 2026Maruti Suzuki Victoris Crosses 50,000 Sales Milestone In 4 monthsThe compact SUV launched at the onset of festive season has crossed the 50,000 sales mark in about 4 months1 min read

car&bike Team | Feb 2, 2026Maruti Suzuki Victoris Crosses 50,000 Sales Milestone In 4 monthsThe compact SUV launched at the onset of festive season has crossed the 50,000 sales mark in about 4 months1 min read car&bike Team | Feb 2, 2026Maruti Suzuki Announces Price Protection Amid Long Waiting PeriodsCountry’s largest carmaker has said that prices of the cars will not be increased for customers who have already made the bookings1 min read

car&bike Team | Feb 2, 2026Maruti Suzuki Announces Price Protection Amid Long Waiting PeriodsCountry’s largest carmaker has said that prices of the cars will not be increased for customers who have already made the bookings1 min read

Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read

Preetam Bora | Feb 2, 2026TVS NTorq 150 Road Test Review: Bigger, Better & More Efficient!We test the new TVS NTorq 150 out in the real world to get a sense of what it offers in terms of performance, dynamics and fuel economy.7 mins read Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read

Bilal Firfiray | Jan 21, 2026Tata Punch Facelift Review: New Turbo Engine; Same Old SoulWith the update, the Tata Punch facelift retains its character of being a healthy runabout, which is perfect for Indian roads. But have these changes made it any better?7 mins read Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read

Amaan Ahmed | Jan 17, 2026Bajaj Chetak C25 First Ride Review: Basic, Likeable E-Scooter For First-Time RidersThe Chetak C25, in quite a few ways, is poles apart from the larger and more powerful 30 and 35 Series models, but in its mannerisms, it is very much a Chetak.8 mins read Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read

Bilal Firfiray | Jan 9, 2026Toyota Urban Cruiser Hyryder: 10,000 km Long-Term ReviewAfter spending over three months and 10,000 km with the Toyota Urban Cruiser Hyryder Hybrid, we were impressed by its real-world mileage, seamless hybrid, practical comfort, and Toyota reliability. Is it the best C-SUV then?5 mins read Seshan Vijayraghvan | Jan 8, 20262026 Mahindra XUV 7XO Review: Big On Tech, Bigger On ComfortThe new Mahindra XUV 7XO is flashier, feature packed, and comes with more advanced tech. But are the changes just incremental or actually substantial?1 min read

Seshan Vijayraghvan | Jan 8, 20262026 Mahindra XUV 7XO Review: Big On Tech, Bigger On ComfortThe new Mahindra XUV 7XO is flashier, feature packed, and comes with more advanced tech. But are the changes just incremental or actually substantial?1 min read